Regulatory Changes and Compliance

Regulatory changes significantly impact the Cash Advance Service Market. Governments worldwide are increasingly scrutinizing cash advance services to protect consumers from predatory lending practices. Recent legislative measures aim to enhance transparency and ensure fair lending practices, which may reshape the operational landscape for service providers. Compliance with these regulations is essential for maintaining consumer trust and avoiding legal repercussions. As a result, many companies are investing in compliance frameworks and risk management strategies. This focus on regulatory adherence could lead to a more sustainable Cash Advance Service Market, where responsible lending practices become the norm, ultimately benefiting consumers.

Increased Demand for Quick Financing

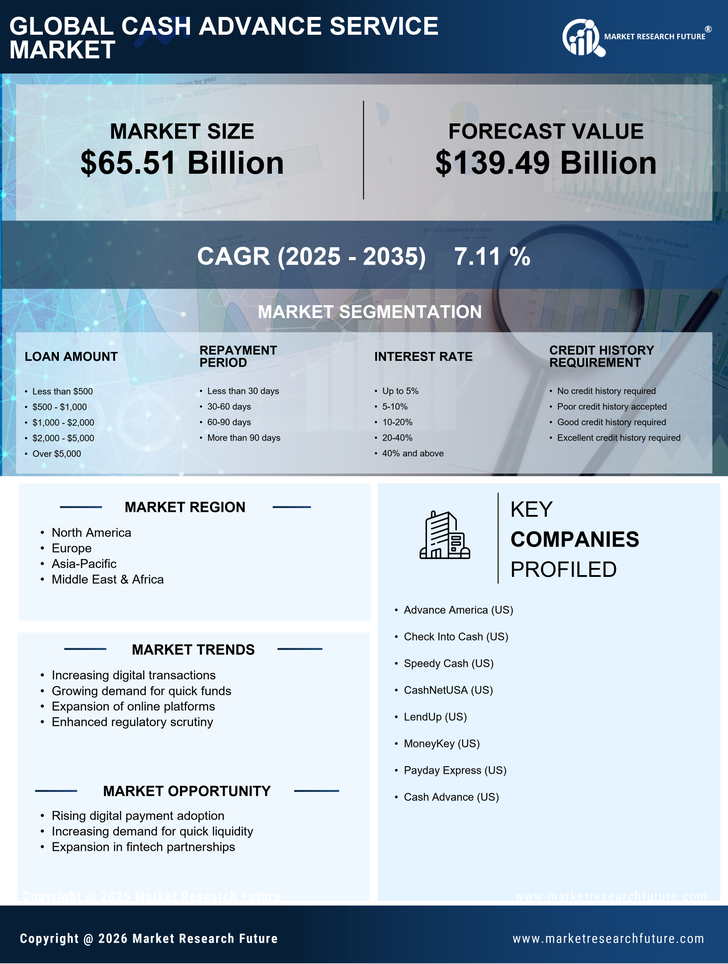

The Cash Advance Service Market experiences heightened demand for quick financing solutions. As consumers face unexpected expenses, the need for immediate cash access becomes paramount. This trend is particularly evident among younger demographics, who often prefer digital solutions for their financial needs. According to recent data, approximately 30% of consumers have utilized cash advance services in the past year, indicating a growing reliance on these services. The convenience and speed of cash advances appeal to individuals who may not have access to traditional credit options. This increasing demand is likely to drive innovation within the Cash Advance Service Market, as providers seek to enhance their offerings and streamline the application process.

Rising Financial Literacy Among Consumers

The Cash Advance Service Market is witnessing a rise in financial literacy among consumers, which influences their borrowing decisions. As individuals become more informed about financial products, they are better equipped to make sound choices regarding cash advances. Educational initiatives and resources have contributed to this trend, empowering consumers to understand the implications of borrowing. Data indicates that consumers with higher financial literacy are more likely to utilize cash advance services responsibly, leading to a healthier market environment. This shift may encourage service providers to offer more tailored products that align with the needs of informed consumers, fostering a more competitive Cash Advance Service Market.

Economic Uncertainty and Consumer Behavior

Economic uncertainty plays a pivotal role in shaping the Cash Advance Service Market. As individuals face fluctuating job markets and rising living costs, the demand for cash advances tends to increase. Economic indicators suggest that during periods of uncertainty, consumers are more likely to seek short-term financial solutions to bridge gaps in their budgets. This behavior is particularly pronounced among those with limited access to traditional credit sources. Consequently, the Cash Advance Service Market may experience growth as more individuals turn to these services for immediate financial relief. Understanding consumer behavior in the context of economic fluctuations is essential for service providers aiming to capture market share.

Technological Advancements in Service Delivery

Technological advancements play a crucial role in shaping the Cash Advance Service Market. The integration of mobile applications and online platforms has revolutionized how consumers access cash advances. With the proliferation of smartphones, users can now apply for cash advances at their convenience, leading to a surge in service adoption. Data suggests that over 50% of cash advance transactions are now conducted online, reflecting a significant shift in consumer behavior. This trend not only enhances accessibility but also fosters competition among service providers, prompting them to innovate and improve user experiences. As technology continues to evolve, the Cash Advance Service Market is poised for further transformation.