China Financial Analytics Market

China Financial Analytics Market Research Report By Components (Financial market analytics, Financial function analytics), By Services (Professional services, Managed services), By Deployment Modes (Cloud technology, On-premise technology), By Applications (Stock management, Wealth management, Fraud prevention and detection, Risk, governance and compliance management, Claim management, Customer management, Track management), By Organization (Small and medium-sized enterprise, Large scale enterprise) and By End-user (Transportation and logist...

China Financial Analytics Market Overview

As per MRFR analysis, the China Financial Analytics Market Size was estimated at 556.78 (USD Million) in 2023. The China Financial Analytics Market Industry is expected to grow from 620.25 (USD Million) in 2024 to 2,380.42 (USD Million) by 2035. The China Financial Analytics Market CAGR (growth rate) is expected to be around 13.005% during the forecast period (2025 - 2035)

Key China Financial Analytics Market Trends Highlighted

The China Financial Analytics Market is experiencing significant trends driven by the rapid growth of digital finance and government encouragement for technology adoption in financial services. The integration of artificial intelligence and big data analytics is becoming prevalent, enabling financial institutions to enhance decision-making, risk management, and customer engagement. As China continues to strengthen its digital economy, financial analytics tools are being increasingly adopted to aid in compliance with regulatory requirements and improve transparency in financial operations.

Opportunities to leverage financial analytics in sectors such as retail banking, insurance, and capital markets are expanding.The rise of fintech companies in China is also creating a rich landscape for the deployment of advanced analytics, as these firms seek to differentiate themselves in a competitive market. Furthermore, the Chinese government's initiatives to boost innovation and technological advancements in finance support the accelerated adoption of these analytical tools. In recent times, there has been a focus on real-time analytics that provide immediate insights into market movements and investment opportunities, enabling stakeholders to react swiftly in a fast-paced environment.

The shift toward cloud-based solutions is facilitating easier access to financial analytics, aligning with China's commitment to cloud computing growth.Enhanced cybersecurity measures are also being prioritized as the demand for sensitive financial data protection increases. Overall, the trend toward digitization and the use of analytics in the financial sector in China continues to evolve, identifying new pathways for growth and efficiency.

Source: Primary Research, Secondary Research, MRFR Database and Analyst Review

China Financial Analytics Market Drivers

Rapid Digital Transformation in Financial Services

China's financial services sector is undergoing fast digital change, which is propelling the China Financial Analytics Market Industry. Government efforts, such as the 14th Five-Year Plan, prioritize the development of the country's digital economy, with the expectation that by 2025, it will account for more than 60% of China's total GDP. Major companies, like as Alibaba and Tencent, are driving this transition by using predictive analytics to examine massive volumes of transaction data.

This emphasis on digitalization is expected to drive demand for advanced financial analytics solutions, as organizations use analytics to extract insights from complex information quickly and efficiently. Furthermore, the People's Bank of China has been supporting the integration of new technology into financial services, suggesting a significant commitment to the development of financial analytics skills. With China's fintech sector likely to expand significantly, the financial analytics market will thrive as businesses adopt data-driven tactics.

Increasing Compliance and Regulatory Requirements

As the financial sector continues to evolve, the regulatory framework in China is becoming increasingly stringent. Organizations must now comply with a myriad of regulations aimed at enhancing transparency and managing risks. According to the China Banking and Insurance Regulatory Commission, compliance costs in the banking sector have risen significantly, creating a demand for financial analytics solutions that can help ensure adherence efficiently.

Established organizations such as the Industrial and Commercial Bank of China are investing heavily in financial analytics to streamline compliance processes and reduce potential fines. This compliance-driven demand for analytics is projected to benefit the China Financial Analytics Market Industry, unlocking new growth opportunities.

Growing Adoption of Artificial Intelligence and Machine Learning

The adoption of Artificial Intelligence (AI) and Machine Learning (ML) technologies within the financial sector in China is rapidly growing, significantly impacting the China Financial Analytics Market Industry. Recent reports indicate that around 45% of Chinese financial institutions are actively integrating AI and ML into their operations to enhance risk management and improve customer experiences. Key players like Ping An Insurance are leveraging AI-driven analytics tools to analyze patterns and predict market trends, which can lead to better decision-making.

The Chinese government has also been supporting AI development through initiatives aimed at becoming a global leader in AI technology. This growing focus on AI and ML in the financial sector is expected to propel the demand for advanced financial analytics solutions over the coming years.

China Financial Analytics Market Segment Insights

Financial Analytics Market Components Insights

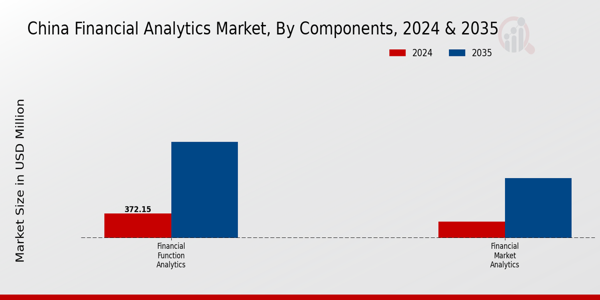

The Components segment of the China Financial Analytics Market plays a crucial role in shaping the financial landscape of the region, reflecting significant growth momentum as digital transformation continues to influence various industries. This segment is critical for enabling organizations to derive actionable insights from voluminous financial data, ensuring improved decision-making and strategic planning. Within this market segment, Financial market analytics focuses on the evaluation and interpretation of data related to financial markets, allowing institutions to gauge market trends and investor behavior.

