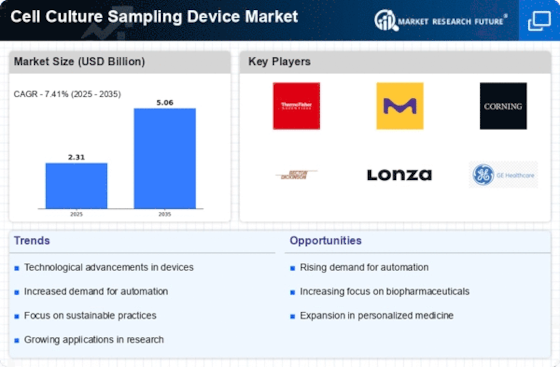

Rising Demand for Biopharmaceuticals

The increasing demand for biopharmaceuticals is a primary driver of the Cell Culture Sampling Device Market. As the biopharmaceutical sector expands, the need for efficient and reliable sampling devices becomes paramount. According to recent data, the biopharmaceutical market is projected to reach over 500 billion USD by 2026, necessitating advanced cell culture techniques. This growth is likely to spur innovations in sampling devices, enhancing their capabilities and efficiency. Furthermore, the rise in chronic diseases and the need for personalized medicine are pushing research and development in this field, thereby increasing the demand for sophisticated cell culture sampling devices. The Cell Culture Sampling Device Market is thus positioned to benefit from these trends, as companies seek to optimize their production processes and ensure high-quality outputs.

Technological Advancements in Cell Culture

Technological advancements in cell culture techniques are significantly influencing the Cell Culture Sampling Device Market. Innovations such as 3D cell culture and organ-on-a-chip technologies are revolutionizing how samples are collected and analyzed. These advancements allow for more accurate and efficient sampling, which is crucial for research and development in pharmaceuticals and biotechnology. The market for 3D cell culture is expected to grow at a compound annual growth rate of over 20% in the coming years, indicating a robust demand for advanced sampling devices. As researchers and companies adopt these new technologies, the need for compatible and efficient cell culture sampling devices will likely increase, driving growth in the market.

Increased Focus on Research and Development

The heightened focus on research and development in life sciences is a significant driver of the Cell Culture Sampling Device Market. With governments and private sectors investing heavily in biotechnology and pharmaceuticals, the demand for effective sampling devices is on the rise. In recent years, R&D spending in the life sciences has seen a substantial increase, with estimates suggesting it could surpass 300 billion USD by 2025. This investment is likely to lead to the development of novel cell culture techniques and, consequently, the need for advanced sampling devices. As researchers strive for precision and efficiency, the Cell Culture Sampling Device Market is expected to experience robust growth, driven by the continuous need for innovation in sampling methodologies.

Regulatory Compliance and Quality Standards

Regulatory compliance and adherence to quality standards are critical drivers of the Cell Culture Sampling Device Market. As the pharmaceutical and biotechnology sectors face stringent regulations, the demand for high-quality sampling devices that meet these standards is increasing. Regulatory bodies are emphasizing the importance of quality assurance in cell culture processes, which in turn drives the need for reliable sampling devices. The market is witnessing a shift towards devices that not only comply with regulations but also enhance the overall quality of cell culture practices. This focus on compliance is likely to propel the growth of the Cell Culture Sampling Device Market, as companies seek to ensure their products meet the necessary quality benchmarks.

Growing Awareness of Cell Culture Applications

The growing awareness of the applications of cell culture in various fields is driving the Cell Culture Sampling Device Market. Cell culture techniques are increasingly utilized in drug discovery, toxicology testing, and regenerative medicine, among other areas. As industries recognize the benefits of cell culture, the demand for reliable sampling devices is likely to increase. Reports indicate that the market for cell culture applications is projected to grow significantly, with a focus on enhancing the efficiency and accuracy of sampling processes. This trend suggests that the Cell Culture Sampling Device Market will continue to expand as more sectors adopt cell culture methodologies, necessitating advanced sampling solutions.