Technological Integration

The integration of advanced technologies is significantly shaping the crypto asset-management market in Canada. Innovations such as blockchain technology, artificial intelligence, and machine learning are being utilized to enhance asset management processes. These technologies facilitate improved security, transparency, and efficiency in transactions. For instance, blockchain technology allows for real-time tracking of assets, which can reduce operational costs by up to 20%. Furthermore, AI-driven analytics provide insights that help asset managers make informed decisions. As these technologies continue to evolve, they are likely to attract more participants to the market, thereby increasing competition and driving innovation within the crypto asset-management market.

Enhanced Regulatory Clarity

In Canada, the crypto asset-management market is benefiting from enhanced regulatory clarity. The Canadian government has been actively working to establish a comprehensive regulatory framework for cryptocurrencies and related services. This effort aims to protect investors while fostering innovation within the sector. Recent developments suggest that clearer guidelines may lead to increased participation from both individual and institutional investors. As regulations become more defined, market participants may feel more secure in their investments, potentially leading to a growth rate of around 25% in the next few years. This regulatory environment is crucial for the long-term sustainability of the crypto asset-management market, as it encourages responsible practices and reduces the risk of fraud.

Increased Focus on Security

Security concerns have become a pivotal driver in the crypto asset-management market in Canada. As the market matures, the need for robust security measures has gained prominence. Investors are increasingly aware of the risks associated with digital assets, including hacking and fraud. In response, asset management firms are investing in advanced security protocols and insurance products to protect client assets. Recent data suggests that firms prioritizing security measures have seen a 20% increase in client trust and retention. This focus on security not only enhances investor confidence but also contributes to the overall stability of the crypto asset-management market, making it a more attractive option for both new and existing investors.

Rising Retail Participation

The crypto asset-management market in Canada is experiencing a surge in retail participation. More individuals are becoming aware of cryptocurrencies and are seeking ways to invest in them. This trend is partly fueled by the increasing availability of user-friendly platforms and educational resources. Recent surveys indicate that approximately 15% of Canadians have invested in cryptocurrencies, a figure that is expected to rise as awareness grows. This influx of retail investors is likely to drive demand for diverse investment products, including exchange-traded funds (ETFs) and managed portfolios. As retail participation increases, the crypto asset-management market may see a corresponding rise in trading volumes and overall market capitalization.

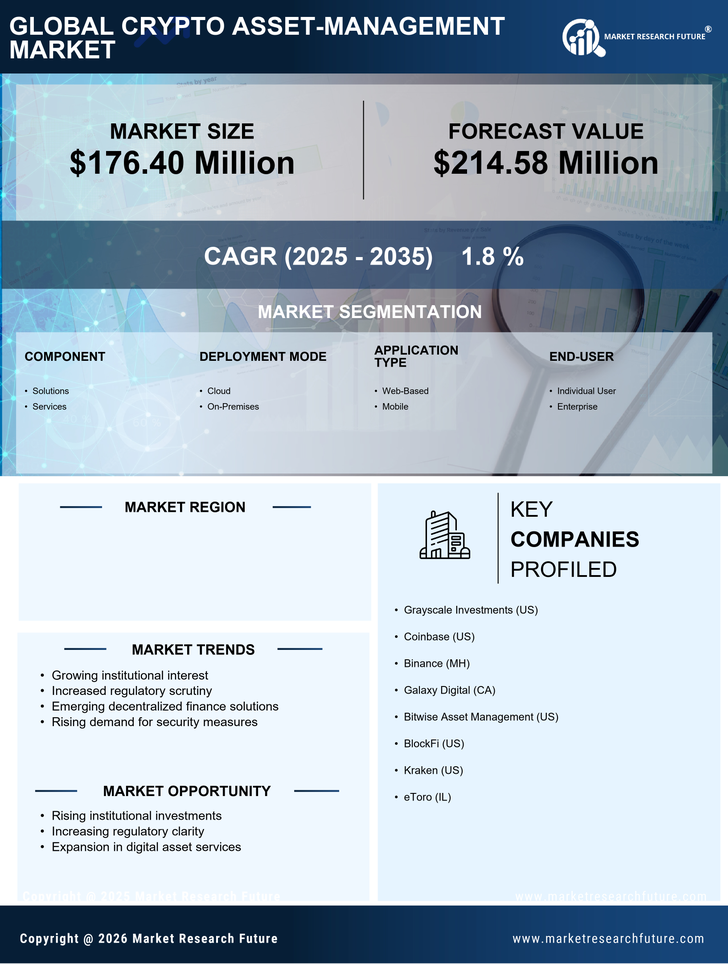

Growing Institutional Interest

The crypto asset-management market in Canada is witnessing a notable increase in institutional interest. Financial institutions, including banks and investment firms, are beginning to allocate resources towards cryptocurrency assets. This shift is driven by the potential for high returns and diversification benefits. According to recent data, institutional investments in cryptocurrencies have surged by approximately 30% in the past year. This trend indicates a growing acceptance of digital assets as a legitimate investment class. As institutions enter the market, they bring with them a level of credibility and stability, which may attract more retail investors. Consequently, the crypto asset-management market is likely to experience enhanced liquidity and increased product offerings tailored to institutional clients.