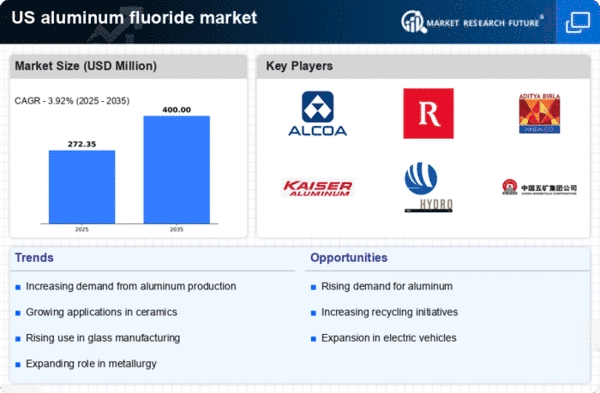

The aluminum fluoride market exhibits a competitive landscape characterized by a blend of established players and emerging entities, driven by increasing demand from the aluminum smelting industry and the growing emphasis on sustainable practices. Key players such as Alcoa Corporation (US), Rio Tinto (GB), and Hindalco Industries Limited (IN) are strategically positioned to leverage their operational capabilities and technological advancements. Alcoa Corporation (US) focuses on innovation in production processes, aiming to enhance efficiency and reduce environmental impact, while Rio Tinto (GB) emphasizes regional expansion and partnerships to strengthen its supply chain. Hindalco Industries Limited (IN) appears to be concentrating on digital transformation initiatives to optimize its operations and improve customer engagement, collectively shaping a competitive environment that prioritizes sustainability and operational excellence.The market structure is moderately fragmented, with several players vying for market share through various business tactics. Localizing manufacturing and optimizing supply chains are prevalent strategies among these companies, allowing them to respond swiftly to regional demands and fluctuations in raw material prices. The collective influence of these key players fosters a dynamic competitive atmosphere, where agility and responsiveness are paramount.

In October Alcoa Corporation (US) announced a partnership with a leading technology firm to develop a new aluminum fluoride production method that significantly reduces carbon emissions. This strategic move not only aligns with global sustainability goals but also positions Alcoa as a frontrunner in eco-friendly production techniques, potentially enhancing its market share and reputation.

In September Rio Tinto (GB) unveiled plans to expand its aluminum fluoride production facility in the US, aiming to increase output by 30% over the next two years. This expansion reflects Rio Tinto's commitment to meeting the rising demand for aluminum fluoride in the North American market, while also reinforcing its competitive edge through enhanced production capabilities.

In August Hindalco Industries Limited (IN) launched a digital platform designed to streamline its supply chain operations, enhancing transparency and efficiency. This initiative is indicative of the company's focus on integrating advanced technologies into its operations, which may lead to improved customer satisfaction and operational performance.

As of November the competitive trends in the aluminum fluoride market are increasingly defined by digitalization, sustainability, and the integration of artificial intelligence. Strategic alliances are becoming more prevalent, as companies seek to pool resources and expertise to navigate the complexities of the market. The shift from price-based competition to a focus on innovation, technology, and supply chain reliability is evident, suggesting that future competitive differentiation will hinge on the ability to adapt to evolving market demands and technological advancements.