Market Growth Projections

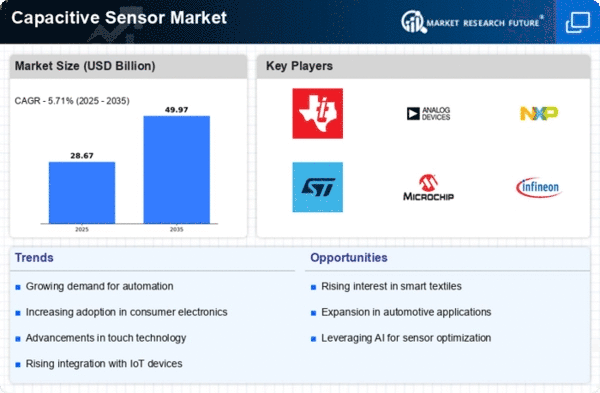

The Global Capacitive Sensor Market Industry is projected to experience substantial growth over the next decade. With a compound annual growth rate (CAGR) of 5.71% anticipated from 2025 to 2035, the market is expected to evolve significantly. This growth trajectory is indicative of the increasing adoption of capacitive sensors across various industries, driven by technological advancements and rising consumer demand. The market's expansion is likely to be fueled by innovations in sensor technology and the diversification of applications, suggesting a robust future for the Global Capacitive Sensor Market Industry.

Growth in Automotive Applications

The automotive sector significantly influences the Global Capacitive Sensor Market Industry, with an increasing number of vehicles incorporating capacitive sensors for touch controls and safety features. As vehicles become more technologically advanced, the integration of these sensors enhances user interfaces and improves overall driving experiences. The market is projected to reach 50.0 USD Billion by 2035, reflecting the automotive industry's shift towards more intuitive and interactive systems. This trend is likely to drive further investments in capacitive sensor technology, as manufacturers seek to meet consumer expectations for modern vehicle functionalities.

Expanding Applications in Healthcare

The healthcare sector is emerging as a significant contributor to the Global Capacitive Sensor Market Industry. Capacitive sensors are increasingly utilized in medical devices for patient monitoring, diagnostics, and therapeutic applications. Their ability to provide precise measurements and facilitate user-friendly interfaces enhances the functionality of healthcare technologies. As the industry evolves, the integration of capacitive sensors into wearable health devices and telemedicine solutions is likely to grow. This expansion reflects a broader trend towards personalized healthcare, indicating a promising future for the market as it adapts to the needs of the healthcare industry.

Rising Demand for Touchscreen Devices

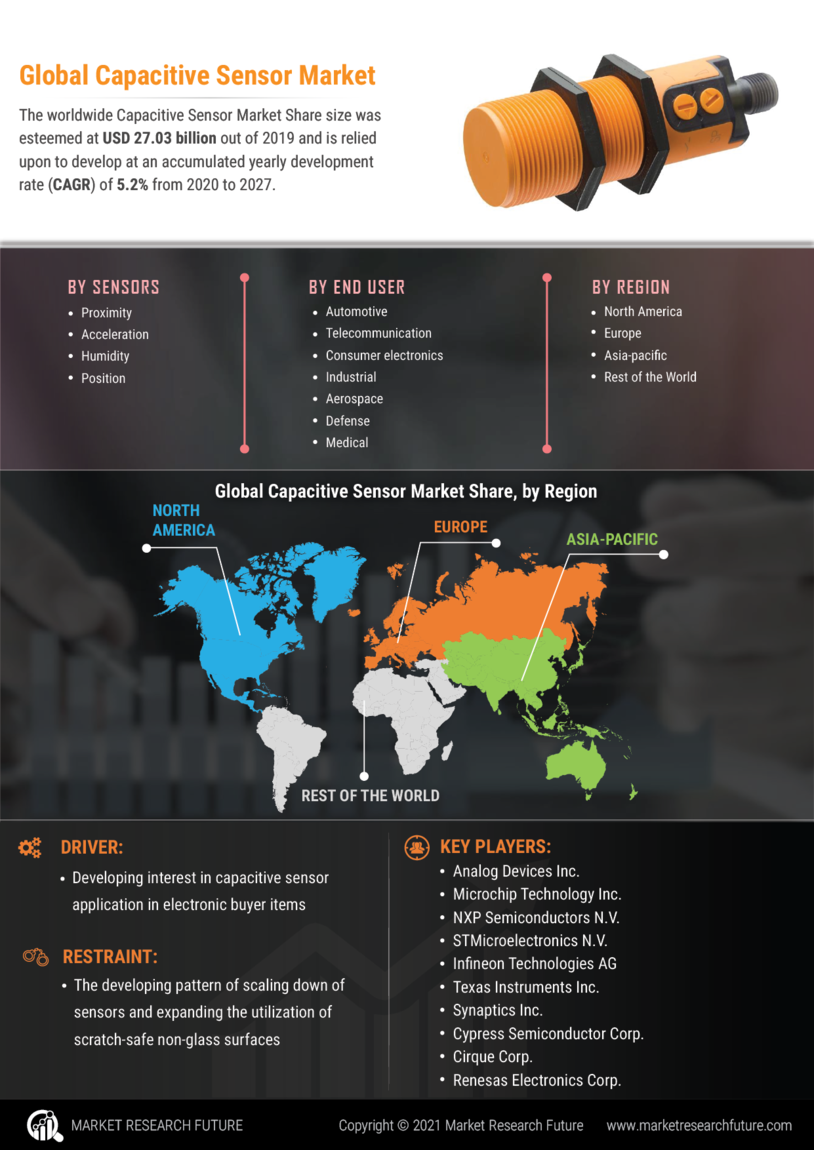

The Global Capacitive Sensor Market Industry experiences a notable surge in demand for touchscreen devices across various sectors, including consumer electronics, automotive, and healthcare. As of 2024, the market is valued at approximately 27.1 USD Billion, driven by the increasing adoption of smartphones and tablets. Capacitive sensors are integral to these devices, providing enhanced user experiences through responsive touch interfaces. The trend is further propelled by advancements in technology, enabling thinner and more efficient sensors. This growing reliance on touchscreen technology suggests a robust future for the Global Capacitive Sensor Market Industry, as it adapts to evolving consumer preferences.

Increasing Focus on Smart Home Technologies

The rise of smart home technologies is a key driver for the Global Capacitive Sensor Market Industry. As consumers increasingly seek convenience and automation, capacitive sensors are being integrated into various smart devices, including lighting systems, security systems, and appliances. This trend is supported by the growing availability of IoT devices, which rely on capacitive sensors for user interaction. The market's expansion in this sector is indicative of a broader shift towards interconnected living spaces, suggesting a sustained demand for capacitive sensors as smart home solutions continue to evolve.

Technological Advancements in Sensor Design

Technological innovations play a pivotal role in shaping the Global Capacitive Sensor Market Industry. Recent advancements in sensor design, such as the development of flexible and transparent capacitive sensors, are expanding their applications beyond traditional uses. Industries are increasingly integrating these sensors into wearables, smart home devices, and automotive systems. The ability to create sensors that are not only more efficient but also adaptable to various surfaces enhances their appeal. This evolution in technology indicates a promising trajectory for the market, potentially contributing to its growth as it aligns with the increasing demand for multifunctional devices.