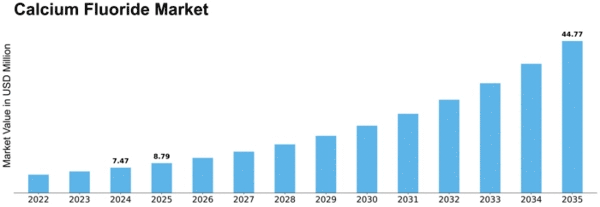

Calcium Fluoride Size

Calcium Fluoride Market Growth Projections and Opportunities

Calcium Fluoride Market Size was valued at USD 1030 Million in 2022. The Calcium Fluoride Market industry is projected to grow from USD 1050 Million in 2023 to USD 2100 Million by 2032, the Calcium Fluoride Market is projected to experience a significant compound annual growth rate (CAGR) of 8.20%

The calcium fluoride market is influenced by various factors that collectively shape its dynamics. One of the primary drivers is the widespread use of calcium fluoride in industries such as metallurgy, glass manufacturing, and the production of aluminum and cement. Calcium fluoride, known for its unique optical and physical properties, finds applications in the production of aluminum, as a flux in metallurgy, and as a raw material in the manufacturing of optical components, lenses, and windows. The demand from these key industries contributes significantly to the overall consumption of calcium fluoride.

Geopolitical factors play a role in shaping the calcium fluoride market, particularly concerning its extraction and production. The distribution of calcium fluoride reserves across different regions and geopolitical events can impact the global supply chain and prices. Changes in production levels, export restrictions, or geopolitical tensions in calcium fluoride-producing regions may lead to fluctuations in the market. Companies operating in this market need to monitor geopolitical developments to adapt their strategies accordingly.

Technological advancements and innovation in extraction and processing techniques are crucial factors in the calcium fluoride market. Continuous research and development efforts focus on improving extraction methods, ensuring efficient production, and developing cost-effective manufacturing processes. Innovations contribute to the competitiveness of calcium fluoride producers by enhancing production yields, reducing costs, and meeting sustainability standards. Manufacturers strive to adopt advanced technologies to stay ahead in the calcium fluoride market.

The global economic landscape significantly influences the calcium fluoride market. Economic growth often leads to increased industrial activities, including those in sectors where calcium fluoride is utilized. Conversely, economic downturns may result in a temporary reduction in industrial activities, affecting the demand for calcium fluoride. The market's sensitivity to economic fluctuations underscores the importance of monitoring global economic trends for stakeholders in the calcium fluoride industry.

Environmental regulations and sustainability considerations also play a role in shaping the calcium fluoride market. As industries strive to adopt more sustainable practices, there is a growing focus on responsible mining and processing of calcium fluoride. Compliance with environmental standards and the adoption of environmentally friendly practices contribute to the market's sustainability and appeal to environmentally conscious consumers.

Raw material availability and pricing are critical considerations for participants in the calcium fluoride market. The primary raw material for calcium fluoride production is fluorite, which is mined in various regions globally. Fluctuations in the prices and availability of fluorite can impact the overall production cost of calcium fluoride. Manufacturers closely monitor raw material markets to adjust their strategies and maintain cost-effectiveness in the competitive market.

Health and safety considerations also play a role in the calcium fluoride market, particularly in industries where exposure to fluoride emissions can pose risks to workers. Regulatory standards related to occupational safety and permissible levels of fluoride emissions impact the production processes and usage of calcium fluoride in certain applications. Compliance with health and safety regulations is essential for calcium fluoride producers to ensure the well-being of workers and maintain a positive industry reputation.

Leave a Comment