Rising Data Volume

The exponential growth of data generated by businesses in Canada is a critical driver for the enterprise data-management market. With the increasing reliance on digital platforms, organizations are producing vast amounts of structured and unstructured data. It is estimated that data volume will continue to grow at a rate of 30% annually, necessitating advanced data management solutions. Companies are compelled to implement effective data storage, processing, and analysis strategies to harness this data for informed decision-making. This surge in data volume is likely to drive investments in scalable data management systems, which can accommodate the growing data landscape. As organizations seek to leverage data for competitive advantage, the enterprise data-management market is expected to expand significantly, with a focus on innovative technologies that facilitate efficient data handling and utilization.

Demand for Real-Time Analytics

The enterprise data-management market in Canada is experiencing a surge in demand for real-time analytics capabilities. Organizations are increasingly recognizing the value of timely insights derived from data to drive strategic decision-making. As businesses strive to remain competitive, the ability to analyze data in real-time is becoming essential. This trend is expected to propel the market for data management solutions that offer advanced analytics features, with a projected growth rate of around 10% over the next few years. Companies are likely to seek solutions that enable them to process and visualize data instantaneously, allowing for agile responses to market changes. The integration of real-time analytics into data management practices is anticipated to enhance operational efficiency and foster innovation, thereby driving further growth in the enterprise data-management market.

Regulatory Compliance Pressure

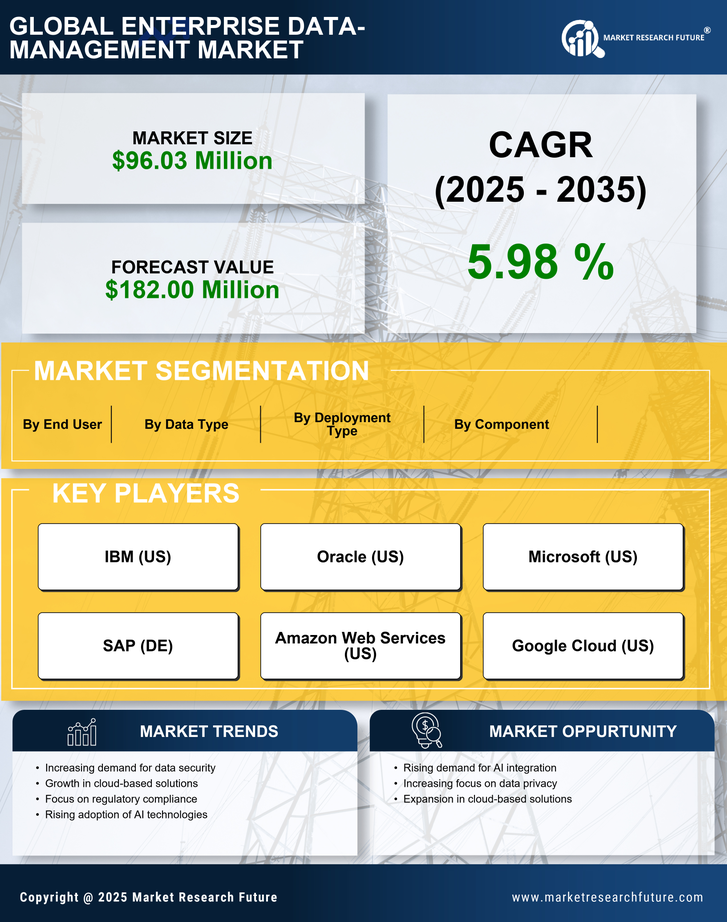

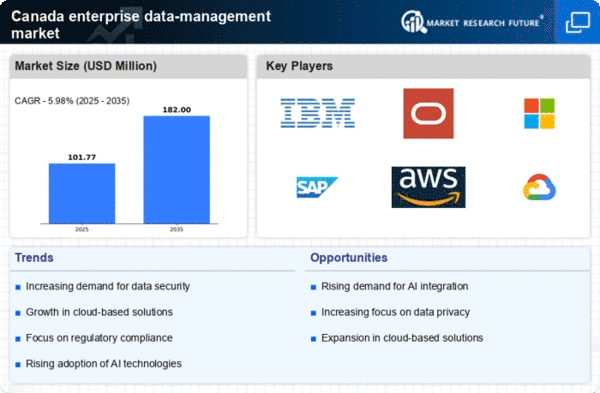

The enterprise data-management market in Canada is under increasing pressure from regulatory compliance requirements. Organizations must adhere to various data protection laws, such as the Personal Information Protection and Electronic Documents Act (PIPEDA). This legislation mandates strict guidelines for data handling and storage, compelling businesses to invest in robust data management solutions. As a result, the market is projected to grow at a CAGR of approximately 12% over the next five years. Companies are likely to prioritize compliance-driven data management strategies, which may lead to increased demand for specialized software and services. Furthermore, the need for transparency and accountability in data practices is becoming paramount, pushing organizations to adopt comprehensive data governance frameworks. This trend indicates a significant shift in how enterprises approach data management, ultimately driving growth in the enterprise data-management market.

Increased Focus on Data Security

Data security concerns are paramount in the enterprise data-management market, particularly in Canada, where data breaches can lead to severe financial and reputational damage. Organizations are increasingly aware of the risks associated with inadequate data protection measures. As a result, there is a growing emphasis on implementing robust security protocols and technologies to safeguard sensitive information. The market for data security solutions is projected to grow by approximately 15% annually, driven by the need for encryption, access controls, and threat detection systems. Companies are likely to invest in comprehensive data management strategies that integrate security features, ensuring compliance with regulatory standards. This heightened focus on data security not only protects organizations from potential threats but also enhances customer trust, thereby contributing to the overall growth of the enterprise data-management market.

Shift Towards Data-Driven Culture

There is a notable shift towards a data-driven culture within organizations across Canada, significantly impacting the enterprise data-management market. Companies are increasingly recognizing the importance of data in shaping business strategies and enhancing operational efficiency. This cultural transformation is likely to drive investments in data management solutions that facilitate data accessibility and usability. As organizations prioritize data literacy and analytics capabilities, the market is expected to grow at a CAGR of approximately 11% in the coming years. The emphasis on fostering a data-driven mindset encourages businesses to leverage data for informed decision-making, ultimately leading to improved performance and competitiveness. This shift not only influences the adoption of advanced data management technologies but also promotes a holistic approach to data governance and utilization, further propelling the enterprise data-management market.