Growing Demand for Customization

The increasing demand for customization in product design is a significant driver in the Canada electrical electronic computer aided design market. As consumers seek personalized solutions, companies are compelled to adopt CAD tools that facilitate tailored designs. This trend is particularly evident in sectors such as consumer electronics and automotive, where unique features and specifications are paramount. The ability to quickly adapt designs to meet specific customer requirements not only enhances customer satisfaction but also provides a competitive edge. Market data indicates that businesses leveraging CAD for customization are likely to see improved operational efficiency and reduced time-to-market, further solidifying the importance of this driver in the industry.

Government Initiatives and Support

Government policies and initiatives significantly influence the Canada electrical electronic computer aided design market. The Canadian government has been actively promoting innovation and technology adoption through various funding programs and grants aimed at enhancing the capabilities of local businesses. For instance, initiatives such as the Strategic Innovation Fund provide financial support to companies investing in research and development, including CAD technologies. This support not only fosters innovation but also encourages collaboration between educational institutions and industry players, ensuring a skilled workforce is available to meet the demands of the evolving market. As a result, the industry is likely to experience growth driven by enhanced capabilities and increased competitiveness.

Expansion of the Manufacturing Sector

The expansion of the manufacturing sector in Canada serves as a vital driver for the electrical electronic computer aided design market. As manufacturing processes become more sophisticated, the demand for advanced CAD solutions that streamline production and improve design accuracy is on the rise. The Canadian manufacturing sector has been experiencing growth, particularly in areas such as aerospace, automotive, and electronics, which rely heavily on CAD technologies for product development. This trend is expected to continue, with projections indicating a steady increase in manufacturing output. Consequently, the CAD market is likely to benefit from this expansion, as manufacturers seek to enhance their design capabilities and maintain competitiveness in a global market.

Technological Advancements in CAD Tools

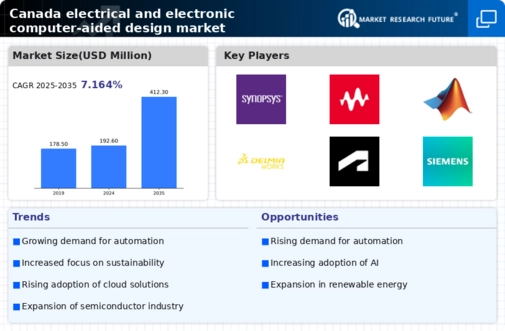

The rapid evolution of technology plays a pivotal role in the Canada electrical electronic computer aided design market. Innovations such as 3D modeling, simulation software, and parametric design tools have transformed the way engineers and designers approach projects. The integration of advanced features enhances productivity and accuracy, allowing for more complex designs to be realized efficiently. According to recent data, the CAD software market in Canada is projected to grow at a compound annual growth rate of approximately 6.5% over the next five years. This growth is driven by the increasing demand for sophisticated design solutions across various sectors, including automotive, aerospace, and electronics, thereby reinforcing the significance of technological advancements in shaping the future of the industry.

Sustainability and Eco-Friendly Design Practices

Sustainability has emerged as a crucial consideration in the Canada electrical electronic computer aided design market. As environmental concerns grow, companies are increasingly adopting eco-friendly design practices that minimize waste and energy consumption. CAD tools are being utilized to create designs that optimize material usage and reduce the carbon footprint of products. This shift towards sustainable design is not only driven by regulatory requirements but also by consumer preferences for environmentally responsible products. The integration of sustainability into the design process is expected to enhance brand reputation and customer loyalty, thereby influencing market dynamics positively. Companies that prioritize sustainability in their CAD practices are likely to gain a competitive advantage in the evolving marketplace.