Market Trends

Key Emerging Trends in the Brown Fused Alumina Market

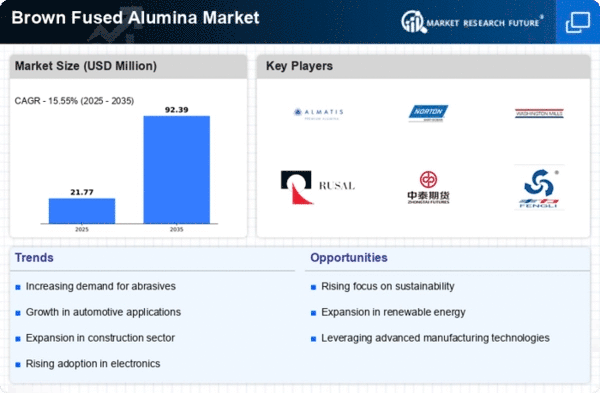

The brown fused alumina market is witnessing several noteworthy trends that are shaping its dynamics and influencing the industry's growth trajectory. One prominent trend is the increasing demand for brown fused alumina across various applications, including abrasives, refractories, ceramics, and surface treatment. Brown fused alumina, also known as brown corundum, is a versatile abrasive material known for its high hardness, toughness, and thermal stability, making it suitable for grinding, cutting, polishing, and surface preparation in various industrial sectors. As industries such as automotive, aerospace, construction, and metal fabrication continue to expand, the demand for brown fused alumina as a cost-effective and efficient abrasive material is expected to rise steadily.

Moreover, there is a growing focus on product innovation and quality improvement in the brown fused alumina market. Manufacturers are investing in research and development to develop advanced production techniques, optimize raw material sourcing, and enhance product properties such as particle size distribution, chemical purity, and abrasion resistance. This trend is driven by the increasing demand for high-performance abrasives with consistent quality and reliability, as end-users seek to improve process efficiency, achieve better surface finish, and extend the lifespan of abrasive tools and components.

Another significant trend in the brown fused alumina market is the growing adoption of sustainable and eco-friendly manufacturing practices. As environmental concerns and regulatory pressures mount, there is a rising demand for abrasives produced using renewable energy sources, recycled materials, and environmentally friendly processes. Manufacturers are investing in energy-efficient technologies, waste reduction measures, and pollution control systems to minimize their environmental footprint and comply with sustainability standards. Additionally, there is a growing preference for eco-friendly abrasive products that minimize dust emissions, reduce waste generation, and have minimal environmental impact throughout their lifecycle.

Furthermore, the brown fused alumina market is experiencing changes in supply chain dynamics and trade patterns, influenced by factors such as raw material availability, geopolitical tensions, and trade policies. Brown fused alumina is primarily produced from bauxite ore through a complex refining process, with China being the leading producer and exporter of brown fused alumina globally. However, fluctuations in bauxite prices, environmental regulations, and trade disputes have led to supply disruptions and volatility in the brown fused alumina market, prompting companies to diversify their supply chains and explore alternative sources of raw materials.

Moreover, advancements in application technologies and surface treatment methods are driving new opportunities for brown fused alumina in niche markets and specialized applications. For instance, brown fused alumina is increasingly used as a blasting media for surface preparation in industries such as shipbuilding, aerospace, and metal fabrication, where stringent surface cleanliness and coating adhesion requirements are essential. Additionally, brown fused alumina is finding utilization in refractory applications such as steelmaking, foundry, and glass manufacturing, where its high temperature resistance and thermal shock resistance properties are valued for lining and insulation purposes.

Additionally, the brown fused alumina market is witnessing growing demand from emerging economies and industries such as electronics, renewable energy, and additive manufacturing, where abrasive materials are used for precision machining, cutting, and polishing of advanced materials and components. As these industries continue to evolve and expand, the demand for high-quality abrasive materials such as brown fused alumina is expected to increase, presenting new growth opportunities for manufacturers and suppliers in the global market.

Leave a Comment