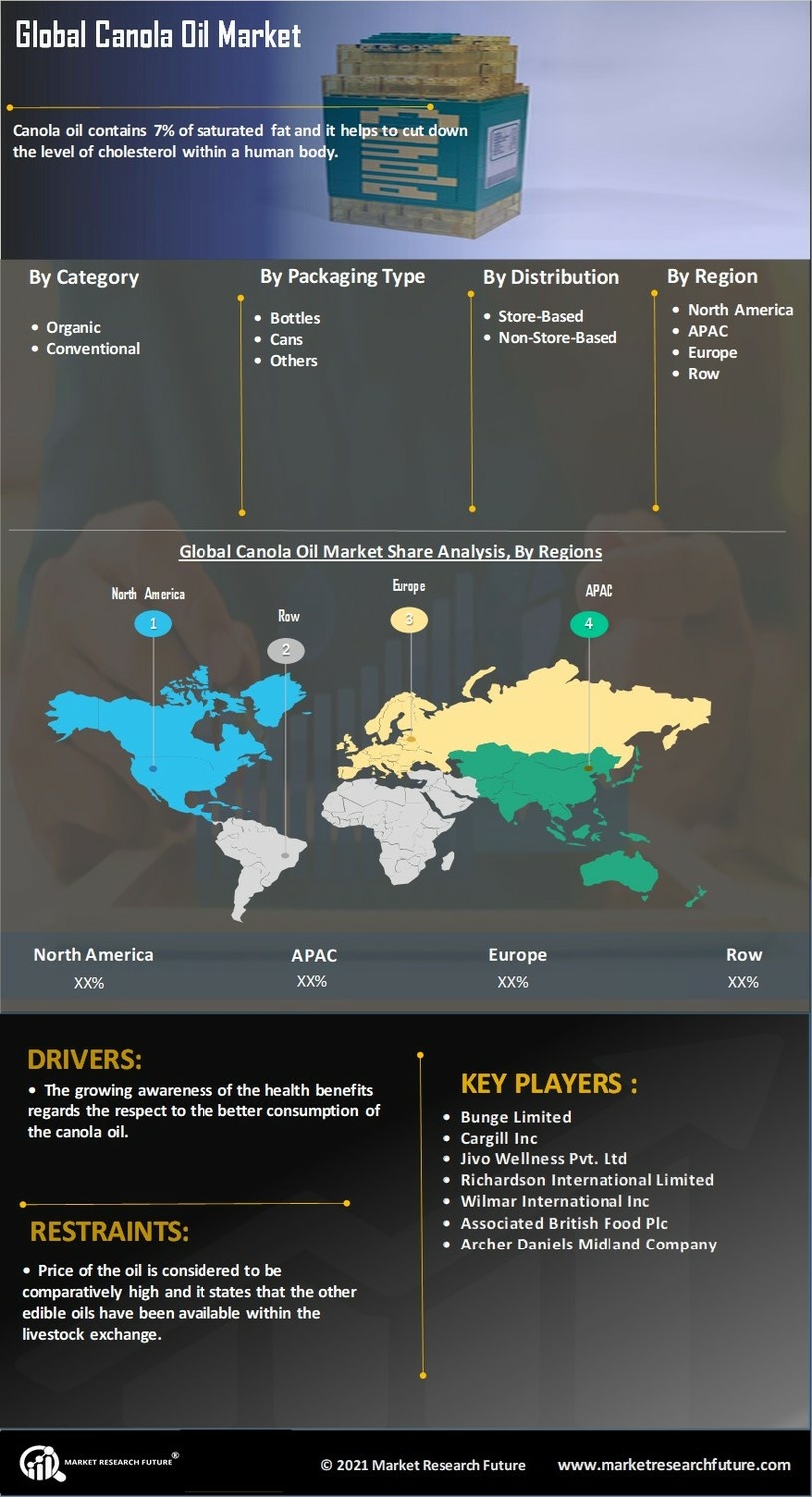

Rising Health Awareness

The increasing awareness regarding health and nutrition is a pivotal driver for the canola oil Market. Consumers are becoming more discerning about their dietary choices, leading to a surge in demand for healthier cooking oils. Canola oil, known for its low saturated fat content and high levels of omega-3 fatty acids, is often perceived as a healthier alternative to other oils. According to recent data, the consumption of canola oil has seen a steady increase, with a notable rise in markets where health consciousness is prevalent. This trend is likely to continue as more individuals seek to improve their overall well-being through dietary modifications. The Canola Oil Market is thus positioned to benefit from this shift in consumer preferences, as health-oriented products gain traction in various culinary applications.

Increased Use in Food Processing

The food processing sector's growing reliance on canola oil is a notable driver for the Canola Oil Market. As manufacturers seek healthier alternatives for their products, canola oil's favorable nutritional profile makes it an attractive option. It is commonly used in salad dressings, margarine, and baked goods, contributing to its rising demand in processed food applications. Recent market data suggests that the food processing industry is increasingly incorporating canola oil due to its functional properties, such as emulsification and stability. This trend is expected to continue, as food producers aim to meet consumer preferences for healthier and more natural ingredients. Consequently, the Canola Oil Market stands to benefit from the expanding use of canola oil in food processing, reinforcing its position in the market.

Growing Demand for Sustainable Products

Sustainability has emerged as a critical factor influencing consumer choices, particularly in the Canola Oil Market. As environmental concerns escalate, consumers are increasingly favoring products that are sustainably sourced and produced. Canola oil, often derived from crops that require fewer pesticides and fertilizers, aligns well with these sustainability goals. The market has witnessed a rise in demand for organic and non-GMO canola oil, reflecting a broader trend towards environmentally friendly products. Data indicates that the market for organic canola oil is expanding, driven by consumers' desire to support sustainable agricultural practices. This shift not only enhances the appeal of canola oil but also positions the Canola Oil Market favorably in a landscape where sustainability is paramount.

Versatile Applications in Food Industry

The versatility of canola oil in various culinary applications serves as a significant driver for the Canola Oil Market. Its neutral flavor and high smoke point make it suitable for a wide range of cooking methods, including frying, baking, and sautéing. This adaptability has led to its widespread use in both household kitchens and commercial food establishments. Recent statistics reveal that canola oil accounts for a substantial share of the cooking oil market, with its usage in food processing and restaurant sectors on the rise. As culinary trends evolve, the demand for canola oil is likely to grow, particularly in regions where diverse cooking styles are prevalent. The Canola Oil Market is thus well-positioned to capitalize on this trend, as its product offerings cater to a variety of culinary needs.

Export Opportunities in Emerging Markets

Emerging markets present substantial export opportunities for the Canola Oil Market. As these regions experience economic growth and rising disposable incomes, the demand for cooking oils, including canola oil, is on the rise. Countries in Asia and Africa are increasingly adopting canola oil due to its health benefits and versatility. Recent trade data indicates a growing trend in canola oil exports to these markets, driven by the need for healthier cooking options. This expansion into emerging markets not only diversifies the customer base for canola oil producers but also enhances the overall growth potential of the Canola Oil Market. As these markets continue to develop, the demand for canola oil is likely to increase, providing further impetus for industry growth.