Rising Demand in Defense Sector

The Ceramic Matrix Composites Market is experiencing a notable surge in demand from the defense sector. This increase is primarily driven by the need for lightweight, high-strength materials that can withstand extreme conditions. The defense industry is increasingly adopting ceramic matrix composites for applications such as armor systems and missile components. The market for defense applications is projected to grow at a compound annual growth rate of approximately 6% over the next few years. This growth is indicative of the material's superior performance characteristics, including thermal stability and resistance to corrosion. As nations invest in advanced military technologies, the reliance on ceramic matrix composites is likely to intensify, further propelling the market forward.

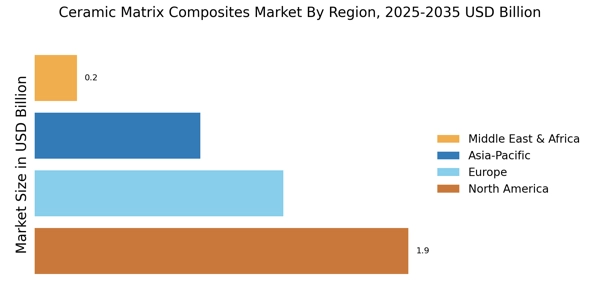

Emerging Markets and Economic Growth

Emerging markets are playing a pivotal role in the growth of the Ceramic Matrix Composites Market. As economies in regions such as Asia-Pacific and Latin America continue to develop, there is a rising demand for advanced materials in various industries, including aerospace, automotive, and energy. The economic growth in these regions is expected to drive investments in infrastructure and technology, leading to an increased adoption of ceramic matrix composites. The market in these areas is projected to grow at a compound annual growth rate of approximately 8% over the next few years. This trend indicates a shift in manufacturing capabilities and a growing recognition of the benefits offered by ceramic matrix composites.

Growing Applications in Energy Sector

The Ceramic Matrix Composites Market is expanding its footprint in the energy sector, particularly in applications related to renewable energy technologies. The demand for high-temperature resistant materials in gas turbines and solar power systems is driving this trend. Ceramic matrix composites offer excellent thermal and mechanical properties, making them suitable for use in harsh environments. The energy sector is projected to account for a significant share of the market, with an expected growth rate of approximately 7% over the next few years. This growth is fueled by the global shift towards sustainable energy solutions, where the durability and efficiency of ceramic matrix composites play a crucial role.

Increased Focus on Lightweight Materials

The Ceramic Matrix Composites Market is witnessing an increased focus on lightweight materials across various sectors, particularly in aerospace and automotive applications. The push for fuel efficiency and reduced emissions is driving manufacturers to seek materials that offer high strength-to-weight ratios. Ceramic matrix composites are emerging as a preferred choice due to their lightweight nature and exceptional mechanical properties. The market is anticipated to grow at a rate of around 6% as industries prioritize the adoption of lightweight solutions. This trend is likely to be further supported by regulatory pressures aimed at reducing carbon footprints, thereby enhancing the appeal of ceramic matrix composites in the market.

Technological Advancements in Manufacturing Processes

Technological advancements in manufacturing processes are significantly influencing the Ceramic Matrix Composites Market. Innovations such as additive manufacturing and advanced sintering techniques are enhancing the production efficiency and quality of ceramic matrix composites. These advancements allow for the creation of complex geometries and improved material properties, which are essential for high-performance applications. The market is expected to witness a growth rate of around 5% annually as manufacturers adopt these new technologies. Furthermore, the integration of automation and digitalization in production processes is likely to reduce costs and lead times, making ceramic matrix composites more accessible to various industries, including aerospace and automotive.