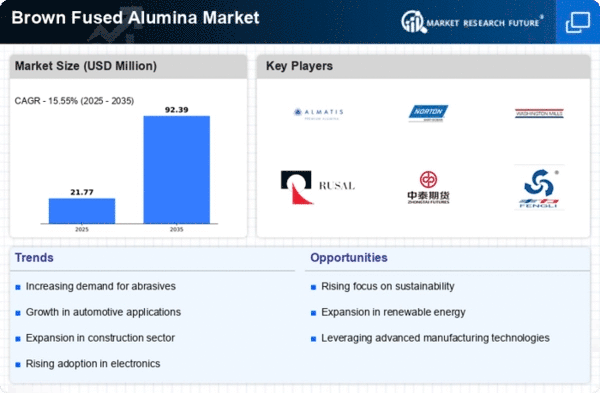

Brown Fused Alumina Size

Brown Fused Alumina Market Growth Projections and Opportunities

The brown fused alumina market is influenced by several key factors that shape its growth and dynamics. One significant driver is the increasing demand from industries such as abrasives, refractories, ceramics, and metal fabrication. Brown fused alumina, a type of abrasive material derived from bauxite ore, is widely used for surface preparation, grinding, cutting, and polishing applications. As these industries continue to grow and diversify, the demand for brown fused alumina for various manufacturing processes also increases, driving market growth.

Additionally, infrastructure development and construction activities play a crucial role in driving the demand for brown fused alumina. The construction industry relies on abrasive materials like brown fused alumina for surface treatment, finishing, and maintenance of buildings, bridges, roads, and other infrastructure projects. With rapid urbanization and industrialization in emerging economies, there is a significant demand for construction materials and related abrasives, contributing to the growth of the brown fused alumina market.

Moreover, technological advancements and innovations in manufacturing processes are driving market growth by improving the quality, efficiency, and versatility of brown fused alumina products. Manufacturers are investing in advanced production technologies, such as electric arc furnaces and rotary kilns, to enhance the purity and particle size distribution of brown fused alumina. Additionally, the development of new formulations and coatings further expands the application possibilities of brown fused alumina, driving demand across various industries.

Furthermore, the focus on sustainability and environmental regulations is influencing the brown fused alumina market. Environmental concerns related to energy consumption, waste generation, and emissions from traditional manufacturing processes have led to the development of eco-friendly production methods and recycling initiatives. Manufacturers are adopting cleaner production technologies, implementing waste reduction measures, and exploring opportunities for recycling brown fused alumina waste products, thereby reducing their environmental footprint and meeting regulatory requirements.

Additionally, globalization and international trade are significant factors shaping the brown fused alumina market. The globalization of supply chains and the expansion of international trade networks have facilitated the movement of brown fused alumina products across borders. Companies leverage international trade to access new markets, source raw materials, and collaborate with partners to optimize production and distribution processes. However, geopolitical tensions, trade barriers, and fluctuations in currency exchange rates can impact market dynamics and pose challenges for brown fused alumina manufacturers operating in global markets.

Moreover, the competitive landscape and market dynamics also play a crucial role in shaping the brown fused alumina market. Intense competition among key players prompts manufacturers to focus on product differentiation, innovation, and operational excellence to gain a competitive edge. Strategic partnerships, mergers, and acquisitions are common strategies adopted by companies to expand their market presence, diversify their product portfolios, and enhance their competitive positioning.

Furthermore, the availability and cost of raw materials, particularly bauxite ore and other precursors, are critical factors influencing the brown fused alumina market. Fluctuations in raw material prices, supply chain disruptions, and changes in demand from other industries can impact production costs and profitability for brown fused alumina manufacturers. Companies must carefully monitor raw material markets, optimize procurement processes, and implement strategies to mitigate risks and maintain a competitive advantage in the market.

Leave a Comment