Calcined Bauxite Size

Calcined Bauxite Market Growth Projections and Opportunities

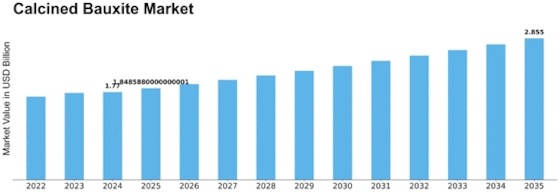

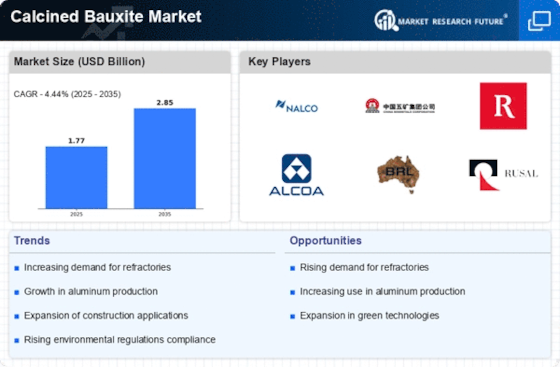

The global calcined bauxite market has shown substantial growth, marking a value of USD 1,376.56 million in 2020. Projections indicate a notable increase, with an expected Compound Annual Growth Rate (CAGR) of 5.46%, reaching an impressive value of USD 2,159.41 million by the end of 2028. In terms of volume, estimations place the market at 4,200.46 kilotons in 2020, foreseeing a rise to 5,361.38 kilotons by the conclusion of 2028.

The market's growth trajectory is primarily fueled by several key factors, including the heightened usage of brown fused alumina in manufacturing refractory materials. This surge in demand is especially pronounced within the steel production sector, where the utilization of high alumina refractories is on the rise. This trend is poised to significantly contribute to the escalating global demand for calcined bauxite during the forecast period. Furthermore, the extensive application of brown fused alumina in the production of abrasives is anticipated to further augment the market's growth trajectory.

However, the market is not without its challenges. The imposition of stringent regulations governing bauxite mining activities emerges as a significant obstacle that could impede the market's growth. These regulations, while aimed at ensuring sustainable mining practices and environmental conservation, are likely to pose hurdles and constraints on the production and supply of calcined bauxite, potentially hindering the market's expansion.

Despite these challenges, the market remains robust, driven by the escalating demand for brown fused alumina in various industries, particularly in the production of refractory materials and abrasives. The continuous growth and innovation in steel production, coupled with the diverse applications of high alumina refractories, are poised to sustain the demand for calcined bauxite, paving the way for substantial market growth in the foreseeable future.

The global calcined bauxite market exhibits segmentation based on purity, application, and regional distribution. This segmentation categorizes the market into high purity (>85%) and low purity (<85%) segments. As of 2020, the high purity (>85%) segment commanded a significant share, accounting for 78.06% of the global calcined bauxite market. Forecasts predict this segment to maintain a steady Compound Annual Growth Rate (CAGR) of 5.46% over the forecast period. The dominance of the high purity (>85%) segment is primarily attributed to its extensive utilization in the production of high-performance refractories, abrasives, and calcinated aluminate cement. These applications have significantly contributed to the growth of this segment in the market landscape.

The escalated demand for high purity (>85%) calcined bauxite in specific industrial sectors has been a driving force behind the dominance of this segment. Its pivotal role in the production of high-performance refractories, which are indispensable in various industries due to their exceptional heat resistance and durability, has significantly fueled the segment's growth. Additionally, the use of high purity calcined bauxite in abrasives and calcinated aluminate cement production has further bolstered its prominence within the market.

Leave a Comment