Emergence of Rental Market Trends

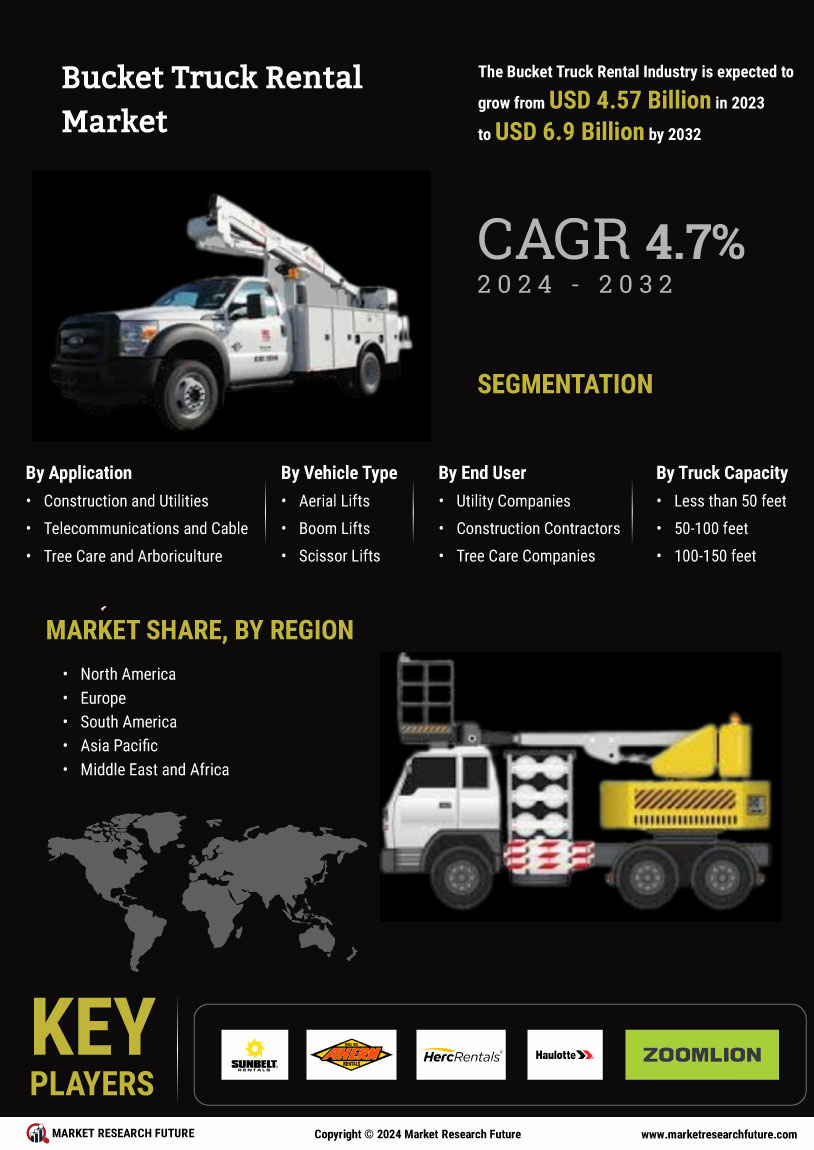

The Bucket Truck Rental Market is witnessing the emergence of new rental market trends, driven by changing consumer preferences and economic factors. Businesses are increasingly opting for rental solutions rather than purchasing equipment outright, as this approach offers financial flexibility and reduces capital expenditure. The market data indicates that the rental segment is projected to grow at a rate of 7% annually, reflecting a shift in how companies manage their equipment needs. This trend is particularly pronounced in industries requiring temporary access to aerial work platforms, such as construction and maintenance. As more companies recognize the benefits of renting, the Bucket Truck Rental Market is likely to expand, catering to a diverse range of clients seeking efficient and economical solutions.

Rising Infrastructure Development

The Bucket Truck Rental Market is experiencing a surge in demand due to the ongoing infrastructure development projects across various regions. Governments and private entities are investing heavily in upgrading and maintaining public utilities, including power lines, telecommunications, and street lighting. This trend is expected to drive the need for bucket trucks, which are essential for accessing elevated work areas safely. According to recent data, the construction sector is projected to grow at a compound annual growth rate of approximately 5.5% over the next few years, further fueling the demand for rental services in the bucket truck segment. As infrastructure projects expand, the Bucket Truck Rental Market is likely to benefit significantly from this growth, as contractors seek efficient and cost-effective solutions for their aerial work needs.

Increased Focus on Safety Regulations

The Bucket Truck Rental Market is influenced by the heightened emphasis on safety regulations in various sectors, including construction and utilities. Regulatory bodies are implementing stricter guidelines to ensure worker safety when performing tasks at heights. This has led to an increased demand for bucket trucks, which are designed to provide a secure platform for workers. Rental companies are responding by expanding their fleets to include newer models equipped with advanced safety features. The market data indicates that compliance with safety standards is becoming a critical factor for contractors, thereby driving the rental of bucket trucks. As safety regulations continue to evolve, the Bucket Truck Rental Market is poised to grow, as businesses prioritize the use of compliant and reliable equipment.

Growth in Utility Maintenance Services

The Bucket Truck Rental Market is benefiting from the growth in utility maintenance services, particularly in the electrical and telecommunications sectors. As utility companies strive to maintain and upgrade their infrastructure, the need for specialized equipment like bucket trucks becomes increasingly apparent. The market data suggests that the utility sector is expected to expand, with investments in renewable energy and smart grid technologies. This growth necessitates regular maintenance and repair work, which often requires aerial access. Consequently, rental services for bucket trucks are likely to see a significant uptick as utility companies seek flexible and cost-effective solutions for their operational needs. The Bucket Truck Rental Market stands to gain from this trend, as it aligns with the evolving demands of utility maintenance.

Technological Innovations in Equipment

The Bucket Truck Rental Market is being transformed by technological innovations in equipment design and functionality. Advances in telematics, automation, and safety features are enhancing the performance and reliability of bucket trucks. Rental companies are increasingly investing in modern fleets that incorporate these technologies, which not only improve operational efficiency but also attract a broader customer base. Market data suggests that the integration of smart technologies in equipment is becoming a key differentiator for rental services. As businesses seek to optimize their operations, the demand for technologically advanced bucket trucks is likely to rise. This trend positions the Bucket Truck Rental Market favorably, as it adapts to the evolving needs of its clientele.

Leave a Comment