Supportive Regulatory Frameworks

Regulatory bodies are increasingly implementing policies that favor the use of sustainable materials, which is beneficial for the Cellulosic Polymer Market. Governments are introducing incentives for the development and use of biodegradable materials, thereby encouraging manufacturers to invest in cellulosic polymers. For instance, regulations aimed at reducing plastic waste are prompting companies to explore alternatives, including cellulosic polymers. This supportive regulatory environment is expected to stimulate market growth, as compliance with environmental standards becomes a priority for businesses. The Cellulosic Polymer Market stands to gain from these initiatives, potentially leading to increased market share and innovation.

Innovations in Production Technologies

Technological advancements in the production of cellulosic polymers are significantly influencing the Cellulosic Polymer Market. Innovations such as enzymatic processes and advanced fermentation techniques are enhancing the efficiency and cost-effectiveness of production. For instance, the development of new catalysts and bioprocessing methods has the potential to reduce production costs by up to 30%. These advancements not only improve yield but also minimize environmental impact, aligning with sustainability goals. As production technologies continue to evolve, the Cellulosic Polymer Market is expected to expand, attracting investments and fostering competition among manufacturers.

Expanding Applications Across Industries

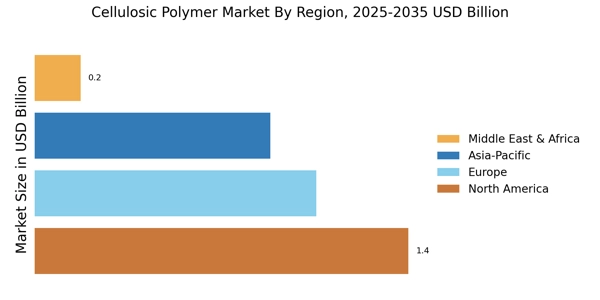

The versatility of cellulosic polymers is leading to their adoption across various sectors, thereby propelling the Cellulosic Polymer Market. Applications range from packaging materials to pharmaceuticals and textiles. For example, the use of cellulose-based films in food packaging is gaining traction due to their barrier properties and biodegradability. The pharmaceutical sector is also increasingly utilizing cellulosic polymers for drug delivery systems. This broad applicability suggests a growing market potential, with estimates indicating that the demand for cellulosic polymers in packaging alone could reach 4 billion USD by 2026. Such diversification is likely to enhance the resilience of the Cellulosic Polymer Market.

Rising Demand for Biodegradable Materials

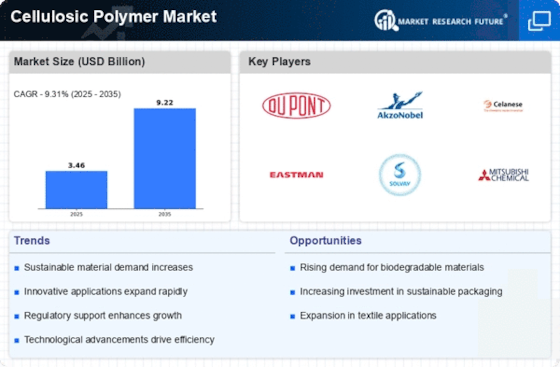

The increasing consumer preference for environmentally friendly products is driving the Cellulosic Polymer Market. As awareness of plastic pollution grows, industries are seeking alternatives that are biodegradable and sustainable. Cellulosic polymers, derived from natural sources, offer a viable solution. The market for biodegradable plastics is projected to reach approximately 6 billion USD by 2025, indicating a robust growth trajectory. This shift towards sustainable materials is not merely a trend but a fundamental change in consumer behavior, compelling manufacturers to innovate and adapt. Consequently, the Cellulosic Polymer Market is likely to experience heightened demand as companies strive to meet these evolving consumer expectations.

Growing Investment in Research and Development

Investment in research and development is crucial for the advancement of the Cellulosic Polymer Market. Companies are allocating significant resources to explore new applications and improve existing technologies related to cellulosic polymers. This focus on R&D is likely to yield innovative products that meet the demands of various industries. For instance, advancements in nanocellulose technology are opening new avenues for applications in electronics and automotive sectors. The increasing funding for R&D initiatives suggests a commitment to enhancing the performance and functionality of cellulosic polymers. As a result, the Cellulosic Polymer Market is poised for growth, driven by continuous innovation and exploration.