Expansion of Distribution Channels

The expansion of distribution channels is a significant driver for the carbonated beverage Processing Equipment Market. As beverage companies explore new markets and distribution avenues, the need for efficient processing equipment becomes increasingly important. The rise of e-commerce and direct-to-consumer sales models has transformed how carbonated beverages reach consumers. This shift necessitates the development of flexible and scalable processing solutions that can adapt to varying production needs. Additionally, the growth of convenience stores and vending machines as key distribution points further emphasizes the need for advanced processing equipment. As companies strive to enhance their market reach, investments in processing technology are likely to increase, thereby propelling the market forward.

Rising Demand for Carbonated Beverages

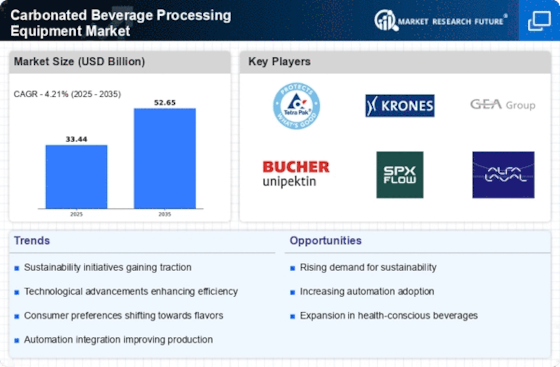

The increasing consumer preference for carbonated beverages is a primary driver for the carbonated beverage processing equipment Market. As consumers seek refreshing and flavorful options, the demand for soft drinks, sparkling water, and flavored sodas continues to rise. According to recent data, the consumption of carbonated beverages has shown a steady growth rate of approximately 3% annually. This trend necessitates the expansion of production capabilities, thereby driving investments in advanced processing equipment. Manufacturers are compelled to enhance their production lines to meet the growing demand, which in turn propels the market for processing equipment. The need for efficient and high-capacity machinery becomes paramount as beverage companies strive to maintain competitive advantage in a saturated market.

Health Consciousness and Product Innovation

The growing health consciousness among consumers is influencing the Carbonated beverage processing equipment Market. As individuals become more aware of the health implications of sugary drinks, there is a noticeable shift towards low-calorie and functional beverages. This trend has prompted manufacturers to innovate and diversify their product offerings, including the introduction of sugar-free and naturally flavored carbonated drinks. The market for health-oriented carbonated beverages is projected to expand significantly, with estimates suggesting a growth rate of around 5% over the next few years. Consequently, beverage producers are investing in processing equipment that can accommodate these new formulations, thereby driving the demand for advanced technology in the processing sector.

Regulatory Compliance and Quality Standards

Regulatory compliance and adherence to quality standards are pivotal factors influencing the carbonated beverage Processing Equipment Market. Governments and health organizations worldwide are implementing stringent regulations regarding food safety and beverage quality. These regulations necessitate that manufacturers invest in high-quality processing equipment that meets safety and quality benchmarks. The increasing focus on consumer safety and product integrity is driving the demand for advanced processing technologies that ensure compliance with these regulations. As a result, beverage producers are compelled to upgrade their equipment to maintain market access and consumer trust. This trend is expected to contribute to the growth of the processing equipment market, with estimates suggesting a steady increase in demand as companies prioritize compliance.

Technological Advancements in Processing Equipment

Technological advancements play a crucial role in shaping the carbonated beverage processing equipment Market. Innovations such as automation, improved carbonation techniques, and energy-efficient machinery are transforming production processes. The integration of smart technologies, including IoT and AI, allows for enhanced monitoring and control of production lines, leading to increased efficiency and reduced operational costs. As manufacturers seek to optimize their processes, the adoption of cutting-edge equipment becomes essential. The market is witnessing a shift towards equipment that not only meets production demands but also adheres to sustainability standards. This technological evolution is expected to drive significant investments in processing equipment, with projections indicating a market growth of approximately 4% annually.