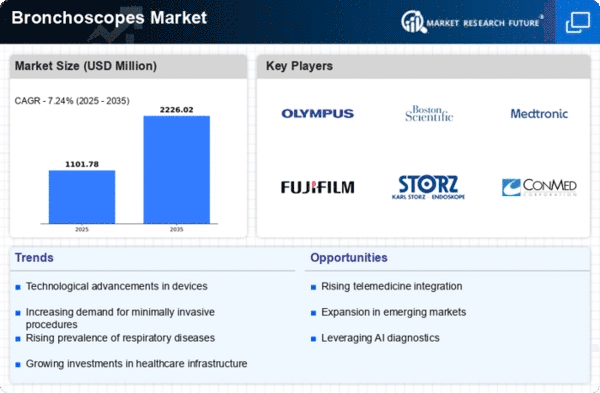

Market Growth Projections

The Global Bronchoscopes Market Industry is poised for substantial growth, with projections indicating a market value of 5.94 USD Billion by 2035. This anticipated growth reflects the increasing demand for advanced bronchoscopic technologies and procedures. The market is expected to experience a compound annual growth rate (CAGR) of 6.74% from 2025 to 2035, driven by factors such as technological advancements, rising healthcare expenditure, and an aging population. The upward trajectory of the market underscores the critical role bronchoscopes play in modern healthcare, particularly in the diagnosis and management of respiratory diseases.

Growing Geriatric Population

The global increase in the geriatric population is a key driver of the Global Bronchoscopes Market Industry. Older adults are more susceptible to respiratory diseases, necessitating regular monitoring and intervention. As the population aged 65 and above continues to grow, the demand for bronchoscopic procedures is likely to rise. This demographic shift presents a significant opportunity for healthcare providers to invest in advanced bronchoscopic technologies. The market's growth trajectory is supported by the increasing need for effective diagnostic tools tailored to the elderly, further solidifying the importance of bronchoscopes in modern healthcare.

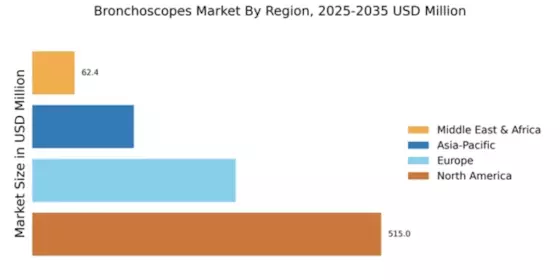

Increasing Healthcare Expenditure

Rising healthcare expenditure across various regions contributes to the expansion of the Global Bronchoscopes Market Industry. Governments and private sectors are investing significantly in healthcare infrastructure, leading to improved access to advanced medical technologies. This trend is particularly evident in developing countries, where investments in healthcare facilities are increasing. Enhanced funding allows for the procurement of state-of-the-art bronchoscopes, which are essential for effective diagnosis and treatment of respiratory conditions. As healthcare expenditure continues to rise, the market is expected to grow at a compound annual growth rate (CAGR) of 6.74% from 2025 to 2035, reflecting the increasing demand for bronchoscopic procedures.

Rising Awareness and Screening Programs

There is a growing awareness of respiratory health and the importance of early detection, which positively impacts the Global Bronchoscopes Market Industry. Public health campaigns and screening programs aimed at identifying respiratory diseases are becoming more prevalent. These initiatives encourage individuals to seek medical attention sooner, leading to an increase in bronchoscopic procedures. As awareness levels rise, healthcare systems are likely to implement more comprehensive screening programs, further driving the demand for bronchoscopes. This trend underscores the critical role of bronchoscopes in facilitating early diagnosis and improving patient outcomes.

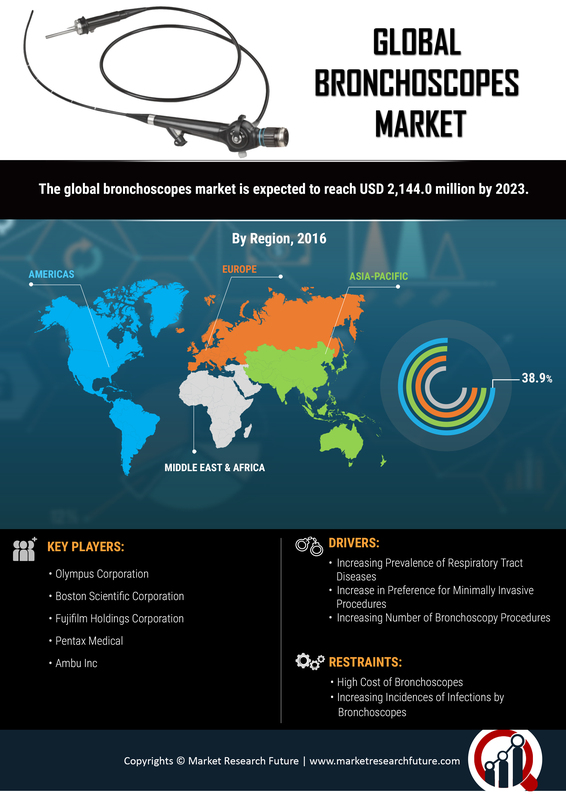

Rising Prevalence of Respiratory Diseases

The increasing incidence of respiratory diseases globally drives the Global Bronchoscopes Market Industry. Conditions such as chronic obstructive pulmonary disease (COPD) and lung cancer are becoming more prevalent, necessitating advanced diagnostic tools. According to health statistics, respiratory diseases account for a significant portion of global morbidity and mortality. The demand for bronchoscopes is expected to rise as healthcare providers seek effective solutions for early diagnosis and treatment. This trend is reflected in the market's projected growth, with an estimated value of 2.9 USD Billion in 2024, highlighting the urgent need for innovative bronchoscopic technologies.

Technological Advancements in Bronchoscopy

Technological innovations in bronchoscopy are transforming the Global Bronchoscopes Market Industry. The development of flexible bronchoscopes with enhanced imaging capabilities, such as high-definition video and narrow-band imaging, improves diagnostic accuracy. These advancements facilitate minimally invasive procedures, reducing patient recovery times and enhancing overall outcomes. Furthermore, the integration of artificial intelligence in bronchoscopy aids in real-time analysis, potentially increasing the efficiency of procedures. As a result, the market is likely to witness substantial growth, with projections indicating a market value of 5.94 USD Billion by 2035, driven by these cutting-edge technologies.