Rising Demand for Renewable Energy

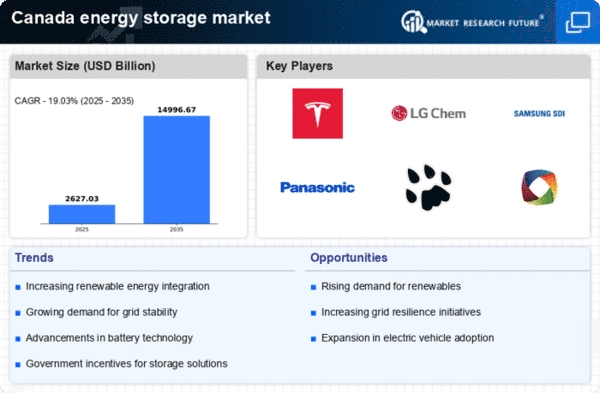

The increasing demand for renewable energy sources in Canada is a pivotal driver for the energy storage market. As provinces aim to reduce greenhouse gas emissions, the integration of solar and wind energy has surged. In 2023, renewable energy accounted for approximately 18% of Canada's total energy generation. This shift necessitates robust energy storage solutions to manage the intermittent nature of these sources. Energy storage systems enable the capture of excess energy produced during peak generation times, ensuring a reliable supply during periods of low production. Consequently, the energy storage market is poised for growth as utilities and businesses invest in storage technologies to enhance grid stability and support the transition to a low-carbon economy.

Increased Investment in Infrastructure

Investment in energy infrastructure is a significant driver for the energy storage market in Canada. The government has allocated substantial funding to modernize the electrical grid, with an estimated $10 billion earmarked for upgrades over the next decade. This modernization includes the integration of energy storage systems to enhance grid resilience and reliability. As aging infrastructure poses challenges, energy storage solutions are increasingly viewed as essential components for future-proofing the grid. Moreover, the energy storage market is likely to benefit from public-private partnerships aimed at developing innovative storage technologies, thereby attracting further investment and fostering a competitive landscape.

Technological Innovations in Energy Storage

Technological advancements in energy storage technologies are transforming the energy storage market in Canada. Innovations such as lithium-ion batteries, flow batteries, and solid-state batteries are enhancing energy density, efficiency, and lifespan. In 2025, the cost of lithium-ion battery systems has decreased by approximately 50% since 2015, making them more accessible for various applications. These advancements not only improve the performance of energy storage systems but also expand their applicability across residential, commercial, and industrial sectors. As technology continues to evolve, the energy storage market is expected to witness increased adoption rates, driven by the need for efficient energy management solutions.

Growing Need for Grid Stability and Reliability

The increasing complexity of the energy grid in Canada necessitates enhanced stability and reliability, driving demand for energy storage solutions. As more renewable energy sources are integrated, the grid faces challenges related to fluctuations in supply and demand. Energy storage systems provide a buffer, allowing for the balancing of energy loads and ensuring a consistent power supply. In 2025, it is projected that energy storage capacity in Canada will reach 5 GW, reflecting a growing recognition of its role in maintaining grid stability. This trend indicates a robust future for the energy storage market, as stakeholders prioritize reliability in energy delivery.

Regulatory Frameworks Supporting Energy Storage

The establishment of supportive regulatory frameworks is a crucial driver for the energy storage market in Canada. Recent policy developments have encouraged the deployment of energy storage systems, with provinces implementing regulations that facilitate their integration into the energy mix. For instance, Ontario's Independent Electricity System Operator has introduced programs that incentivize energy storage projects, allowing for a smoother transition to a more flexible energy system. These regulatory measures not only promote investment in energy storage technologies but also enhance market confidence, leading to a more robust energy storage market that aligns with national energy goals.