Rising Demand for Automation

The cognitive services-platform market is experiencing a notable surge in demand for automation across various sectors in Canada. Organizations are increasingly recognizing the potential of cognitive services to streamline operations, enhance productivity, and reduce operational costs. According to recent data, the automation market in Canada is projected to grow at a CAGR of approximately 15% over the next five years. This growth is driven by the need for businesses to remain competitive and agile in a rapidly evolving landscape. As companies seek to leverage cognitive technologies, the The cognitive services-platform market is likely to benefit from this trend. More enterprises are adopting AI-driven solutions to automate routine tasks and improve decision-making processes.

Regulatory Support for AI Integration

Regulatory frameworks in Canada are evolving to support the integration of AI technologies within the cognitive services-platform market. The Canadian government is actively promoting policies that encourage the responsible use of AI, ensuring ethical standards and compliance. This regulatory support is likely to create a conducive environment for businesses to adopt cognitive services, as it mitigates concerns related to data privacy and ethical implications. As organizations navigate these regulations, the cognitive services-platform market may witness increased adoption, as companies feel more secure in implementing AI solutions that align with governmental guidelines.

Investment in AI Research and Development

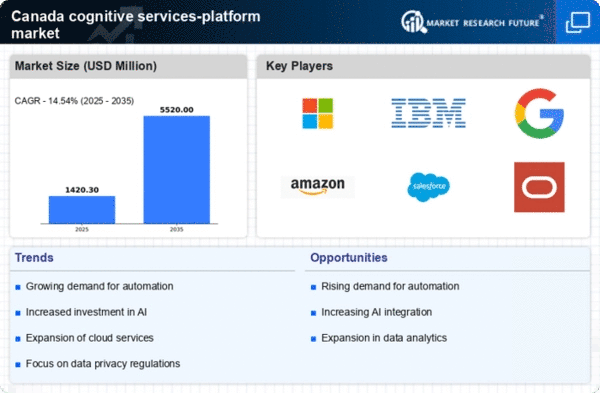

Investment in research and development (R&D) within the cognitive services-platform market is gaining momentum in Canada. Government initiatives and private sector funding are increasingly directed towards advancing AI technologies. In 2025, Canadian investments in AI R&D are expected to exceed $1 billion, reflecting a commitment to fostering innovation. This influx of capital is likely to enhance the capabilities of cognitive services, enabling the development of more sophisticated algorithms and applications. As a result, the cognitive services-platform market is poised for growth, as enhanced technologies will attract more businesses seeking to implement AI solutions in their operations.

Collaboration Between Tech Firms and Academia

Collaboration between technology firms and academic institutions is emerging as a vital driver for the cognitive services-platform market in Canada. Partnerships are being formed to foster innovation, share knowledge, and develop cutting-edge AI solutions. These collaborations often result in the creation of new technologies and applications that can be commercialized, thereby expanding the cognitive services-platform market. In 2025, it is anticipated that such partnerships will lead to a 20% increase in the number of AI startups in Canada, further stimulating market growth and enhancing the overall ecosystem for cognitive services.

Growing Need for Enhanced Customer Experience

The cognitive services-platform market is being propelled by the growing need for enhanced customer experience across various industries in Canada. Businesses are increasingly leveraging cognitive technologies to analyze customer data, personalize interactions, and improve service delivery. A recent survey indicated that 70% of Canadian companies prioritize customer experience as a key driver of their digital transformation strategies. This focus on customer-centric approaches is likely to drive the adoption of cognitive services, as organizations seek to utilize AI-driven insights to better understand and meet customer needs, thereby fostering loyalty and retention.