Technological Innovations in Device Design

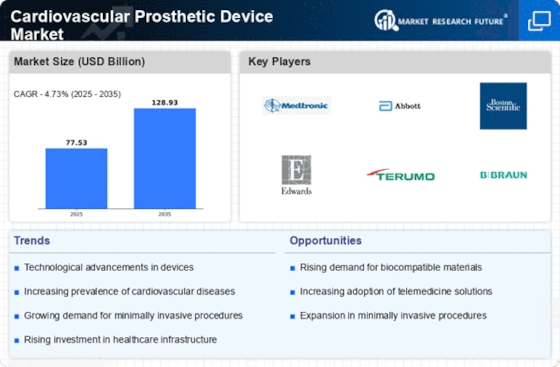

Technological advancements play a crucial role in shaping the Cardiovascular Prosthetic Device Market. Innovations such as biocompatible materials, advanced imaging techniques, and minimally invasive surgical procedures are enhancing the efficacy and safety of prosthetic devices. For instance, the development of next-generation stents and heart valves has significantly improved patient outcomes. Furthermore, the integration of smart technologies, such as remote monitoring and data analytics, is transforming the way cardiovascular conditions are managed. These innovations not only improve the performance of devices but also increase patient compliance and satisfaction. As a result, the Cardiovascular Prosthetic Device Market is poised for substantial growth, driven by the continuous evolution of technology.

Rising Prevalence of Cardiovascular Diseases

The increasing incidence of cardiovascular diseases is a primary driver for the Cardiovascular Prosthetic Device Market. According to recent data, cardiovascular diseases account for a substantial portion of global mortality rates, necessitating advanced treatment options. As populations age and lifestyle-related health issues become more prevalent, the demand for prosthetic devices is expected to rise. This trend is further supported by the growing awareness of heart health and the importance of early intervention. Consequently, healthcare providers are increasingly adopting innovative prosthetic solutions to address these challenges, thereby propelling market growth. The Cardiovascular Prosthetic Device Market is likely to witness a surge in demand as more patients seek effective treatments for heart-related ailments.

Growing Awareness and Education on Heart Health

The rising awareness and education regarding heart health are pivotal in driving the Cardiovascular Prosthetic Device Market. Public health campaigns and educational initiatives are informing individuals about the risks associated with cardiovascular diseases and the importance of early detection and treatment. This heightened awareness is leading to increased screening and diagnosis rates, which in turn drives demand for prosthetic devices. Additionally, healthcare professionals are emphasizing the need for preventive measures and lifestyle changes, further contributing to the market's growth. As more individuals seek proactive solutions for heart health, the Cardiovascular Prosthetic Device Market is likely to experience a corresponding increase in demand for innovative prosthetic options.

Increasing Investment in Healthcare Infrastructure

Investment in healthcare infrastructure is a significant driver for the Cardiovascular Prosthetic Device Market. Governments and private entities are allocating substantial resources to enhance healthcare facilities and services, particularly in cardiology. This trend is evident in various regions, where new hospitals and specialized cardiac centers are being established. Enhanced infrastructure facilitates the adoption of advanced prosthetic devices, as healthcare providers are better equipped to offer cutting-edge treatments. Moreover, increased funding for research and development in cardiovascular technologies is likely to yield innovative solutions that address unmet medical needs. Consequently, the Cardiovascular Prosthetic Device Market stands to benefit from these investments, as they create a conducive environment for growth and innovation.

Regulatory Support and Streamlined Approval Processes

Regulatory support and streamlined approval processes are essential drivers for the Cardiovascular Prosthetic Device Market. Regulatory bodies are increasingly recognizing the need for efficient pathways to bring innovative devices to market. This is particularly relevant in the context of cardiovascular medical devices, where timely access to new technologies can significantly impact patient outcomes. The establishment of expedited review processes and clear guidelines for clinical trials is facilitating the introduction of advanced prosthetic solutions. As a result, manufacturers are more inclined to invest in research and development, knowing that their innovations can reach the market more swiftly. This supportive regulatory environment is likely to foster growth within the Cardiovascular Prosthetic Device Market, encouraging the development of next-generation devices.

Leave a Comment