Increased Defense Budgets

Rising defense budgets across various nations contribute significantly to the Global CBRN Defense Industry. Governments are allocating more resources to enhance their defense capabilities, particularly in response to emerging threats. This trend is evident in countries that prioritize national security and invest in advanced CBRN defense systems. For example, nations are increasingly funding research and development initiatives aimed at improving detection, protection, and response technologies. The commitment to enhancing defense capabilities is reflected in the market's projected growth, with an expected value of 5.82 USD Billion in 2024. As defense budgets continue to rise, the demand for CBRN defense solutions is likely to expand.

Increasing Global Threats

The Global CBRN Defense Industry is experiencing growth due to escalating threats from chemical, biological, radiological, and nuclear agents. Governments worldwide are increasingly aware of the potential risks posed by these agents, leading to enhanced investment in defense capabilities. For instance, the rise in geopolitical tensions and the proliferation of weapons of mass destruction have prompted nations to bolster their CBRN defense strategies. This heightened awareness is reflected in the projected market value of 5.82 USD Billion in 2024, indicating a robust commitment to addressing these threats. As nations prioritize security, the demand for advanced CBRN defense technologies is expected to rise significantly.

Market Growth Projections

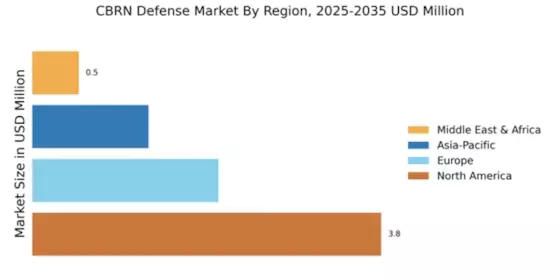

The Global CBRN Defense Industry is poised for substantial growth, with projections indicating a market value of 5.82 USD Billion in 2024 and an anticipated increase to 23.1 USD Billion by 2035. This growth trajectory suggests a compound annual growth rate (CAGR) of 13.36% from 2025 to 2035. Such projections reflect the increasing recognition of the need for robust CBRN defense capabilities in response to evolving threats. The market's expansion is likely to be driven by advancements in technology, regulatory frameworks, and increased defense spending. As nations prioritize security and preparedness, the demand for innovative CBRN defense solutions is expected to rise significantly.

Technological Advancements

Technological innovation plays a pivotal role in shaping the Global CBRN Defense Industry. The development of advanced detection systems, protective gear, and decontamination technologies is crucial for effective response to CBRN incidents. For example, the integration of artificial intelligence and machine learning in detection systems enhances the accuracy and speed of identifying threats. This trend is likely to drive market growth, as governments and defense organizations seek to adopt cutting-edge technologies to improve their CBRN capabilities. The anticipated growth trajectory, with a projected market size of 23.1 USD Billion by 2035, underscores the importance of technological advancements in ensuring national and global security.

Growing Awareness and Training

The Global CBRN Defense Industry is also driven by the increasing awareness and training initiatives aimed at preparing personnel for potential CBRN incidents. Governments and organizations are recognizing the importance of training first responders and military personnel in CBRN defense protocols. This focus on education and preparedness is crucial for effective response to CBRN threats. Training programs are being developed to enhance skills in detection, decontamination, and emergency response. As awareness grows, the demand for training solutions and related technologies is expected to rise. This trend aligns with the overall market growth, which is projected to reach 23.1 USD Billion by 2035, highlighting the importance of preparedness in CBRN defense.

Regulatory Frameworks and Policies

The establishment of stringent regulatory frameworks and policies is a significant driver for the Global CBRN Defense Industry. Governments are implementing comprehensive policies to enhance preparedness and response capabilities against CBRN threats. For instance, international agreements and national regulations mandate the development of robust defense systems. This regulatory environment fosters collaboration among nations and encourages investment in CBRN defense technologies. As a result, organizations are compelled to comply with these regulations, leading to increased demand for innovative solutions. The market's growth is further supported by the projected CAGR of 13.36% from 2025 to 2035, reflecting the ongoing commitment to enhancing CBRN defense capabilities.