Growing Awareness of Soil Health

The catalyst fertilizer Market is witnessing a heightened awareness regarding soil health and its impact on agricultural productivity. Farmers and agricultural stakeholders are increasingly recognizing the importance of maintaining soil fertility and structure. Catalyst fertilizers, which enhance nutrient availability and promote microbial activity, are becoming essential tools in sustainable farming practices. This trend is reflected in the increasing investments in soil health initiatives, with the market for soil health products projected to reach USD 5 billion by 2028. As awareness continues to grow, the demand for catalyst fertilizers is expected to rise, reinforcing their significance in modern agriculture.

Rising Demand for Food Production

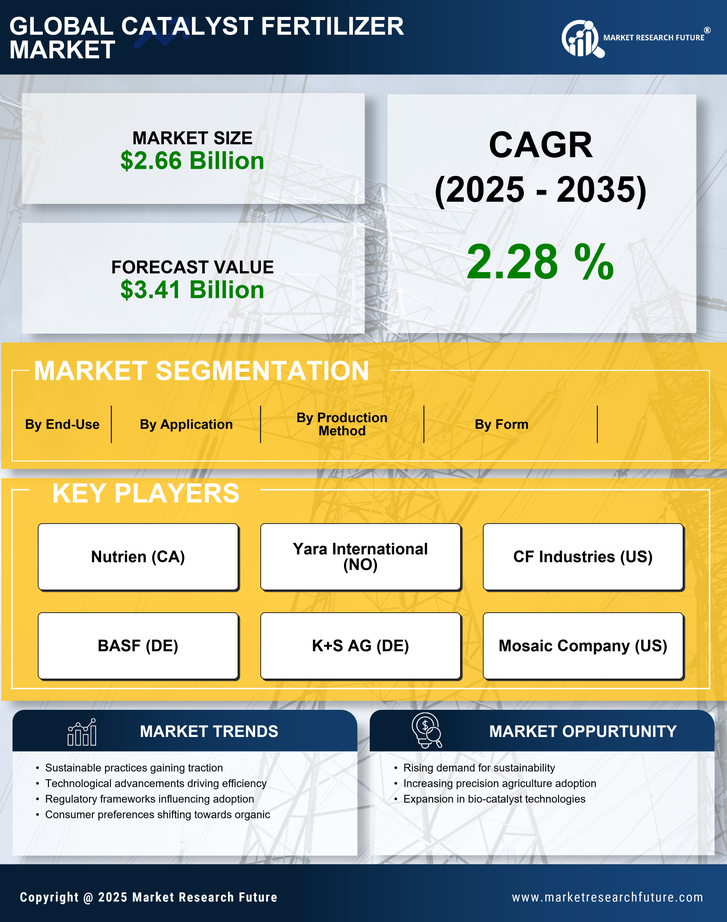

The Catalyst Fertilizer Market is experiencing a surge in demand driven by the increasing global population and the corresponding need for enhanced food production. As the world population is projected to reach approximately 9.7 billion by 2050, agricultural output must rise significantly to meet this demand. This necessitates the use of catalyst fertilizers, which improve nutrient efficiency and crop yields. In fact, the market for catalyst fertilizers is expected to grow at a compound annual growth rate (CAGR) of around 5.5% over the next several years. This growth is indicative of the critical role that catalyst fertilizers play in ensuring food security and sustainable agricultural practices.

Increased Adoption of Precision Agriculture

The Catalyst Fertilizer Market is benefiting from the rising adoption of precision agriculture practices. Farmers are increasingly utilizing data-driven approaches to optimize crop yields and resource use. Catalyst fertilizers play a vital role in this context, as they can be tailored to meet specific crop needs based on soil and environmental conditions. This targeted application not only enhances productivity but also minimizes environmental impact. The precision agriculture market is anticipated to grow significantly, with estimates suggesting it could reach USD 12 billion by 2025. This growth is likely to further bolster the demand for catalyst fertilizers.

Technological Innovations in Fertilizer Production

Technological advancements are reshaping the Catalyst Fertilizer Market, leading to more efficient production processes and improved product formulations. Innovations such as nanotechnology and controlled-release fertilizers are enhancing the effectiveness of catalyst fertilizers. These technologies allow for better nutrient absorption and reduced wastage, which is crucial in a market where efficiency is paramount. The integration of smart farming technologies is also facilitating precise application of fertilizers, further driving market growth. As these innovations continue to evolve, the catalyst fertilizer market is expected to expand, with a projected market size of USD 8 billion by 2026.

Environmental Regulations and Sustainability Initiatives

The Catalyst Fertilizer Market is increasingly influenced by stringent environmental regulations and sustainability initiatives. Governments and regulatory bodies are promoting the use of eco-friendly fertilizers to minimize environmental impact. Catalyst fertilizers, known for their efficiency in nutrient delivery, align well with these initiatives. The market is witnessing a shift towards products that reduce nitrogen runoff and greenhouse gas emissions. As a result, the catalyst fertilizer segment is projected to capture a larger share of the fertilizer market, potentially reaching a valuation of USD 10 billion by 2027. This trend underscores the importance of sustainable practices in agriculture.