Regulatory Support and Incentives

The Canadian government is actively promoting the directional drilling market through various regulatory frameworks and incentives aimed at enhancing energy efficiency and reducing environmental impact. Policies that support advanced drilling techniques are likely to encourage investment in directional drilling technologies. For instance, tax incentives for companies adopting environmentally friendly practices may lead to a projected increase of 15% in directional drilling activities by 2026. This regulatory support not only fosters innovation but also aligns with Canada's commitment to sustainable energy practices, thereby bolstering the directional drilling market.

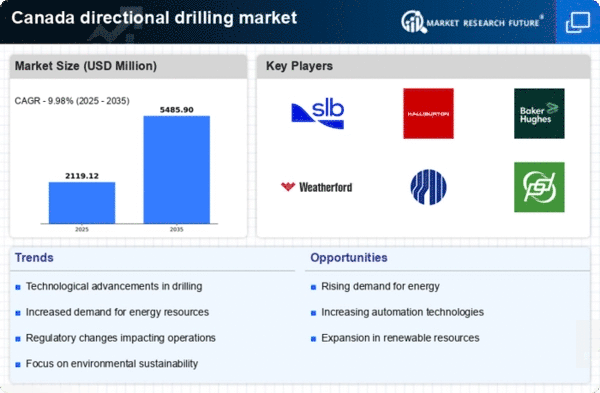

Increased Demand for Energy Resources

The directional drilling market in Canada is experiencing heightened demand due to the country's rich energy resources, particularly in oil and natural gas. As energy consumption continues to rise, the need for efficient extraction methods becomes paramount. Directional drilling allows for accessing hard-to-reach reserves, thereby enhancing production capabilities. In 2025, the Canadian oil and gas sector is projected to contribute approximately $100 billion to the economy, with directional drilling playing a crucial role in this growth. The industry's ability to minimize surface disruption while maximizing resource recovery is likely to drive further investments in directional drilling technologies.

Technological Integration and Innovation

The integration of advanced technologies such as automation, data analytics, and real-time monitoring is transforming the directional drilling market in Canada. These innovations enhance operational efficiency and reduce costs, making directional drilling more attractive to operators. The adoption of smart drilling technologies is expected to increase by 20% in the next few years, as companies seek to optimize their drilling processes. This technological evolution not only improves the precision of drilling operations but also contributes to safer and more environmentally responsible practices, thereby reinforcing the market's growth.

Growing Focus on Renewable Energy Sources

While the directional drilling market is traditionally associated with fossil fuel extraction, there is a growing interest in utilizing these techniques for renewable energy projects, such as geothermal energy. The Canadian government aims to increase the share of renewables in the energy mix, which could lead to a diversification of applications for directional drilling. This shift may result in a 10% increase in directional drilling projects related to renewable energy by 2027. As companies adapt to this trend, the directional drilling market is likely to expand its scope, catering to both conventional and renewable energy sectors.

Market Consolidation and Strategic Partnerships

The directional drilling market in Canada is witnessing a trend of consolidation, with companies forming strategic partnerships to enhance their competitive edge. Mergers and acquisitions are becoming more common as firms seek to combine resources and expertise. This consolidation is expected to lead to a more robust directional drilling market, with an anticipated growth rate of 12% over the next five years. By pooling resources, companies can invest in research and development, thereby driving innovation and improving service offerings. Such strategic collaborations are likely to reshape the competitive landscape of the directional drilling market.