The operational intelligence market in Canada is characterized by a dynamic competitive landscape, driven by the increasing demand for real-time data analytics and decision-making capabilities. Key players such as IBM (CA), SAP (CA), and Microsoft (CA) are at the forefront, each adopting distinct strategies to enhance their market positioning. IBM (CA) emphasizes innovation through its AI-driven analytics solutions, while SAP (CA) focuses on integrating operational intelligence with enterprise resource planning (ERP) systems. Microsoft (CA) leverages its cloud infrastructure to provide scalable operational intelligence solutions, thereby shaping a competitive environment that prioritizes technological advancement and customer-centric approaches.

The market structure appears moderately fragmented, with a mix of established players and emerging startups. Key business tactics include localizing services to meet regional demands and optimizing supply chains to enhance efficiency. The collective influence of these major companies fosters a competitive atmosphere where agility and responsiveness to market needs are paramount. This competitive structure encourages continuous improvement and innovation, as companies strive to differentiate themselves in a crowded marketplace.

In November 2025, IBM (CA) announced a strategic partnership with a leading Canadian telecommunications provider to enhance its operational intelligence offerings. This collaboration aims to integrate advanced analytics into telecommunications infrastructure, enabling real-time insights for network optimization. The strategic importance of this partnership lies in its potential to expand IBM's reach within the telecommunications sector, thereby solidifying its position as a leader in operational intelligence solutions.

In October 2025, SAP (CA) launched a new suite of operational intelligence tools designed specifically for the manufacturing sector. This initiative reflects SAP's commitment to digital transformation and aims to streamline production processes through data-driven insights. The launch is significant as it positions SAP to capture a larger share of the manufacturing market, which is increasingly reliant on operational intelligence for efficiency and competitiveness.

In September 2025, Microsoft (CA) unveiled enhancements to its Azure platform, incorporating advanced machine learning capabilities tailored for operational intelligence applications. This move is indicative of Microsoft's strategy to leverage its cloud services to provide comprehensive solutions that address the evolving needs of businesses. The integration of machine learning into operational intelligence tools is likely to enhance predictive analytics, thereby offering clients a competitive edge in their respective industries.

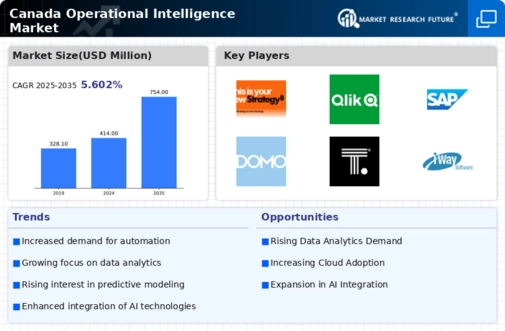

As of December 2025, current trends in the operational intelligence market include a pronounced focus on digitalization, sustainability, and the integration of AI technologies. Strategic alliances among key players are shaping the landscape, fostering innovation and collaboration. The competitive differentiation is expected to evolve, shifting from traditional price-based competition to a focus on technological innovation, reliability in supply chains, and the ability to deliver tailored solutions. This transition underscores the importance of agility and responsiveness in meeting the demands of an increasingly complex market.

Leave a Comment