Research Methodology on Calcium Carbonate Market

Introduction

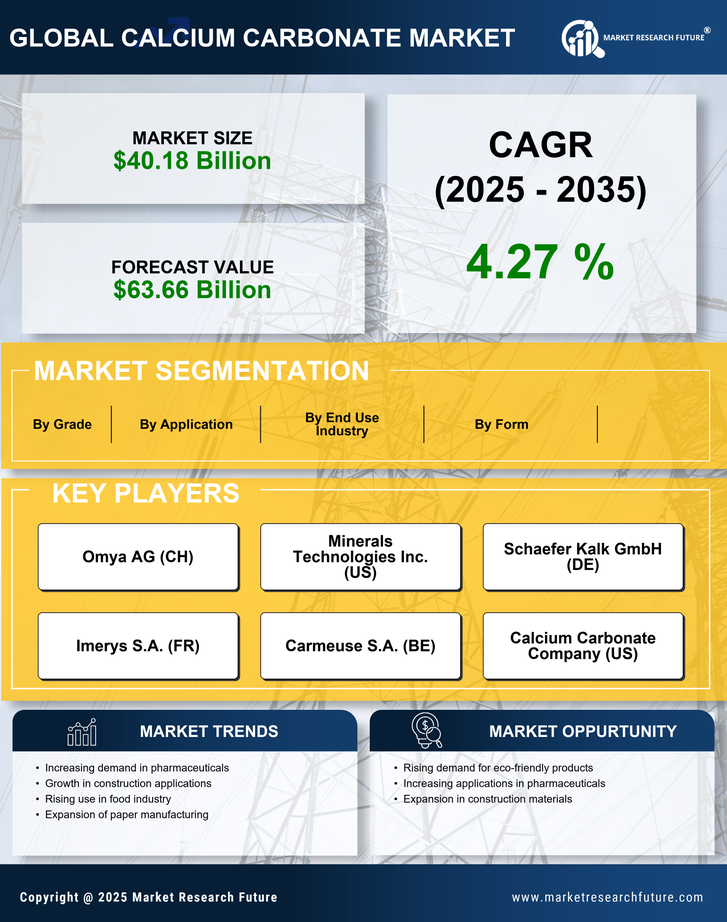

This research aims to study the global market for calcium carbonate. Calcium Carbonate is a mineral that is widely used in many industries. This market is studied to analyze the changes in consumer demand and market trends over the next few years. The research analyzes the current and future potential revenue opportunities in the calcium carbonate market along with the market drivers, competitors, and challenges. This research aims to develop a deep-dive analysis of the key dynamics and trends influencing this market.

Research Approach

The research methodology for the study is based on several approaches that include secondary and primary research. A variety of techniques and data sources are used to carry out a comprehensive investigation of the calcium carbonate market. Secondary sources include industry reports, trade journals, published studies, whitepapers, surveys, and interviews with industry experts. Primary sources include interviews with industry participants and expert opinion surveys.

Secondary Research

In the secondary research phase, various reliable and secondary databases such as Factiva, Hoovers, ABI/INFORM and Mintel are used to gain a better understanding of the background of the market.

Moreover, a research report commissioned from Market Research Future (MRFR) on the calcium carbonate market where past, current and future market trends are extensively studied.

Primary Research

The primary research phase involves the analysis of industry experts and market participants to assess their level of experience, knowledge and expertise within the sector. Furthermore, market participants and experts were also contacted to gain greater insights into the market.

Data Collection

In order to ensure the accuracy of the data, two methods of data collection are applied during the course of the research.

Data Inclusion

The study took into consideration all key, relevant, and up-to-date market data for the analysis and reporting of the findings. This includes :

- Market volume and value

- Market trends

- Market forecast

- Market drivers

- Market challenges

- Market opportunities

- Market competitors

- Government regulations

- Revenues

- Pricing

- Demand and supply

Data Analysis

The collected data is analyzed by using a variety of methods and data analysis techniques such as qualitative, quantitative and inference analysis.

Qualitative Analysis

Various qualitative data analysis methods in the form of direct and indirect interviews with experts, notes and key developments are used to analyze market trends. The analysis of the findings is organized to provide a better understanding of the market by categorizing data based on the type of interviewees, areas of expertise, date of the interview, key issues identified, etc.

Quantitative Analysis

In order to analyze numerical data and provide a logical overview of the market, key financial ratios (e.g. revenue, CAGR, etc.) and market data are collected. Market data and analysis techniques are also used to analyze pricing structures and develop a general overview of the market.

Inference Analysis

To infer both the factors influencing the market and the possible market outcomes, a thorough evaluation of both primary and secondary sources is carried out to draw a logical inference.

Finally, the primary and secondary research results are collated and verified to gain a holistic view of the market and draw logical conclusions.

Conclusion

In conclusion, both primary and secondary research methods are employed to develop a clear understanding of the global market for calcium carbonate. To analyze the key market trends and reach a thorough understanding of the market dynamics, data and analysis techniques are used to gain a holistic view of the market. Ultimately, the research is designed to provide a clear understanding of the current and future potential opportunities in the market.