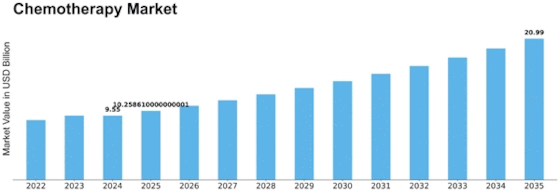

Chemotherapy Size

Chemotherapy Market Growth Projections and Opportunities

The research and development (R&D) phase in chemotherapy products focuses on creating new formulations and improving existing ones for better efficiency and cost-effectiveness. This stage involves a brainstorming process that requires a high level of knowledge and skills. The product development process includes conceptualization, formulation, development, and testing. The R&D team continually works on enhancing formulations, contributing the highest value of nearly 25% to 30% of the total value chain.

Once the product strategies are defined in the R&D phase, the manufacturing process begins. This process starts with the assembly of raw materials, a critical phase for creating these products. Manufacturing involves assembling reagents and materials, and it is a rapid process. After manufacturing, the products undergo testing to evaluate absorption and metabolism. This manufacturing and testing segment holds a value ranging between 20% to 25% of the total value chain.

Distribution and sales are integral parts of any industry, and the chemotherapy market follows a value chain analysis that includes distribution channels like intermediaries, direct selling, and others. This market primarily focuses on hospitals and specialty centers. A robust sales team is essential for market development. Leading players in the chemotherapy market employ various strategies, such as seminars, knowledge sessions, and marketing campaigns, to create awareness about their products. Marketing and sales strategies are crucial in understanding the industry's characteristics and play a significant role in this segment, contributing 20% to 25% of the total value chain.

Product differentiation is crucial in the highly competitive chemotherapy market, given the variety of available products. Research and development efforts aim to make products stand out in the market. The process involves continual improvement, ensuring that chemotherapy products are effective and affordable.

The manufacturing process begins with the collection of raw materials, a vital step in creating high-quality chemotherapy products. Manufacturing is a swift process, followed by testing to assess how well the products are absorbed and metabolized. This phase holds a value of 20% to 25% in the overall value chain.

Distribution and sales are vital aspects of the chemotherapy market. The value chain analysis considers various distribution channels, such as intermediaries and direct selling. The focus is on hospitals and specialty centers. A robust sales team is essential for market development, and companies use strategies like seminars and marketing campaigns to create product awareness. This segment contributes 20% to 25% of the total value chain.

Leave a Comment