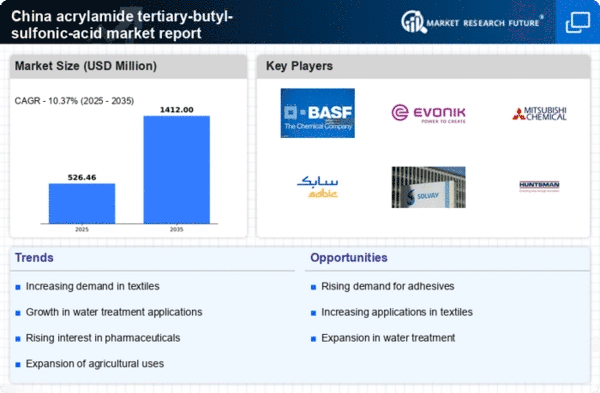

The acrylamide tertiary-butyl-sulfonic-acid market exhibits a dynamic competitive landscape, characterized by a blend of innovation and strategic partnerships among key players. Companies such as BASF SE (Germany), Evonik Industries AG (Germany), and Mitsubishi Chemical Corporation (Japan) are at the forefront, leveraging their extensive R&D capabilities to enhance product offerings. BASF SE, for instance, focuses on sustainable solutions, aligning its operations with global environmental standards, which appears to resonate well with market demands. Meanwhile, Evonik Industries AG emphasizes digital transformation, integrating advanced technologies into its production processes to optimize efficiency and reduce costs. These strategies collectively foster a competitive environment that prioritizes innovation and sustainability.In terms of business tactics, localizing manufacturing and optimizing supply chains are pivotal for companies operating in this market. The competitive structure is moderately fragmented, with several players vying for market share. However, the influence of major companies like SABIC (Saudi Arabia) and Solvay SA (Belgium) is pronounced, as they continue to expand their operational footprints in China. This collective presence of key players not only enhances competition but also drives advancements in product quality and customer service.

In October SABIC (Saudi Arabia) announced a strategic partnership with a local Chinese firm to enhance its production capabilities in the region. This move is significant as it allows SABIC to tap into local expertise and resources, potentially reducing operational costs while increasing market responsiveness. Such partnerships are likely to strengthen SABIC's position in the market, enabling it to better serve its customers with tailored solutions.

In September Solvay SA (Belgium) unveiled a new line of eco-friendly acrylamide derivatives, aimed at reducing environmental impact. This initiative underscores Solvay's commitment to sustainability and innovation, positioning the company as a leader in environmentally conscious manufacturing. The introduction of these products may attract a growing segment of environmentally aware consumers and businesses, thereby enhancing Solvay's competitive edge.

In August Mitsubishi Chemical Corporation (Japan) expanded its research and development facilities in China, focusing on advanced materials for various applications. This expansion is indicative of Mitsubishi's long-term strategy to innovate and diversify its product portfolio. By investing in R&D, the company aims to stay ahead of market trends and meet the evolving needs of its customers, which could lead to increased market share in the coming years.

As of November the competitive trends in the acrylamide tertiary-butyl-sulfonic-acid market are increasingly defined by digitalization, sustainability, and the integration of AI technologies. Strategic alliances are becoming more prevalent, as companies recognize the value of collaboration in enhancing innovation and operational efficiency. Looking ahead, the competitive differentiation is likely to shift from price-based strategies to a focus on technological advancements, sustainable practices, and reliable supply chains. This evolution suggests that companies that prioritize innovation and sustainability will be better positioned to thrive in the future.