- Global Market Outlook

- In-depth analysis of global and regional trends

- Analyze and identify the major players in the market, their market share, key developments, etc.

- To understand the capability of the major players based on products offered, financials, and strategies.

- Identify disrupting products, companies, and trends.

- To identify opportunities in the market.

- Analyze the key challenges in the market.

- Analyze the regional penetration of players, products, and services in the market.

- Comparison of major players’ financial performance.

- Evaluate strategies adopted by major players.

- Recommendations

- Vigorous research methodologies for specific market.

- Knowledge partners across the globe

- Large network of partner consultants.

- Ever-increasing/ Escalating data base with quarterly monitoring of various markets

- Trusted by fortune 500 companies/startups/ universities/organizations

- Large database of 5000+ markets reports.

- Effective and prompt pre- and post-sales support.

Market Size Snapshot

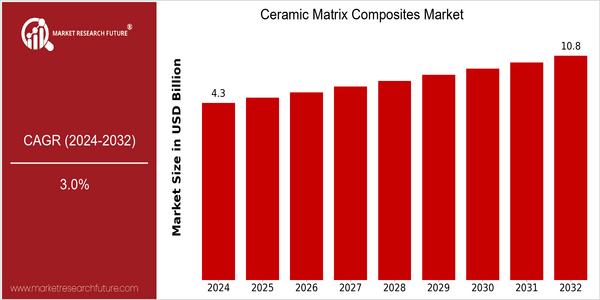

| Year | Value |

|---|---|

| 2024 | USD 4.31 Billion |

| 2032 | USD 10.85 Billion |

| CAGR (2024-2032) | 3.0 % |

Note – Market size depicts the revenue generated over the financial year

The CMC market is expected to grow at a CAGR of 3.1 per cent from 2024 to 2032. This is a steady growth, and it is due to the unique properties of the material, such as high-temperature resistance, lightness, and high mechanical strength. These properties make it a very suitable material for applications in the aviation, automobile, and industry sectors. The CMC market is growing due to many factors, such as the development of new production processes, which improve the performance and cost-effectiveness of the material. It is also due to the growing demand from the aviation industry for lightweight materials to improve fuel efficiency and reduce carbon dioxide emissions. The leading companies, such as GE, Rolls-Royce, and Northrop Grumman, are launching new products to take advantage of these opportunities. In recent years, the industry has made great strides in the development of new CMC materials for use in jet engines.

Regional Market Size

Regional Deep Dive

The Ceramic Matrix Composites (CMCs) market is experiencing a significant growth in various regions, due to technological advancements and the growing demand for lightweight and high-performance materials in industries such as the aircraft, automobile and energy industries. Each region has its own characteristics, which are influenced by the local industry, government regulations and technological innovations. North America is a research and development leader, Europe is the regulatory and compliance leader and Asia-Pacific is the fastest growing region for production. The Middle East and Africa are developing regions with a high growth potential, mainly driven by the development of the transport network. In Latin America, CMCs are slowly finding their way into various applications.

Europe

- The European Union has implemented stringent regulations aimed at reducing carbon emissions, prompting industries to adopt CMCs for their lightweight and high-temperature resistance properties, particularly in automotive applications.

- Research initiatives such as the Horizon 2020 program are funding projects focused on the development of sustainable CMCs, fostering collaboration between universities and industry leaders like Airbus and Rolls-Royce.

Asia Pacific

- China is rapidly expanding its CMC production capabilities, with state-owned enterprises investing in advanced manufacturing technologies to meet the growing demand in aerospace and energy sectors.

- Japan's focus on innovation in materials science has led to breakthroughs in CMC applications, particularly in the automotive industry, where companies like Toyota are exploring CMCs for engine components to enhance performance and efficiency.

Latin America

- Brazil is beginning to explore the use of CMCs in its aerospace sector, with government support for research initiatives aimed at enhancing the performance of local aircraft manufacturers.

- Mexico is seeing a gradual increase in CMC adoption in automotive manufacturing, driven by foreign investments and partnerships with companies specializing in advanced materials.

North America

- The U.S. Department of Defense has increased funding for advanced materials research, including CMCs, to enhance the performance of military aircraft and vehicles, which is expected to drive innovation and adoption in the aerospace sector.

- Companies like General Electric and Boeing are investing heavily in CMC technology for jet engines, leading to significant advancements in thermal resistance and weight reduction, which are critical for improving fuel efficiency.

Middle East And Africa

- The UAE is investing in advanced materials as part of its Vision 2021 initiative, which includes projects aimed at developing CMCs for use in aerospace and defense applications.

- South Africa is exploring the use of CMCs in renewable energy projects, particularly in solar thermal applications, which could lead to increased adoption of these materials in the region.

Did You Know?

“Ceramic Matrix Composites can withstand temperatures exceeding 1,600 degrees Celsius, making them ideal for high-performance applications in aerospace and energy sectors.” — NASA

Segmental Market Size

The Ceramic Matrix Composites market, in which it is playing an important role, is currently experiencing a very high level of growth, particularly in the field of aircraft and military equipment. The main reasons for this are the increasing need for lightweight, heat-resistant and weather-resistant materials, and the growing need to reduce the emissions of aircraft. Also, the technological advances in the production of ceramics, such as 3D printing, which allow for the production of complex shapes and a reduction in production costs, will further increase the importance of ceramics. At present, the implementation of Ceramic Matrix Composites is at the scale deployment stage, with General Electric and Rolls-Royce leading the way in the field of aeronautics. The most important projects are the development of CMC components for jet engines, which will significantly reduce fuel consumption. CMCs are also used in the fields of aeronautics, automobiles and energy, primarily for the manufacture of blades and brakes. The CMC market is also driven by the development of energy systems and the growing importance of sustainable development. The development of production methods such as chemical vapor infiltration will also have an important influence on the development of this market.

Future Outlook

Ceramic Matrix Composites (CMC) market is expected to grow significantly from 2024 to 2032, when the market value is expected to increase from $ 4.31 billion to $ 10.85 billion, at a CAGR of 3.0%. The main reasons for this growth are the increasing demand for lightweight, high-performance materials in various industries, especially in the aircraft, automobile and energy industries. In the aircraft industry, the penetration of CMCs is expected to reach 25.0% by 2032, driven by improvements in material properties and processing technology. In addition, the development of advanced manufacturing processes, such as additive manufacturing, and the development of new ceramic materials, will enhance the performance and reduce the cost of CMCs. Furthermore, the government's encouragement of sustainable materials and reducing carbon emissions will accelerate the growth of the market. Also, the integration of CMCs into electric vehicles and new energy systems will create new opportunities for the industry. The future of the industry is closely related to the development of the materials industry, and the development of the industry is mainly based on the collaboration between materials and manufacturing.

Covered Aspects:| Report Attribute/Metric | Details |

|---|---|

| Growth Rate | 12.9% (2023-2030) |

Ceramic Matrix Composites Market Highlights:

Leading companies partner with us for data-driven Insights

Kindly complete the form below to receive a free sample of this Report

Tailored for You

- Dedicated Research on any specifics segment or region.

- Focused Research on specific players in the market.

- Custom Report based only on your requirements.

- Flexibility to add or subtract any chapter in the study.

- Historic data from 2014 and forecasts outlook till 2040.

- Flexibility of providing data/insights in formats (PDF, PPT, Excel).

- Provide cross segmentation in applicable scenario/markets.