Technological Innovations

Technological advancements in fiber production processes are likely to enhance the efficiency and quality of cellulose acetate fibers. Innovations such as improved spinning techniques and enhanced purification methods could lead to higher yield rates and reduced production costs. The Cellulose Acetate Fiber Market may benefit from these developments, as they can facilitate the introduction of new products with superior properties. For instance, advancements in fiber modification techniques can result in cellulose acetate fibers with enhanced durability and moisture-wicking capabilities. This could potentially expand the application range of cellulose acetate fibers in various sectors, including fashion and home textiles.

Sustainability Initiatives

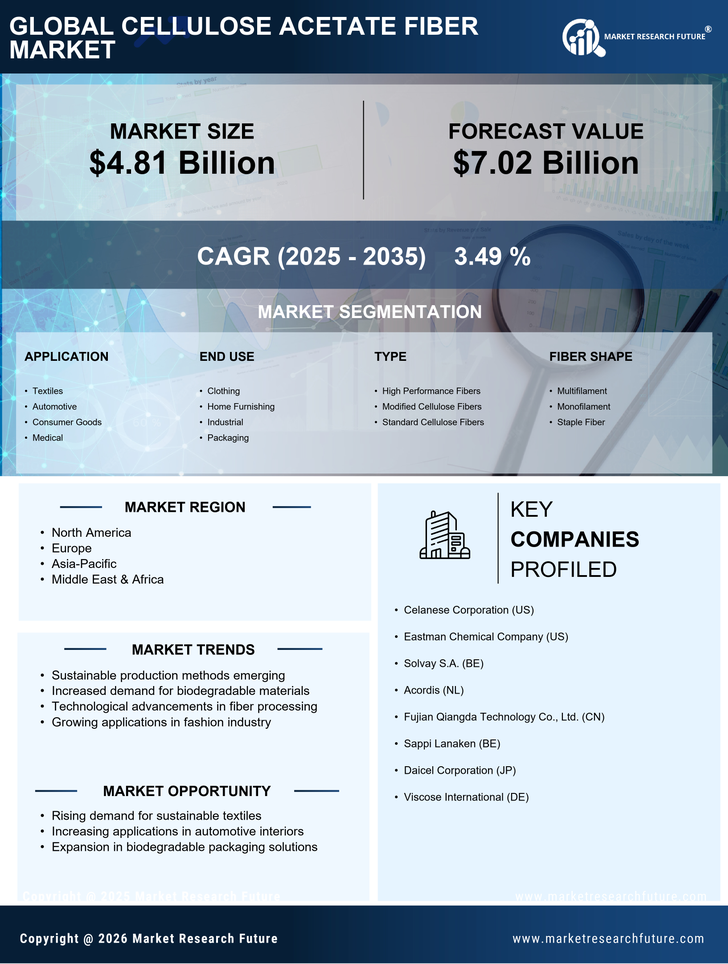

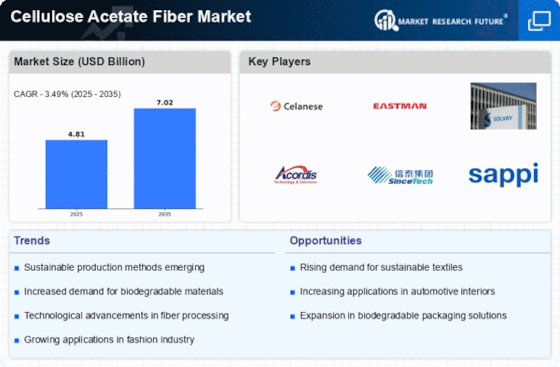

The increasing emphasis on sustainability within the textile industry appears to be a pivotal driver for the Cellulose Acetate Fiber Market. As consumers become more environmentally conscious, there is a growing demand for fibers that are biodegradable and derived from renewable resources. Cellulose acetate, being a semi-synthetic fiber made from wood pulp, aligns well with these sustainability goals. Reports indicate that the market for sustainable textiles is projected to grow at a compound annual growth rate of approximately 9% over the next five years. This trend suggests that manufacturers focusing on eco-friendly practices may gain a competitive edge, thereby propelling the Cellulose Acetate Fiber Market forward.

Diverse End-Use Applications

The versatility of cellulose acetate fibers is a notable driver for the Cellulose Acetate Fiber Market. These fibers are utilized in a wide array of applications, including apparel, home furnishings, and industrial products. The increasing demand for high-quality textiles in fashion and upholstery is expected to bolster the market. For example, cellulose acetate fibers are often blended with other materials to enhance fabric performance, which is appealing to manufacturers. Market data suggests that the apparel segment alone accounts for a significant share of the cellulose acetate fiber consumption, indicating a robust growth trajectory for the industry.

Consumer Preference for Natural Fibers

There is a discernible shift in consumer preferences towards natural and semi-synthetic fibers, which is expected to benefit the Cellulose Acetate Fiber Market. As consumers become more aware of the environmental impact of synthetic fibers, they are gravitating towards options that offer a more sustainable profile. Cellulose acetate fibers, derived from natural cellulose, provide an appealing alternative due to their biodegradable nature. Market trends indicate that products made from cellulose acetate are increasingly favored in the fashion industry, where eco-conscious consumers are willing to pay a premium for sustainable options. This shift in consumer behavior could significantly influence market dynamics.

Regulatory Support for Eco-Friendly Materials

Government regulations promoting the use of eco-friendly materials are likely to influence the Cellulose Acetate Fiber Market positively. Many countries are implementing policies aimed at reducing plastic waste and encouraging the use of biodegradable alternatives. This regulatory environment may create favorable conditions for cellulose acetate fibers, which are perceived as a sustainable option compared to traditional synthetic fibers. As a result, manufacturers may increasingly invest in cellulose acetate production to comply with these regulations, thereby driving market growth. The alignment of industry practices with regulatory frameworks could enhance the overall market landscape.