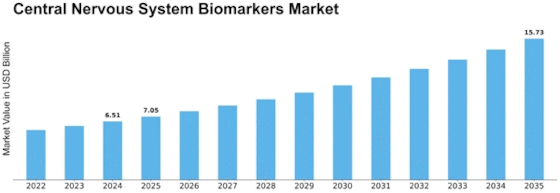

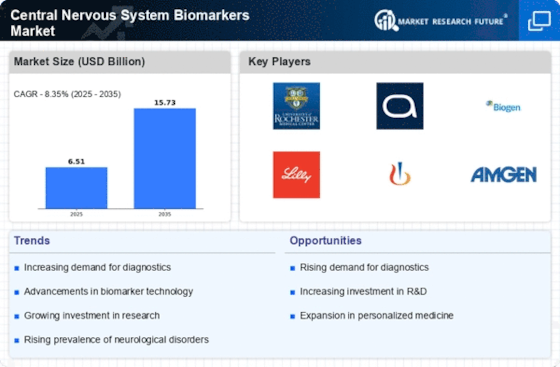

Central Nervous System Biomarkers Size

Central Nervous System Biomarkers Market Growth Projections and Opportunities

The Central Nervous System Biomarkers market is significantly influenced by the rising prevalence of central nervous system disorders such as Alzheimer's, Parkinson's, and multiple sclerosis. The increasing incidence of these conditions has fueled the demand for diagnostic tools and biomarkers that can aid in early detection and monitoring of disease progression. Decent technological development has notably contributed to the growth of the Central Nervous System Biomarkers market. It has thus resulted in the establishment of more accurate diagnostic tools for CNS disorders. A major market driver is the aging population globally. As people grow older, the hazard of neurodegenerative diseases imminently increases, making the CNS biomarker market to be equally big. Rapid increase in elderly human population has raised the demand for suitable biomarkers to allow rapid diagnosis allowing early intervention, hence the growth of this market. However, the market has been positively influenced by increasing awareness as well as government initiatives towards early diagnosis. The number of CNS biomarkers demanded has also increased due to public health campaigns and screening programs individuals have grown more proactive about management of neurological health. Central Nervous System Biomarkers market is a witness a rise in the collaborations and the partnerships among the pharmaceutical firms, research institutes, and the diagnostic tool developers. Such collaborations seek to combine resources, exchange knowledge, and speed up the introduction of novel biomarkers which would stimulate market development. Regulatory intricacy and mounting initiatives to standardization strengthen the Central Nervous System Biomarkers market. In today’s world, validated biomarkers are emphasized by most regulatory bodies worldwide; they must be precise and reliable for clinical use. There is enough confidence for both healthcare professionals and end-users for the market to grow. It was due to artificial intelligence, that revolutionized CNS diagnostics with the combination of biomarker discovery and data analysis. Big data analysis algorithms, machine learning algorithms can recognize patterns in massive datasets and predict potential biomarkers at increased speed. The addition of AI has improved the efficiency and correctness of biomarker discovery, with market enhancing benefits. Ethical considerations and concerns related to patient privacy in biomarker research and diagnostics are factors that can impact the market. Striking a balance between advancing diagnostic capabilities and ensuring patient confidentiality is crucial to maintaining trust and sustaining market growth.

Leave a Comment