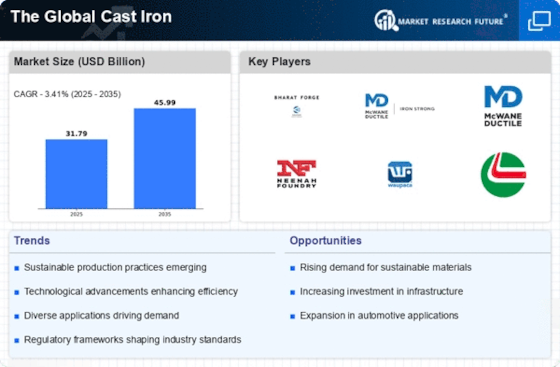

Cast Iron Market Summary

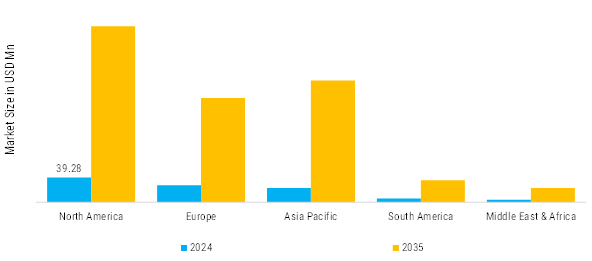

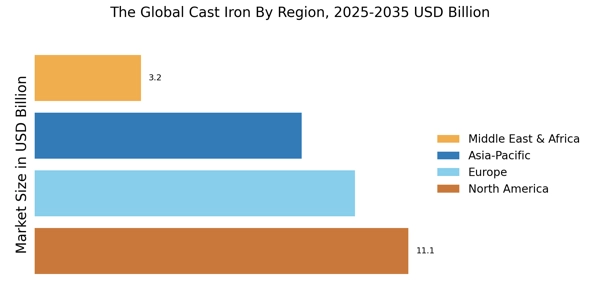

As per Market Research Future analysis, The Cast Iron Market Size was valued at USD 97,852.17 million in 2024. The Cast Iron Industry is projected to grow from USD 1,03,432.42 million in 2025 to USD 1,79,287.95 million by 2035, exhibiting a compound annual growth rate (CAGR) of 5.655% during the forecast period (2025 - 2035).

Key Market Trends & Highlights

The Cast Iron Market is experiencing reflect strong growth fueled by health-conscious consumers and plant-based innovations.

- Recycling initiatives drive major gains, with foundries adopting circular economy models to reuse scrap iron, reducing raw ore dependency by up to 70% in leading facilities. Ductile iron variants gain traction for their higher strength-to-weight ratio, supporting lighter components in eco-focused industries.

- The sector claims the largest share, fueled by engine blocks, brake components, and exhaust manifolds that leverage cast iron's heat resistance and vibration damping. Electric vehicle transitions spur demand for specialized castings in battery housings and structural frames, offsetting some losses from lightweight aluminum substitutions.

- Construction and railways propel demand, with iron cast pipes integral to water infrastructure and oil/gas pipelines worldwide. High-durability parts for bridges and heavy machinery underscore resilience against volatile material costs.

- Adoption of oxygen-enriched smelting narrows energy gaps between regions, while Industry 4.0 integrations enable real-time quality control. These shifts favor smaller, agile producers over legacy giants.

- Industrial machinery grows fastest, with custom castings for robotics and renewables like wind turbine housings. Niche sectors, such as cast-iron cookware, expand at 5-6% CAGR in Asia via urbanization and health trends

Market Size & Forecast

| 2024 Market Size | 97,852.17 (USD Million) |

| 2035 Market Size | 1,79,287.95 (USD Million) |

| CAGR (2025 - 2035) | 5.655% |

Major Players

JS Auto Cast, American Cast Iron Pipe Company, Govind Steel Company Limited, Jianzhi, Electro steel Castings Limited, GF Piping Systems, McWane, Kubota Corporation, Teksid, Charlotte Pipe and Foundry and others.