Expansion of IoT Devices

The proliferation of Internet of Things (IoT) devices is significantly influencing the big data market in Canada. With millions of devices generating vast amounts of data, organizations are increasingly seeking solutions to manage and analyze this information. By 2025, it is projected that the number of connected IoT devices in Canada will exceed 1 billion, creating a substantial influx of data. This surge necessitates robust big data solutions to process and derive insights from the information generated. Consequently, the integration of IoT with big data technologies is expected to foster innovation and create new opportunities within the big data market.

Rising Cybersecurity Concerns

As organizations increasingly rely on data, concerns regarding cybersecurity are becoming more pronounced, impacting the big data market in Canada. The need to protect sensitive information from breaches and cyber threats is prompting businesses to invest in advanced security solutions. In 2025, it is anticipated that spending on cybersecurity measures will reach $10 billion in Canada, reflecting a growing awareness of the importance of data protection. This trend is likely to drive demand for big data solutions that incorporate robust security features, thereby enhancing the overall resilience of the big data market.

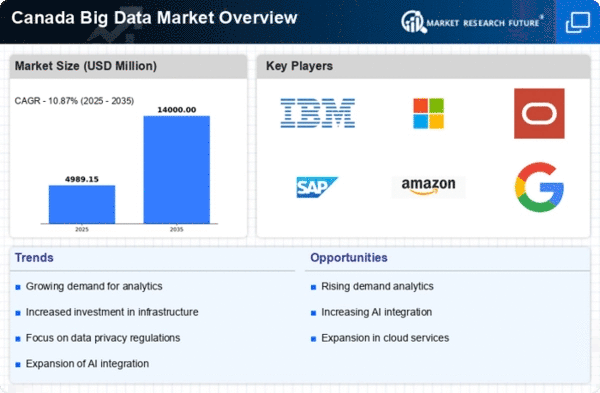

Growing Demand for Data Analytics

The increasing reliance on data-driven decision-making is propelling the big data market in Canada. Organizations across various sectors are recognizing the value of data analytics to enhance operational efficiency and customer engagement. In 2025, it is estimated that the data analytics segment will account for approximately 30% of the overall big data market. This trend is particularly evident in industries such as finance, healthcare, and retail, where actionable insights derived from data can lead to improved outcomes. As businesses strive to remain competitive, the demand for advanced analytics tools and services is likely to surge, further driving growth in the big data market.

Government Initiatives and Support

Government initiatives aimed at fostering innovation and technological advancement are playing a crucial role in the growth of the big data market in Canada. Various programs and funding opportunities are being introduced to support research and development in data analytics and related fields. For instance, the Canadian government has allocated over $200 million to enhance data infrastructure and promote the adoption of big data technologies among businesses. Such initiatives not only stimulate investment in the big data market but also encourage collaboration between public and private sectors, thereby driving the overall growth of the industry.

Emergence of Real-Time Data Processing

The shift towards real-time data processing is transforming the landscape of the big data market in Canada. Organizations are increasingly seeking solutions that enable them to analyze data as it is generated, allowing for timely decision-making and responsiveness to market changes. By 2025, the real-time analytics segment is expected to capture around 25% of the big data market share. This trend is particularly relevant in sectors such as e-commerce and telecommunications, where immediate insights can lead to competitive advantages. As businesses prioritize agility and responsiveness, the demand for real-time data processing solutions is likely to escalate, further propelling the growth of the big data market.