Growth in Renewable Energy Sector

The Carbon Fiber Reinforced Polymer Cost Market is poised for growth as the renewable energy sector expands. Wind turbine blades, which require lightweight yet strong materials, increasingly utilize carbon fiber reinforced polymers. This shift is driven by the need for more efficient energy production and the desire to reduce the overall weight of turbine components. Recent estimates suggest that the use of carbon fiber composites in wind energy applications could increase by over 15% in the coming years. As countries invest in renewable energy infrastructure, the demand for carbon fiber reinforced polymers is expected to rise, thereby positively impacting the Carbon Fiber Reinforced Polymer Cost Market. The integration of these materials not only enhances performance but also contributes to sustainability goals, making them a preferred choice in the renewable energy landscape.

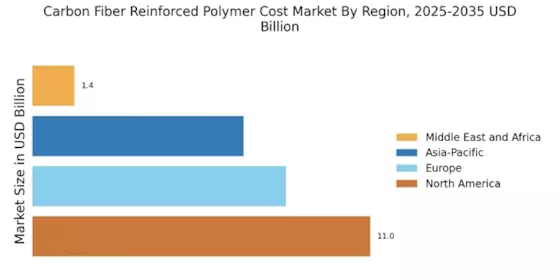

Emerging Markets and Economic Growth

The Carbon Fiber Reinforced Polymer Cost Market is witnessing growth fueled by emerging markets and their economic development. Countries with rapidly expanding industrial sectors are increasingly adopting advanced materials, including carbon fiber reinforced polymers, to enhance their manufacturing capabilities. This trend is particularly evident in regions where infrastructure development is a priority, as these materials provide the necessary strength and durability for various applications. Recent reports suggest that the demand for carbon fiber composites in emerging markets could grow by approximately 30% over the next five years. As these economies continue to develop, the Carbon Fiber Reinforced Polymer Cost Market is likely to benefit from increased investments in infrastructure and manufacturing, positioning itself as a key player in the global materials landscape.

Increasing Applications in Construction

The Carbon Fiber Reinforced Polymer Cost Market is experiencing a notable surge in demand due to its increasing applications in the construction sector. Carbon fiber reinforced polymers are being utilized for strengthening existing structures, enhancing durability, and reducing weight. This trend is particularly evident in bridge construction and retrofitting projects, where the material's high strength-to-weight ratio offers significant advantages. According to recent data, the construction sector's adoption of carbon fiber composites is projected to grow at a compound annual growth rate of approximately 10% over the next five years. This growth is driven by the need for innovative materials that can withstand harsh environmental conditions while maintaining structural integrity. As the construction industry continues to evolve, the Carbon Fiber Reinforced Polymer Cost Market is likely to benefit from this expanding application base.

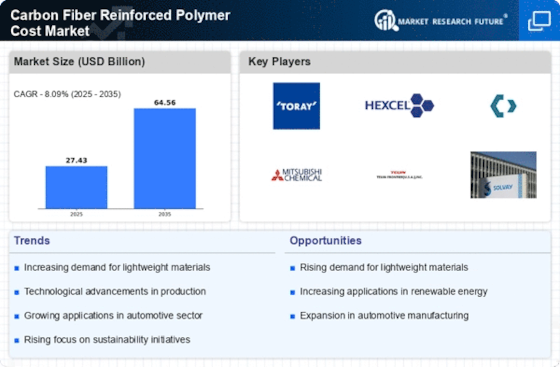

Rising Demand for Lightweight Materials

The Carbon Fiber Reinforced Polymer Cost Market is experiencing a surge in demand for lightweight materials across various sectors. Industries such as automotive and aerospace are increasingly prioritizing weight reduction to improve fuel efficiency and performance. Carbon fiber reinforced polymers offer an ideal solution due to their exceptional strength-to-weight ratio. Recent market analyses indicate that the automotive sector alone is expected to increase its use of carbon fiber composites by over 25% in the next few years. This trend is driven by stringent regulations aimed at reducing emissions and enhancing vehicle performance. As manufacturers seek to comply with these regulations while maintaining competitive advantages, the Carbon Fiber Reinforced Polymer Cost Market is likely to thrive, driven by the growing preference for lightweight materials.

Advancements in Manufacturing Techniques

The Carbon Fiber Reinforced Polymer Cost Market is benefiting from advancements in manufacturing techniques that enhance production efficiency and reduce costs. Innovations such as automated fiber placement and resin transfer molding are streamlining the manufacturing process, allowing for higher precision and lower waste. These advancements are crucial as they enable manufacturers to produce carbon fiber composites at a lower price point, making them more accessible to various industries. Recent data indicates that the cost of producing carbon fiber reinforced polymers has decreased by approximately 20% over the last few years due to these technological improvements. As production costs continue to decline, the Carbon Fiber Reinforced Polymer Cost Market is likely to see increased adoption across sectors, including automotive and aerospace, where performance and weight savings are paramount.