Rising Demand for Security Solutions

The computer vision market in Canada is experiencing a notable surge in demand for advanced security solutions. This trend is largely driven by the increasing need for surveillance systems in both public and private sectors. With crime rates fluctuating, organizations are investing heavily in computer vision technologies to enhance security measures. The market for security cameras equipped with computer vision capabilities is projected to grow at a CAGR of approximately 15% over the next five years. This growth is indicative of a broader shift towards automated monitoring systems that can analyze real-time data, thereby improving response times and reducing human error. As businesses and government entities prioritize safety, the computer vision market is likely to expand significantly, offering innovative solutions that cater to these evolving security needs.

Expansion of Smart Cities Initiatives

The push towards smart cities in Canada is significantly influencing the computer vision market. Municipalities are increasingly adopting computer vision technologies to improve urban infrastructure and enhance public services. Applications such as traffic monitoring, waste management, and public safety are becoming more prevalent, with computer vision systems playing a crucial role in data collection and analysis. The Canadian government has allocated substantial funding for smart city projects, which is expected to drive the computer vision market's growth. By 2027, the smart city market in Canada is projected to reach approximately $1.5 billion, with a considerable portion attributed to computer vision applications. This trend indicates a growing recognition of the importance of data-driven decision-making in urban planning and management, thereby creating new opportunities for stakeholders in the computer vision market.

Growing Applications in Retail Analytics

The computer vision market in Canada is increasingly being driven by its applications in retail analytics. Retailers are leveraging computer vision technologies to gain insights into consumer behavior, optimize inventory management, and enhance the overall shopping experience. For instance, computer vision systems can analyze foot traffic patterns and product interactions, providing valuable data that can inform marketing strategies. The retail sector is projected to invest approximately $500 million in computer vision solutions by 2026, reflecting a growing recognition of the technology's potential to drive sales and improve operational efficiency. As competition intensifies, retailers are likely to adopt more sophisticated computer vision tools, thereby propelling the market forward. This trend underscores the importance of data analytics in retail, positioning computer vision as a key player in the industry's evolution.

Integration with Artificial Intelligence

The integration of artificial intelligence (AI) with computer vision technologies is transforming the landscape of the computer vision market in Canada. AI algorithms enhance the capabilities of computer vision systems, enabling them to process and analyze visual data more effectively. This synergy is particularly evident in sectors such as manufacturing and agriculture, where AI-driven computer vision applications are optimizing operations. For instance, predictive maintenance powered by computer vision can reduce downtime by up to 30%, leading to substantial cost savings. The Canadian government has recognized the potential of AI and is investing in research and development initiatives, which is likely to further propel the computer vision market. As AI continues to evolve, its impact on the computer vision market will likely be profound, fostering innovation and efficiency across various industries.

Increased Investment in Research and Development

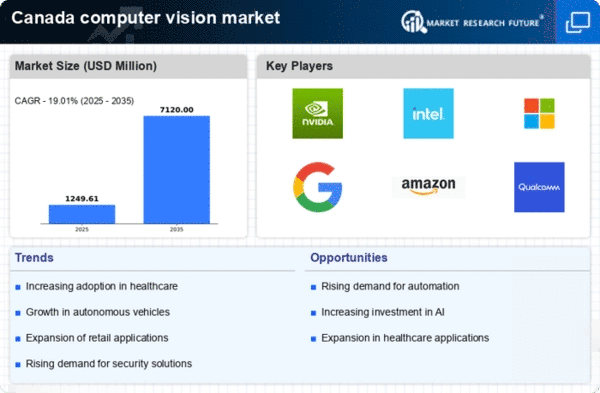

Investment in research and development (R&D) is a critical driver of growth in the computer vision market in Canada. Both public and private sectors are channeling resources into innovative projects aimed at enhancing computer vision technologies. This focus on R&D is fostering advancements in areas such as image recognition, object detection, and real-time processing capabilities. The Canadian government has launched several initiatives to support tech startups and research institutions, which is likely to stimulate innovation within the computer vision market. As a result, the market is expected to witness a compound annual growth rate (CAGR) of around 12% over the next five years. This investment climate not only encourages technological advancements but also attracts The computer vision market, further enriching the ecosystem.