- Global Market Outlook

- In-depth analysis of global and regional trends

- Analyze and identify the major players in the market, their market share, key developments, etc.

- To understand the capability of the major players based on products offered, financials, and strategies.

- Identify disrupting products, companies, and trends.

- To identify opportunities in the market.

- Analyze the key challenges in the market.

- Analyze the regional penetration of players, products, and services in the market.

- Comparison of major players’ financial performance.

- Evaluate strategies adopted by major players.

- Recommendations

- Vigorous research methodologies for specific market.

- Knowledge partners across the globe

- Large network of partner consultants.

- Ever-increasing/ Escalating data base with quarterly monitoring of various markets

- Trusted by fortune 500 companies/startups/ universities/organizations

- Large database of 5000+ markets reports.

- Effective and prompt pre- and post-sales support.

Market Size Snapshot

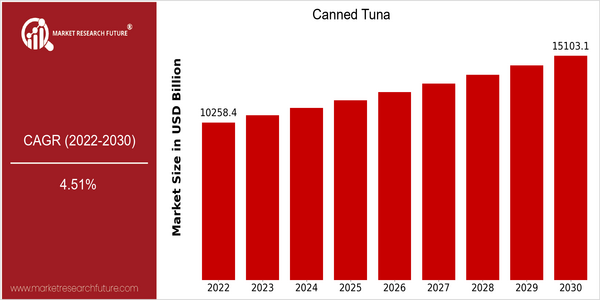

| Year | Value |

|---|---|

| 2022 | USD 10258.36 Billion |

| 2030 | USD 15103.07 Billion |

| CAGR (2022-2030) | 4.51 % |

Note – Market size depicts the revenue generated over the financial year

Canned Tuna Market The worldwide canned tuna market was valued at about $ 10,258.36 million in 2022 and is estimated to reach about $ 15,103.07 million by 2030, at a CAGR of 4.51% for the forecast period. This increase in canned tuna consumption is driven by a growing demand for ready-to-eat and convenient foods, as well as an increased awareness of the health benefits of tuna, such as high content of omega-3 fatty acids and high-quality fish oil. Furthermore, technological advancements in food preservation and packaging are also driving the market. Vacuum-packaging and improved canning methods have increased the shelf life and quality of canned tuna, thereby increasing its attractiveness to consumers. Canned tuna manufacturers such as Bumble Bee, Starkist, and Chicken of the Sea are investing in strategic alliances, new product launches, and sustainable fishing practices. These efforts not only strengthen their market position, but also respond to consumers' growing demand for sustainable and ethically sourced food, which in turn drives the canned tuna market.

Regional Market Size

Regional Deep Dive

The canned tuna market is characterized by diverse preferences of consumers and varying regulatory environments in different regions. North America is driven by a growing demand for convenient and healthy food, while Europe is concerned with the issue of sustainable exploitation and social responsibility. Asia-Pacific is experiencing rapid growth, due to urbanization and changing eating habits. Middle East and Africa (MEA) is experiencing a significant increase in canned tuna consumption, mainly due to economic growth and changes in lifestyle. Latin America, with its rich fishing grounds, is mainly concerned with the export opportunities and the local consumption, which makes it a special player in the world market.

Europe

- The European Union has introduced new labeling regulations that require clearer information on the sustainability of fish sources, impacting brands like John West and Princes to adapt their marketing strategies to highlight responsible sourcing.

- Innovations in packaging, such as the introduction of eco-friendly materials by companies like Fish4Ever, are gaining traction as consumers become more environmentally conscious, influencing purchasing decisions.

Asia Pacific

- Countries like Japan and South Korea are seeing a surge in demand for premium canned tuna products, driven by a growing trend towards gourmet and high-quality food options, with brands like Dongwon Industries capitalizing on this shift.

- The rise of e-commerce platforms in countries such as China is transforming the distribution landscape for canned tuna, allowing brands to reach a broader audience and cater to the increasing online shopping trend.

Latin America

- Countries like Peru and Ecuador are focusing on sustainable fishing practices, with organizations such as the Marine Stewardship Council (MSC) promoting certification programs that enhance the marketability of their canned tuna exports.

- The increasing popularity of canned tuna as a protein source among younger consumers in Brazil is driving innovation in flavors and packaging, with local brands experimenting with new recipes to attract this demographic.

North America

- The U.S. Food and Drug Administration (FDA) has implemented stricter regulations on mercury levels in seafood, prompting companies like Bumble Bee Foods to enhance their sourcing and testing protocols to ensure compliance and consumer safety.

- Recent trends show a significant increase in demand for organic and sustainably sourced canned tuna, with brands like Wild Planet leading the charge by offering products that meet these consumer preferences.

Middle East And Africa

- The UAE is witnessing a growing trend towards ready-to-eat meals, with canned tuna being a popular choice among busy consumers, prompting local brands like Al Ain Food and Beverages to expand their product lines.

- Government initiatives aimed at boosting local fishing industries, such as the Saudi Vision 2030, are expected to enhance the availability and affordability of canned tuna products in the region.

Did You Know?

“Canned tuna is one of the most consumed seafood products globally, with an estimated 3 million tons produced annually, making it a staple in many households.” — FAO (Food and Agriculture Organization of the United Nations)

Segmental Market Size

The canned tuna market is an important part of the fishery industry. Its consumption is constantly increasing, being based on convenience and health. The tuna industry is in the process of being restructured. Companies such as Bumble Bee Foods and Starkist are leading the way, with sustainable practices that increase their market share. Canned tuna is the main ingredient in prepared dishes, salads and sandwiches, being a staple food in households and in the catering industry. The trend towards healthy eating, which has been accelerated by the COVID-19 epidemic, has increased its popularity. Canned tuna is one of the least processed foods, and its quality is high. Technological advances in the canning process and in packaging are increasing its shelf life and quality. In the future, as sustainable practices gain momentum, innovations in catching and processing tuna will be developed, ensuring their continued success in a highly competitive market.

Future Outlook

Canned tuna is expected to show significant growth from 2022 to 2030, with a projected CAGR of 4.51% from a value of $ 10.26 billion to $1.51 billion. The rise in the consumption of tuna is mainly due to the increasing demand for convenient and nutritious food, and the growing concern for sustainable exploitation of natural resources. Canned tuna is expected to rise in popularity and could reach up to 30 percent of the overall market for fish in 2030. The future of canned tuna will also be influenced by technological developments and government policy. The development of packaging technology, such as vacuum packaging and biodegradable materials, will extend the shelf life of products and reduce the impact on the environment, which will be attractive to the growing number of consumers who care about the environment. Meanwhile, the framework for sustainable fishing will encourage companies to source from responsible sources, which will also improve consumer trust and market growth. The trend of vegetarianism and the use of canned tuna in meal kits will also contribute to the growth of the market, and canned tuna will remain a popular food in the home.

Covered Aspects:| Report Attribute/Metric | Details |

|---|---|

| Growth Rate | 7.58% (2024-2032) |

Canned Tuna Market Highlights:

Leading companies partner with us for data-driven Insights

Kindly complete the form below to receive a free sample of this Report

Tailored for You

- Dedicated Research on any specifics segment or region.

- Focused Research on specific players in the market.

- Custom Report based only on your requirements.

- Flexibility to add or subtract any chapter in the study.

- Historic data from 2014 and forecasts outlook till 2040.

- Flexibility of providing data/insights in formats (PDF, PPT, Excel).

- Provide cross segmentation in applicable scenario/markets.