Emergence of IoT Applications

The proliferation of Internet of Things (IoT) devices in Canada is significantly influencing the fpga in-telecom-sector market. As more devices become interconnected, the demand for efficient data processing and transmission increases. FPGAs are well-suited for handling the diverse requirements of IoT applications, including real-time data processing and low power consumption. The Canadian IoT market is anticipated to reach $30 billion by 2025, which could drive telecom operators to invest in FPGAs to support the growing number of connected devices. This trend suggests that the fpga in-telecom-sector market will likely expand as telecom companies seek to leverage FPGAs to enhance their service offerings and improve operational efficiency.

Advancements in Cloud Computing

The shift towards cloud computing in the Canadian telecom sector is another significant driver for the fpga in-telecom-sector market. As telecom providers increasingly adopt cloud-based solutions, the need for high-performance computing resources becomes critical. FPGAs can be utilized to accelerate cloud services, providing the necessary computational power for data-intensive applications. The Canadian cloud computing market is projected to grow at a CAGR of 15% over the next five years, indicating a robust demand for technologies that can enhance cloud performance. This growth may lead telecom companies to integrate FPGAs into their cloud infrastructure, thereby driving the expansion of the fpga in-telecom-sector market as they seek to optimize their service delivery.

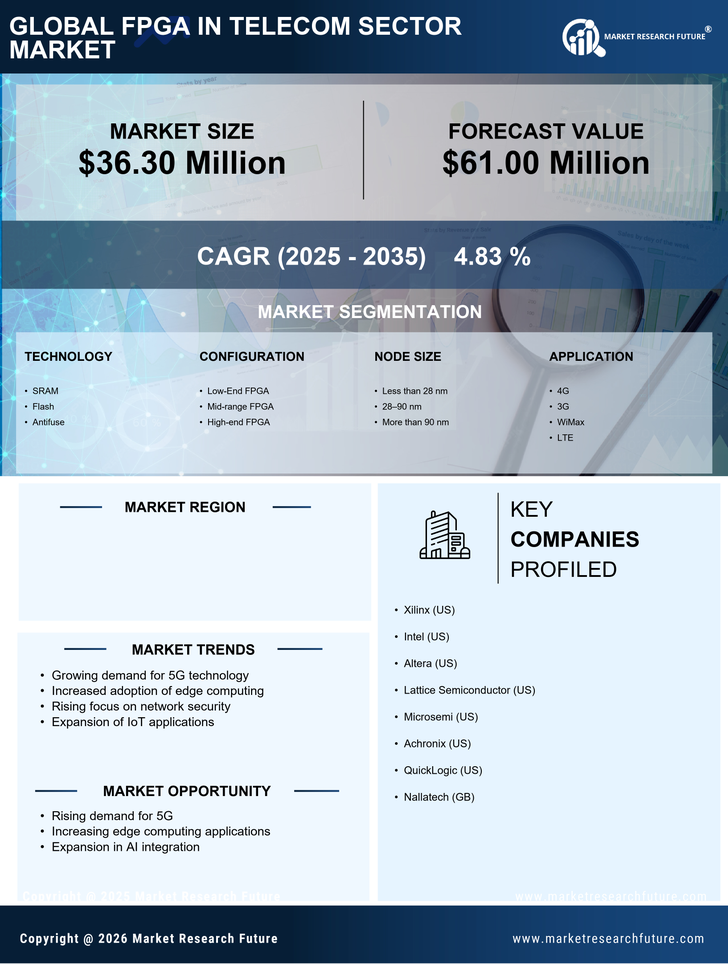

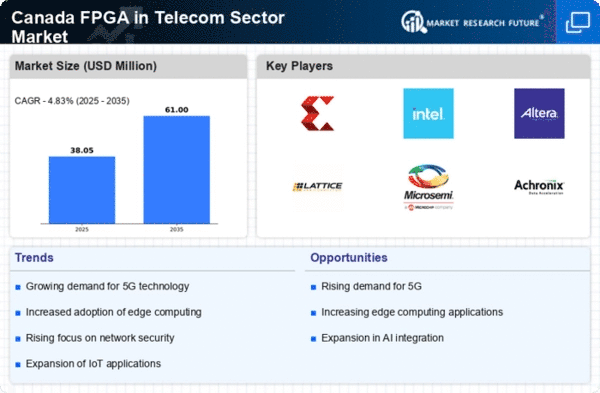

Rising Adoption of 5G Technology

The ongoing rollout of 5G technology in Canada is a pivotal driver for the fpga in-telecom-sector market. As telecom operators upgrade their infrastructure to support higher data rates and lower latency, the demand for FPGAs is expected to surge. FPGAs offer the flexibility and performance required for 5G applications, enabling rapid deployment of new services. According to recent estimates, the Canadian telecom sector is projected to invest approximately $10 billion in 5G infrastructure by 2026. This investment is likely to create a substantial market for FPGAs, as they are integral to the development of advanced network equipment and services. The fpga in-telecom-sector market is thus positioned to benefit significantly from this technological shift, as companies seek to enhance their capabilities to meet the demands of 5G connectivity.

Increased Focus on Network Security

As cyber threats continue to evolve, the need for robust network security solutions has become paramount in the Canadian telecom sector. The fpga in-telecom-sector market is likely to experience growth driven by the demand for FPGAs that can be programmed to implement advanced security protocols. FPGAs provide the necessary processing power to handle encryption and decryption tasks efficiently, which is crucial for protecting sensitive data transmitted over telecom networks. With the Canadian government emphasizing cybersecurity measures, telecom companies are expected to allocate more resources towards enhancing their security infrastructure. This trend may lead to an increase in the adoption of FPGAs, as they offer a customizable solution to address specific security challenges within the telecom industry.

Growing Demand for Customizable Solutions

The need for customizable solutions in the telecom sector is increasingly shaping the fpga in-telecom-sector market. Telecom operators are seeking flexible and adaptable technologies to meet the unique demands of their networks. FPGAs offer the ability to be reprogrammed for various applications, allowing telecom companies to tailor their solutions to specific requirements. This adaptability is particularly valuable in a rapidly changing technological landscape, where new standards and protocols frequently emerge. As Canadian telecom companies strive to maintain a competitive edge, the demand for FPGAs is likely to rise, as they provide a means to innovate and respond to market changes effectively. This trend underscores the potential for growth within the fpga in-telecom-sector market.