Market Analysis

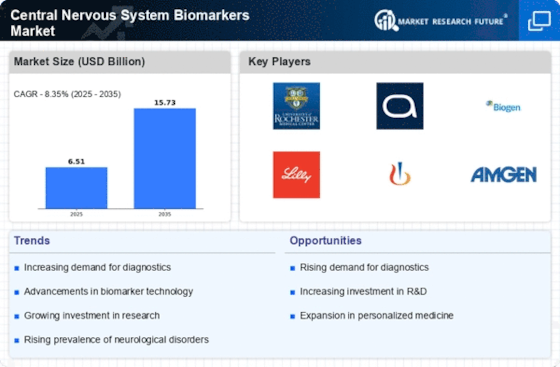

In-depth Analysis of Central Nervous System Biomarkers Market Industry Landscape

The Central Nervous System (CNS) Biomarkers Market is a dynamic sector that plays a crucial role in understanding and diagnosing neurological disorders. Biomarkers, measurable indicators of biological processes, have gained prominence in the field, aiding in early detection, diagnosis, and monitoring of CNS-related conditions.

Wide availability of anti-VTE drugs along with widening applications in several CDI categories supports the market. These disorders continue to escalate with rising aging population and shifted lifestyles; however, lack of valid biomarker has hampered the development of early intervention. The recent evolution of technology has greatly improved biomarker discovery techniques. The integration of genomics, protectomics, and neuroimaging techniques has allowed the discovery of new biomarkers that have enabled the more accurate diagnosis which leads to the personalized treatment strategies. Personalized therapeutic approaches based on the individual patient’s profile is contributing to the popularity of precision medicine in the CNS biomarkers market. With the help of, biomarkers allow us to target the specific molecular targets, it promotes the concept of targeted therapy as well-a way to achieve better results in treating the patients. Diagnosis of CNS disorders at an early stage is very important for its appropriate management. The increasing focus on creating biomarkers that are sensitive to neurological abnormalities during the early stages to allow intervention will intervene in the market dynamics. The potential disease progression stalling maybe observed. Although it is always a major challenge to solve current problems, advancements are evident in terms of various collaborations between pharmaceutical companies, research institutions, and diagnostic companies in the industry. Regulatory frameworks and reimbursement challenges also inform the market dynamics Validation and approval of biomarkers, reimbursement insurance complexities are problems for market players. Regulating these environments is thus essential to any successful market entry. The R&D investments are, however, considerably rising in the light of the growing significance of CNS biomarkers. If the truth were told, innovative biomarkers are looked for by firms due to a cut-throat environs that seeks to bring new technologies into the market. Treating the patient suffering is the main thing which patient advocacy groups and awareness initiatives do in order to alter the market dynamics that must be noted. It is very significant participation in public education, stigma reduction, campaigning for additional research funding, and the increased accessibility to biomarker–dependent diagnostics of these groups. Standardizing biomarker assays and methodologies poses a challenge in the market. Efforts are underway to establish industry-wide standards for biomarker validation and measurement, ensuring consistency and reliability in results across different laboratories and diagnostic platforms.

Leave a Comment