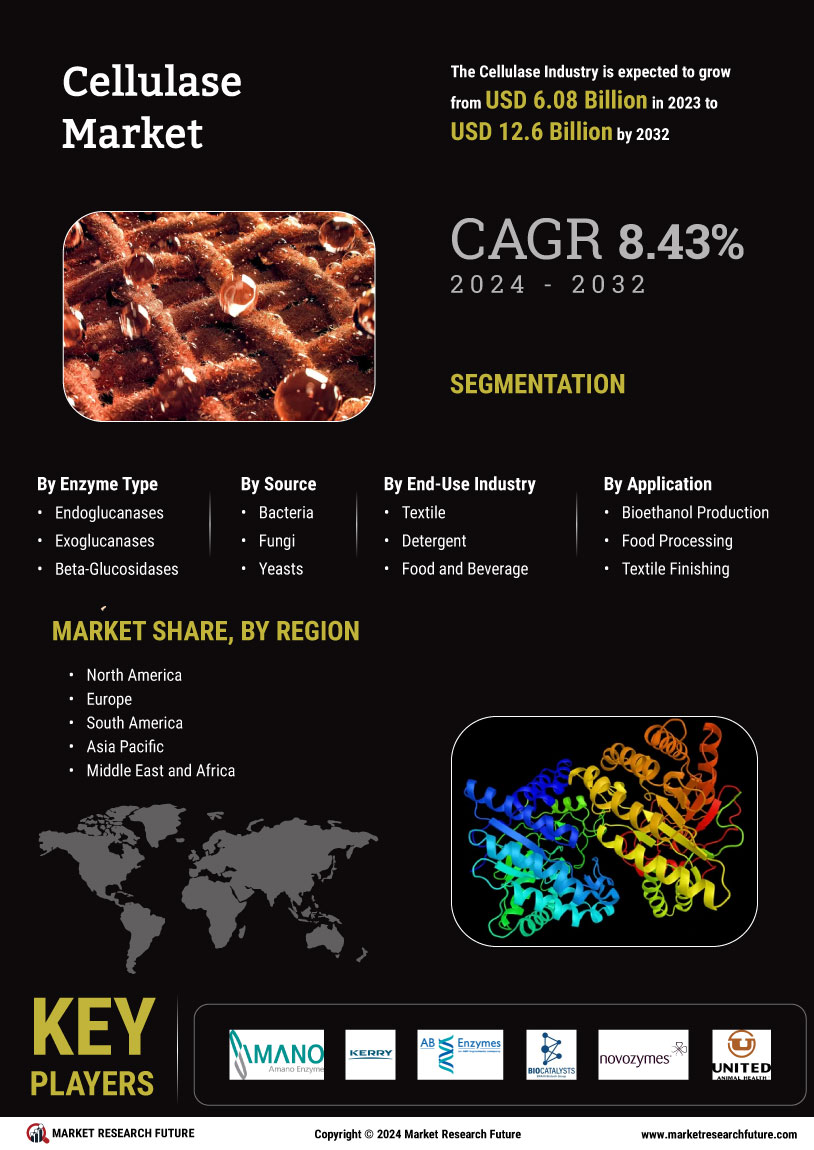

Growth in the Textile Industry

The Cellulase Market is significantly influenced by the growth of the textile sector, particularly in the production of eco-friendly fabrics. Cellulase Market enzymes are employed in the textile industry for processes such as bio-polishing and fabric finishing, enhancing the quality and durability of textiles. The Cellulase Market is anticipated to reach USD 1 trillion by 2025, with a growing emphasis on sustainable practices. This shift towards environmentally friendly production methods is likely to increase the demand for cellulase, as manufacturers seek to reduce water and chemical usage in textile processing. Consequently, the cellulase market is expected to benefit from this trend, as more companies adopt enzymatic solutions to improve their sustainability profiles.

Focus on Waste Management and Recycling

The Cellulase Market is increasingly aligned with the focus on waste management and recycling initiatives. Cellulase Market enzymes are instrumental in the breakdown of cellulose-rich waste materials, facilitating the conversion of agricultural and industrial waste into valuable products. As countries implement stricter waste management regulations and promote recycling efforts, the demand for cellulase is likely to rise. The Cellulase Market is projected to reach USD 500 billion by 2025, with a significant portion dedicated to innovative recycling technologies. This trend presents a substantial opportunity for the cellulase market, as industries seek to utilize enzymatic solutions to enhance waste processing efficiency and reduce environmental impact.

Increasing Demand for Cellulosic Ethanol

The Cellulase Market is experiencing a notable surge in demand for cellulosic ethanol, a renewable fuel derived from plant materials. This trend is largely driven by the global push for sustainable energy sources and the need to reduce greenhouse gas emissions. According to recent estimates, the production of cellulosic ethanol is projected to reach approximately 1.5 billion gallons by 2025, indicating a robust growth trajectory. The enzymatic processes facilitated by cellulase are crucial in converting lignocellulosic biomass into fermentable sugars, which are then transformed into ethanol. This increasing demand for biofuels is likely to propel the cellulase market, as manufacturers seek efficient and cost-effective solutions to meet the rising energy needs while adhering to environmental regulations.

Rising Adoption in Animal Feed Production

The Cellulase Market is witnessing a rise in the adoption of cellulase enzymes in animal feed production. These enzymes play a vital role in enhancing the digestibility of feed ingredients, particularly fibrous materials, thereby improving animal health and productivity. The Cellulase Market is projected to grow at a CAGR of 4.5% through 2025, driven by increasing meat consumption and the need for efficient feed formulations. As livestock producers seek to optimize feed efficiency and reduce costs, the incorporation of cellulase into feed formulations is likely to gain traction. This trend not only supports animal growth but also aligns with the broader movement towards sustainable agricultural practices, further bolstering the cellulase market.

Technological Advancements in Enzyme Production

The Cellulase Market is benefiting from technological advancements in enzyme production, which enhance the efficiency and cost-effectiveness of cellulase manufacturing. Innovations such as recombinant DNA technology and fermentation optimization are enabling producers to develop high-performance cellulase enzymes with improved stability and activity. As the demand for cellulase continues to rise across various applications, these advancements are likely to play a crucial role in meeting market needs. The enzyme production market is expected to grow significantly, with projections indicating a compound annual growth rate of 6% through 2025. This growth is anticipated to drive down production costs and increase the availability of cellulase, thereby expanding its application scope in industries such as biofuels, textiles, and animal feed.

Leave a Comment