Rising Urbanization

The increasing trend of urbanization is a pivotal driver for the Building Construction Glass Market. As populations migrate to urban areas, the demand for residential and commercial buildings escalates. This surge in construction activities necessitates the use of glass for facades, windows, and interior applications. According to recent data, urban areas are expected to house approximately 68% of the world's population by 2050, which could lead to a substantial increase in the demand for building materials, including glass. The aesthetic appeal and functional benefits of glass, such as natural light enhancement and energy efficiency, further bolster its adoption in urban construction projects. Consequently, the Building Construction Glass Market is likely to experience significant growth driven by urbanization trends.

Architectural Trends

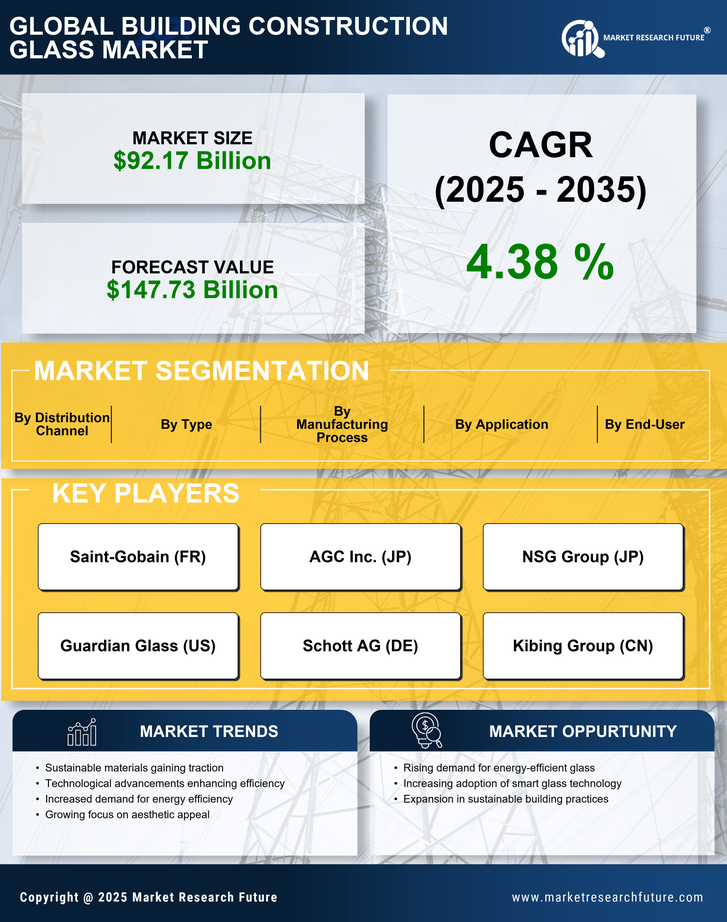

Architectural trends significantly influence the Building Construction Glass Market. The contemporary design ethos emphasizes transparency, natural light, and open spaces, which has led to a heightened preference for glass in building designs. Architects and designers are increasingly incorporating large glass panels and curtain walls to create visually striking structures that enhance the aesthetic appeal of urban landscapes. This trend is supported by data indicating that the architectural glass segment is expected to witness a compound annual growth rate of over 5% in the coming years. Additionally, the versatility of glass allows for innovative applications, such as smart glass that can adjust its opacity based on environmental conditions. As these architectural trends continue to evolve, the Building Construction Glass Market is poised for sustained growth.

Sustainability Initiatives

Sustainability initiatives are increasingly driving the Building Construction Glass Market. The growing awareness of environmental issues has prompted both consumers and businesses to prioritize sustainable building practices. This shift is reflected in the rising demand for recycled glass and eco-friendly manufacturing processes. Many construction projects now aim for green certifications, such as LEED, which often require the use of sustainable materials, including glass. Data suggests that the market for sustainable building materials is expected to grow at a compound annual growth rate of over 10% in the next few years. As sustainability becomes a core focus in construction, the Building Construction Glass Market is likely to see a corresponding increase in the adoption of environmentally friendly glass solutions.

Technological Advancements

Technological advancements are a crucial driver of the Building Construction Glass Market. Innovations in glass manufacturing processes and materials have led to the development of high-performance glass products that offer enhanced durability, thermal insulation, and safety features. For instance, the introduction of tempered and laminated glass has improved the structural integrity of buildings while providing better resistance to environmental factors. Furthermore, advancements in smart glass technology, which allows for dynamic control of light and heat, are gaining traction in modern construction. The market for smart glass is anticipated to expand significantly, driven by its potential applications in energy-efficient buildings. As technology continues to evolve, the Building Construction Glass Market is likely to benefit from the introduction of new products that meet the demands of contemporary architecture.

Energy Efficiency Regulations

Energy efficiency regulations are increasingly shaping the Building Construction Glass Market. Governments and regulatory bodies are implementing stringent standards aimed at reducing energy consumption in buildings. These regulations often mandate the use of energy-efficient glass products, such as low-emissivity (Low-E) glass, which minimizes heat transfer and enhances insulation. The market for energy-efficient glass is projected to grow as more countries adopt policies to meet sustainability goals. For instance, the implementation of energy codes in various regions has led to a marked increase in the demand for high-performance glazing solutions. This regulatory push not only promotes environmental sustainability but also drives innovation within the Building Construction Glass Market, as manufacturers strive to develop advanced glass technologies that comply with these standards.