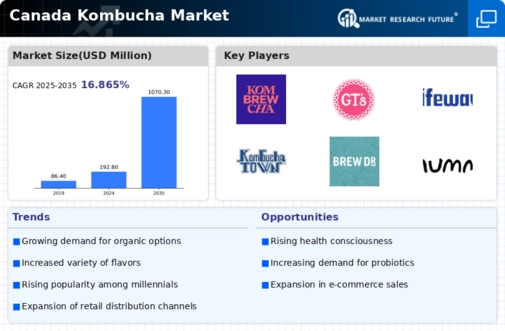

The kombucha market in Canada is characterized by a dynamic competitive landscape, driven by increasing consumer demand for health-oriented beverages and a growing awareness of the benefits associated with fermented products. Key players such as GT's Living Foods (CA), Brew Dr. Kombucha (CA), and Health-Ade Kombucha (CA) are strategically positioned to capitalize on these trends. GT's Living Foods (CA) emphasizes innovation in flavor profiles and product formulations, while Brew Dr. Kombucha (CA) focuses on expanding its distribution channels and enhancing brand visibility through partnerships. Health-Ade Kombucha (CA) has adopted a strategy centered on sustainability, which resonates well with environmentally conscious consumers. Collectively, these strategies contribute to a competitive environment that is increasingly focused on differentiation through product quality and brand loyalty.

In terms of business tactics, companies are localizing manufacturing to reduce supply chain complexities and enhance responsiveness to market demands. The competitive structure of the market appears moderately fragmented, with several players vying for market share. This fragmentation allows for niche brands to thrive, while larger companies leverage economies of scale to optimize their operations. The collective influence of these key players shapes the market dynamics, fostering an environment where innovation and consumer engagement are paramount.

In November 2025, GT's Living Foods (CA) announced the launch of a new line of organic, low-sugar kombucha aimed at health-conscious consumers. This strategic move is likely to attract a demographic increasingly concerned with sugar intake, thereby expanding their market reach. The introduction of this product line not only aligns with current health trends but also reinforces GT's commitment to innovation, potentially enhancing its competitive edge.

In October 2025, Brew Dr. Kombucha (CA) expanded its distribution network by partnering with a major Canadian grocery chain, significantly increasing its market presence. This partnership is indicative of Brew Dr.'s strategy to enhance accessibility and visibility, which may lead to increased sales and brand recognition. Such strategic alliances are crucial in a competitive landscape where consumer convenience plays a vital role in purchasing decisions.

In September 2025, Health-Ade Kombucha (CA) launched a sustainability initiative aimed at reducing its carbon footprint by 30% over the next five years. This initiative not only reflects the growing consumer preference for environmentally responsible brands but also positions Health-Ade as a leader in sustainability within the kombucha market. The strategic importance of this move lies in its potential to attract eco-conscious consumers and differentiate the brand in a crowded marketplace.

As of December 2025, current trends in the kombucha market are increasingly defined by digitalization, sustainability, and the integration of AI technologies in production and marketing strategies. Strategic alliances are shaping the landscape, enabling companies to leverage shared resources and expertise. Looking ahead, competitive differentiation is likely to evolve from traditional price-based competition to a focus on innovation, technology, and supply chain reliability. This shift underscores the importance of adaptability and responsiveness in a rapidly changing market.

Leave a Comment