Market Share

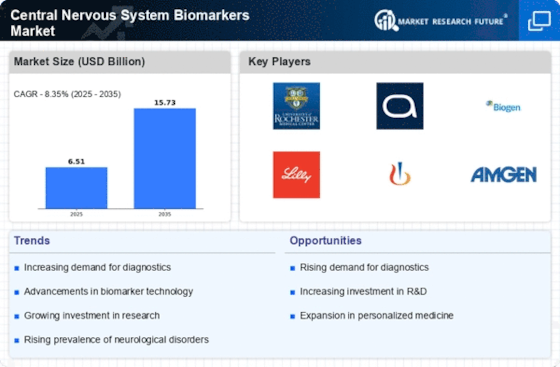

Central Nervous System Biomarkers Market Share Analysis

The Central Nervous System (CNS) Biomarkers Market is highly competitive, and market share positioning strategies play a crucial role in determining the success of companies operating in this space. As the demand for innovative diagnostics and treatments for neurological disorders rises, companies are employing strategic approaches to secure and expand their market share. In order to develop a powerful market niche, companies pursue biomarker exploration as well as specification of the CNS diseases that they are associated with. Because of this, the identification of particular biomarkers allows companies to develop special diagnostic products and therapies which give them an edge over competitors by allowing them to deal with the specific challenges posed by neurological diseases. Companies invest huge amount of money on research development to find new biomarkers and develop better technologies for diagnosis. The enhanced quality of CNS biomarker products is not only improved accuracy and reliability but also increase the company as a leader in innovation which appeals both healthcare professionals and patients. Partnership with research institutions, pharmaceutical companies, and healthcare agencies is a standard market building strategy. Such arrangements promote knowledge transfer, common resources, and accelerated product development, allowing firms to launch innovative CNS biomarkers earlier. Obtaining the necessary regulatory approvals is pivotal for market success. Companies primarily focusing on compliance with tight regulatory standards, as their products provide bulletproof safety and efficacy. Not only does timely approvals help establish credibility amongst paramedics but it also gives a competitive edge in the market. Companies typically deploy aggressive market spread approaches to gain a larger footprint. Geographic expansion is also covered as one of the segments of this horizontal integration, as well as the opening of new territories not yet tapped, and strong distribution. A wider geographical coverage enables firms to cover a bigger market, thus increasing the market share. Much focus is placed on the tailoring of biomarker solutions to meet the specific requirements for health care providers and patients and so on. Flexible diagnostic tools and treatments provide organizations to meet the unique needs of the CNS disorder terrain, accommodating a broader range of conditions and patients. To achieve awareness and trust that creates demand in the marketplace, effective marketing and branding should be put in place. Companies implement tactical marketing campaigns that aim to capture the strengths and potentials of their CNS biomarker products. Brand construction not only attracts consumers but also guarantees market oligopoly in the long term.

Engaging with patients and providing educational resources about CNS disorders and biomarkers is a growing trend. Companies that actively participate in patient advocacy, support groups, and educational initiatives not only contribute to the well-being of patients but also enhance their reputation and market position.

Leave a Comment