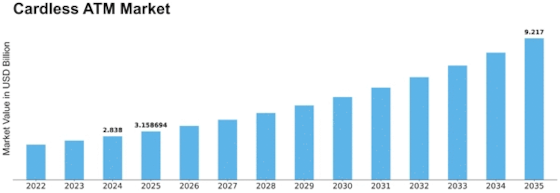

Cardless Atm Size

Cardless ATM Market Growth Projections and Opportunities

The Cardless ATM market is motivated by a myriad of things that collectively form its panorama and power its boom. One of the pivotal marketplace elements is the increasing adoption of digital charge methods globally. As societies transition toward a cashless economy, clients are searching for convenient and stable options for traditional ATM transactions. Cardless ATMs offer an answer by permitting customers to withdraw coins through the usage of cell apps, QR codes, or biometric authentication, aligning with the evolving preferences of tech-savvy individuals. Moreover, the growing emphasis on more advantageous security measures is another critical element shaping the Cardless ATM marketplace. Traditional card-based total transactions are prone to fraud and browsing sports, prompting financial institutions to discover more steady options. Cardless ATM transactions, frequently requiring biometric authentication or particular cell codes, offer an extra layer of security, decreasing the hazard of unauthorized get entry to and fraudulent activities. This increased protection function is especially attractive to both economic establishments and customers, contributing to the market's expansion. The surge in smartphone penetration and the massive availability of cell banking apps additionally play a pivotal function in driving the Cardless ATM marketplace. With a full-size portion of the global population owning smartphones, the accessibility and convenience of using cell gadgets for economic transactions have soared. Cardless ATMs leverage this trend by integrating seamlessly with cell banking apps, empowering users to initiate transaction results easily without the want for bodily playing cards. This symbiotic relationship between cellular generation and Cardless ATMs fosters a market boom as monetary establishments adapt to the evolving wishes of their digitally connected patron base. Furthermore, the COVID-19 pandemic has improved the adoption of contactless answers throughout numerous industries, including banking. Cardless ATMs, requiring minimum physical interaction, flawlessly align with this converting consumer behavior. Financial establishments are recognizing this shift and are investing in the deployment of Cardless ATM solutions to offer customers a more secure and extra-hygienic option for coin withdrawals.

Leave a Comment