Rising Demand in Automotive Sector

The Ceramic Electric Capacitor Market is witnessing a notable increase in demand from the automotive sector. With the automotive industry transitioning towards electric and hybrid vehicles, the need for reliable and efficient capacitors is becoming critical. These capacitors are essential for various applications, including power management systems, infotainment, and advanced driver-assistance systems (ADAS). The automotive sector is projected to account for a significant share of the ceramic capacitor market, with estimates suggesting a growth rate of approximately 7% annually. This trend indicates a robust opportunity for manufacturers to innovate and cater to the evolving needs of the automotive industry, thereby enhancing their market position.

Technological Advancements in Electronics

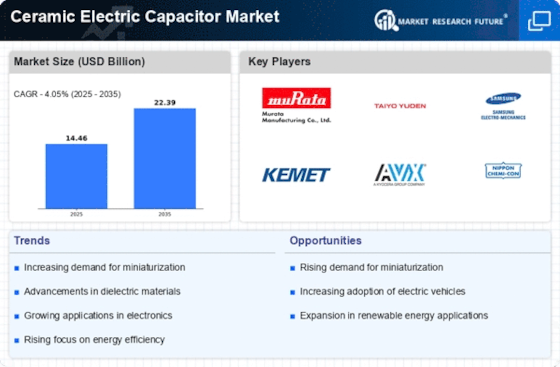

The Ceramic Electric Capacitor Market is experiencing a surge in demand due to rapid technological advancements in electronics. Innovations in consumer electronics, automotive applications, and telecommunications are driving the need for high-performance capacitors. For instance, the increasing integration of electric vehicles and renewable energy systems necessitates capacitors that can handle higher voltages and temperatures. The market is projected to grow at a compound annual growth rate (CAGR) of approximately 6% over the next five years, reflecting the industry's response to these technological shifts. As manufacturers invest in research and development, the introduction of new materials and designs is likely to enhance the performance and reliability of ceramic capacitors, further propelling market growth.

Increased Adoption in Consumer Electronics

The Ceramic Electric Capacitor Market is experiencing heightened adoption in the consumer electronics sector. As devices become more compact and multifunctional, the demand for smaller, high-capacity capacitors is rising. Products such as smartphones, tablets, and wearable technology are increasingly utilizing ceramic capacitors due to their superior performance characteristics, including stability and reliability. The consumer electronics market is projected to grow at a rate of approximately 5% annually, which is likely to drive further demand for ceramic capacitors. This trend suggests that manufacturers who can innovate and provide high-quality capacitors tailored for consumer electronics will find substantial opportunities for growth in the coming years.

Growth in Telecommunications Infrastructure

The Ceramic Electric Capacitor Market is benefiting from the expansion of telecommunications infrastructure. As the demand for high-speed internet and advanced communication technologies increases, the need for reliable capacitors in networking equipment and devices is becoming more pronounced. The rollout of 5G technology is particularly driving this demand, as it requires capacitors that can operate efficiently at higher frequencies. Market analysts predict that the telecommunications sector will contribute significantly to the growth of the ceramic capacitor market, with an expected CAGR of around 8% over the next few years. This growth presents opportunities for manufacturers to develop specialized capacitors that meet the stringent requirements of modern telecommunications applications.

Sustainability and Environmental Regulations

The Ceramic Electric Capacitor Market is increasingly influenced by sustainability initiatives and stringent environmental regulations. As industries strive to reduce their carbon footprint, there is a growing emphasis on eco-friendly materials and manufacturing processes. Capacitors made from non-toxic materials are gaining traction, aligning with global efforts to promote sustainability. Furthermore, regulatory bodies are imposing stricter guidelines on electronic waste management, compelling manufacturers to adopt greener practices. This shift not only enhances the market appeal of ceramic capacitors but also positions them as a preferred choice in applications where environmental considerations are paramount. The market is likely to see a rise in demand for sustainable capacitor solutions, potentially leading to a market expansion of around 5% in the coming years.