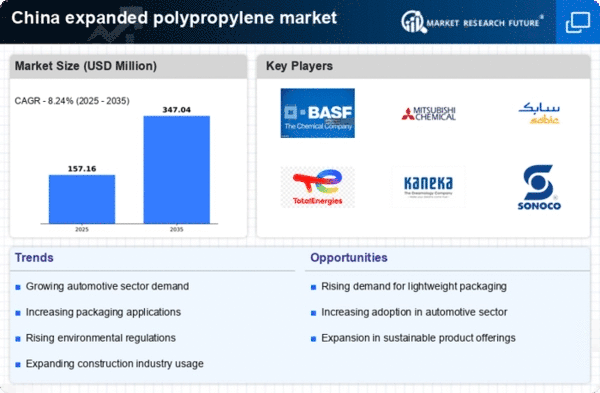

The expanded polypropylene market in China is characterized by a dynamic competitive landscape, driven by increasing demand across various sectors such as automotive, packaging, and consumer goods. Key players are actively pursuing strategies that emphasize innovation, sustainability, and regional expansion. For instance, BASF SE (DE) has been focusing on enhancing its product portfolio through the development of advanced materials that cater to the growing need for lightweight and durable solutions. Similarly,

Mitsubishi Chemical Corporation (JP) is leveraging its technological expertise to innovate in the field of sustainable materials, thereby positioning itself as a leader in eco-friendly solutions. These strategic initiatives collectively contribute to a competitive environment that is increasingly oriented towards meeting the evolving needs of consumers and industries alike.In terms of business tactics, companies are localizing manufacturing to reduce costs and improve supply chain efficiency. This approach appears to be particularly effective in a moderately fragmented market where several players vie for market share. The collective influence of key players, including SABIC (SA) and TotalEnergies SE (FR), is shaping the market structure, as they engage in strategic partnerships and collaborations to enhance their operational capabilities and market reach.

In October SABIC (SA) announced a partnership with a leading automotive manufacturer to develop lightweight components using expanded polypropylene. This collaboration is significant as it underscores SABIC's commitment to innovation in the automotive sector, where weight reduction is critical for improving fuel efficiency and reducing emissions. Such strategic alliances not only enhance product offerings but also strengthen market positioning in a highly competitive landscape.

In September TotalEnergies SE (FR) launched a new line of expanded polypropylene products designed specifically for the packaging industry. This move is indicative of the company's strategy to diversify its product range and cater to the growing demand for sustainable packaging solutions. The introduction of these products is likely to bolster TotalEnergies' market presence and appeal to environmentally conscious consumers, thereby enhancing its competitive edge.

In August JSP Corporation (JP) expanded its production capacity for expanded polypropylene in response to rising demand from the construction sector. This strategic expansion is crucial as it allows JSP to meet the increasing needs of its customers while also positioning itself as a key player in the construction materials market. The ability to scale production effectively may provide JSP with a competitive advantage in a market that is witnessing rapid growth.

As of November current trends in the expanded polypropylene market are increasingly defined by digitalization, sustainability, and the integration of advanced technologies such as AI. Strategic alliances are playing a pivotal role in shaping the competitive landscape, as companies collaborate to enhance their capabilities and innovate. Looking ahead, it appears that competitive differentiation will evolve from traditional price-based competition to a focus on innovation, technological advancements, and supply chain reliability. This shift may redefine how companies position themselves in the market, emphasizing the importance of sustainable practices and cutting-edge solutions.