Expansion of IoT Applications

The expansion of Internet of Things (IoT) applications is significantly influencing the enterprise vsat market in China. As industries increasingly adopt IoT technologies for monitoring and automation, the need for reliable satellite communication becomes paramount. VSAT systems provide the necessary bandwidth and connectivity to support a multitude of IoT devices deployed in remote locations. This trend is particularly evident in sectors such as agriculture, transportation, and logistics, where real-time data collection and analysis are critical. The enterprise vsat market is projected to benefit from this expansion, with estimates suggesting a potential increase in market size by over 15% in the coming years. The integration of IoT with VSAT technology is likely to enhance operational efficiency and drive innovation across various industries.

Rising Demand for Remote Operations

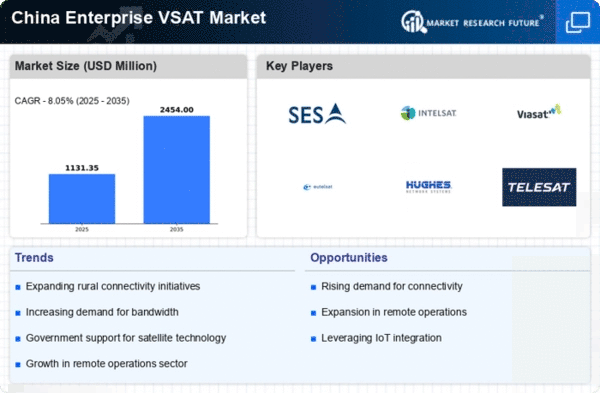

The enterprise vsat market in China is experiencing a notable surge in demand for remote operations. As businesses increasingly adopt remote work models, the need for reliable communication solutions has intensified. This trend is particularly evident in sectors such as oil and gas, mining, and agriculture, where operations are often located in remote areas. The enterprise vsat market provides essential connectivity, enabling real-time data transmission and communication. According to recent estimates, the market is projected to grow at a CAGR of approximately 10% over the next five years, driven by the necessity for uninterrupted connectivity in these sectors. This growth reflects a broader shift towards digital transformation, where enterprises seek to enhance operational efficiency through advanced communication technologies.

Government Initiatives and Investments

Government initiatives in China are playing a pivotal role in shaping the enterprise vsat market. The Chinese government has been actively investing in satellite communication infrastructure to enhance connectivity across the nation. This includes initiatives aimed at improving internet access in rural and underserved areas, which is crucial for fostering economic development. The enterprise vsat market stands to benefit significantly from these investments, as they facilitate the deployment of satellite communication systems that cater to various industries. With an estimated investment of over $1 billion in satellite technology over the next few years, the government’s commitment to enhancing communication infrastructure is likely to propel the growth of the enterprise vsat market.

Growing Demand for High-Speed Internet

The growing demand for high-speed internet access is a key driver for the enterprise vsat market in China. As businesses increasingly rely on digital platforms for operations, the need for fast and reliable internet connectivity has become essential. This demand is particularly pronounced in sectors such as finance, healthcare, and education, where high-speed internet is critical for data-intensive applications. The enterprise vsat market is responding to this need by offering advanced satellite communication solutions that provide high-speed internet access even in remote areas. Recent data indicates that the market is expected to grow by approximately 12% annually, driven by the increasing reliance on digital services and the need for seamless connectivity. This trend underscores the importance of VSAT technology in meeting the evolving connectivity requirements of enterprises.

Increased Focus on Disaster Recovery Solutions

The enterprise vsat market in China is witnessing an increased focus on disaster recovery solutions. As natural disasters pose significant risks to business continuity, organizations are prioritizing robust communication systems that can withstand such events. VSAT technology offers a reliable means of maintaining connectivity during emergencies, ensuring that businesses can continue operations even in adverse conditions. This trend is particularly relevant in regions prone to natural disasters, where traditional communication infrastructure may be compromised. The enterprise VSAT market is expected to see a rise in demand for these solutions., as companies recognize the importance of having contingency plans in place. This shift towards disaster recovery is likely to drive market growth, as businesses invest in resilient communication technologies.