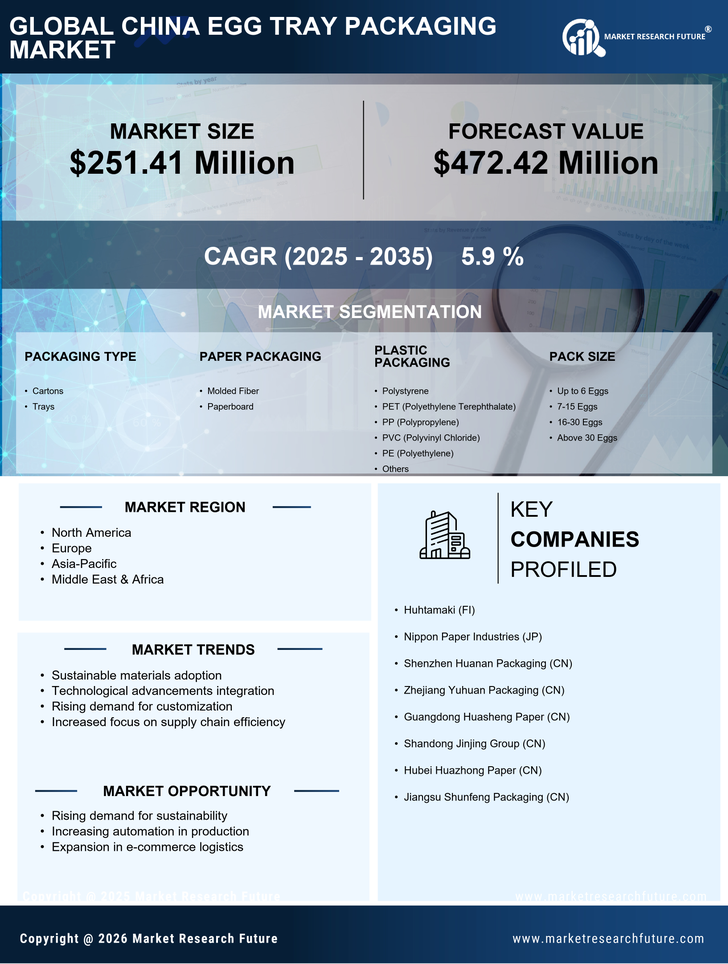

Growth of the Poultry Industry

The expansion of the poultry industry in China serves as a crucial driver for the China Egg Tray Packaging Market. With the country being one of the largest producers and consumers of eggs, the demand for efficient and reliable packaging solutions is on the rise. In 2025, the poultry sector is anticipated to contribute over USD 200 billion to the national economy, thereby necessitating an increase in egg production and distribution. This growth directly correlates with the need for egg trays that ensure product safety and minimize damage during transportation. As poultry farms scale up operations, the demand for high-quality egg tray packaging is likely to escalate, presenting lucrative opportunities for manufacturers within the China Egg Tray Packaging Market.

Increasing Export Opportunities

The growing international demand for Chinese agricultural products, particularly eggs, is likely to drive the China Egg Tray Packaging Market. As China strengthens its position in the global food supply chain, the need for high-quality packaging solutions that meet international standards becomes paramount. In 2025, exports of Chinese eggs are projected to increase by 20%, necessitating robust packaging that ensures product integrity during transit. This trend presents a significant opportunity for manufacturers to innovate and enhance their packaging solutions to cater to export requirements. Consequently, the China Egg Tray Packaging Market may experience a surge in demand for specialized packaging that complies with global regulations, thereby expanding its market reach.

Consumer Preference for Convenience

The evolving consumer lifestyle in China, characterized by a preference for convenience and ready-to-use products, is emerging as a key driver for the China Egg Tray Packaging Market. As more consumers opt for pre-packaged food items, the demand for egg trays that facilitate easy handling and storage is likely to increase. In 2025, the market for convenient food packaging is expected to grow by 25%, reflecting a shift in consumer behavior. This trend compels manufacturers to design egg trays that not only protect the product but also enhance user experience. As a result, the China Egg Tray Packaging Market is anticipated to adapt to these changing consumer preferences, leading to innovative packaging solutions that cater to the convenience-driven market.

Rising Demand for Eco-Friendly Packaging

The increasing consumer awareness regarding environmental sustainability appears to be a pivotal driver for the China Egg Tray Packaging Market. As consumers become more conscious of their ecological footprint, the demand for biodegradable and recyclable packaging solutions is likely to surge. In 2025, the market for eco-friendly packaging in China is projected to reach approximately USD 20 billion, indicating a robust growth trajectory. This trend is compelling manufacturers to innovate and adopt sustainable practices, thereby enhancing their market competitiveness. The shift towards eco-friendly materials not only aligns with consumer preferences but also complies with stringent government regulations aimed at reducing plastic waste. Consequently, the China Egg Tray Packaging Market is expected to witness a significant transformation as companies increasingly prioritize sustainability in their packaging solutions.

Technological Innovations in Manufacturing

Technological advancements in manufacturing processes are poised to significantly influence the China Egg Tray Packaging Market. Innovations such as automated production lines and advanced molding techniques are enhancing the efficiency and quality of egg tray production. In 2025, it is estimated that the adoption of such technologies could reduce production costs by up to 15%, thereby allowing manufacturers to offer competitive pricing. Furthermore, these advancements enable the production of customized egg trays that cater to specific client needs, enhancing customer satisfaction. As manufacturers embrace these technologies, the overall productivity and sustainability of the China Egg Tray Packaging Market are likely to improve, fostering a more dynamic market environment.