Additionally, Financial function analytics emphasizes the optimization of internal operations, enhancing areas like budgeting, forecasting, and performance analysis. Given the advancing technology in data analytics and artificial intelligence, both areas have seen a surge in adoption rates among Chinese enterprises, facilitating integration into business intelligence operations. The government of China has prioritized the development of a robust financial analytics framework as part of its modernization efforts, encouraging investments in technology sectors.This landscape is ripe with opportunities for service providers who can offer tailored solutions to meet the diverse needs of businesses. Challenges in this market may include data privacy issues and regulatory compliance; however, the ongoing push for financial reforms in China presents avenues for growth.

The demand for sophisticated analytical tools marks an upward trend in the financial analytics domain, signifying a shift towards more data-driven strategies for financial management. With the rapid evolution in digital capabilities, organizations are increasingly recognizing the importance of data insight, making both Financial market analytics and Financial function analytics key components for competitiveness within the China Financial Analytics Market.As companies seek to harness data for enhanced operational efficiency and strategic advantages, these segments are expected to gain prominence, indicating substantial contributions to the overall market dynamics in the coming years.

Source: Primary Research, Secondary Research, MRFR Database and Analyst Review

Financial Analytics Market Services Insights

The Services segment of the China Financial Analytics Market is growing rapidly, characterized by its increasing significance to financial institutions and enterprises navigating a complex economic landscape. This segment encompasses various offerings, notably Professional services and Managed services, each playing a crucial role in optimizing financial performance and ensuring data accuracy. Professional services often include consulting and advisory roles, enabling organizations to customize their financial strategies effectively in response to market dynamism and regulatory changes.

Managed services, on the other hand, often dominate as they provide organizations with the flexibility to outsource analytical workloads, thereby allowing internal teams to focus on strategic tasks rather than day-to-day analytics management. The demand for these services is driven by the need for more robust data analysis and interpretation to facilitate informed decision-making in a competitive market environment. With increasing strategic investments and technological advancements, the Services segment enhances the overall efficiency and effectiveness of the China Financial Analytics Market, supporting organizations in leveraging data for sustainable growth.

Financial Analytics Market Deployment Modes Insights

The China Financial Analytics Market is notably segmented by Deployment Modes, which play a critical role in shaping the industry's landscape. The increasing shift towards Cloud technology within this segment is fueled by the rising demand for scalable solutions that enhance operational efficiency and cost-effectiveness for financial institutions. Cloud technology offers unparalleled flexibility and enables real-time data analysis, which is vital for decision-making in the fast-paced financial sector. Conversely, On-premise technology remains significant, as many organizations prioritize data security and regulatory compliance, adhering to China's stringent data protection laws.

This segment caters to traditional businesses that require extensive control over their IT infrastructure. The dynamics between these deployment modes illustrate the diverse needs of the market, where Cloud technology is set to garner major adoption due to its agile nature, while On-premise solutions maintain a steadier, more conservative presence, showcasing the dual approach companies are taking in navigating the rapidly evolving landscape of financial analytics. Additionally, market growth is supported by increasing investments in digital transformation as companies seek to leverage China Financial Analytics Market data and improve overall efficiency through intelligent analytics solutions.

Financial Analytics Market Applications Insights

The Applications segment of the China Financial Analytics Market plays a critical role in enhancing financial decision-making processes across various sectors. As the overall market grows, applications such as Stock management and Wealth management are increasingly pivotal, catering to the demands of investors and financial institutions seeking efficient portfolio management and asset allocation. Fraud prevention and detection have become imperative due to rising concerns over financial security, driven by digital transformations and an increase in online transactions. Risk, governance, and compliance management are also significant, ensuring organizations adhere to stringent regulations while managing potential risks effectively.

Claim management and Customer management applications focus on improving service delivery and operational efficiency, which are vital as companies strive to enhance customer experiences. Track management contributes to valuable financial analytics, enabling businesses to oversee their financial health meticulously. This combination of applications addresses the evolving needs within China's dynamic financial landscape, fostering opportunities for growth while navigating challenges such as regulatory changes and increasing competition in the financial analytics domain.

Financial Analytics Market Organization Insights

The Organization segment within the China Financial Analytics Market plays a crucial role in shaping the overall landscape of financial data analysis in the region. In recent years, there has been significant growth in the utilization of financial analytics tools by small and medium-sized enterprises, which are increasingly recognizing the benefits of data-driven decision-making. These businesses leverage financial analytics to enhance operational efficiency, optimize cash flow, and improve customer insights, thereby fostering competitive advantages.On the other hand, large-scale enterprises contribute substantially to the market by adopting advanced analytics solutions that facilitate complex financial forecasting and risk management efforts.

The dominance of these organizations is often attributed to their extensive resources and the necessity to manage vast amounts of financial data. The growing adoption of cloud-based solutions and advanced technologies like artificial intelligence and machine learning provides extensive opportunities for innovation and enhanced capabilities in financial analytics across all organizational sizes.The increasing emphasis on compliance and regulatory requirements in China further propels the need for sophisticated financial analytics tools to ensure accurate reporting and risk mitigation. This overall momentum highlights the importance of the Organization segment in driving growth within the broader China Financial Analytics Market.

Financial Analytics Market End-user Insights

The End-user segment of the China Financial Analytics Market plays a pivotal role in shaping the industry dynamics, reflecting the diverse application of financial analytics across various sectors. Both the banking, insurance, and financial services industries are major contributors to the adoption of financial analytics, utilizing data-driven insights to enhance customer service, risk management, and regulatory compliance. Similarly, the rapidly evolving retail and e-commerce sector leverages financial analytics to optimize inventory management and personalize customer experiences, resulting in increased sales and customer satisfaction. The transportation and logistics sector significantly benefits from improving operational efficiency and route planning through advanced analytical models, thereby reducing costs and enhancing service delivery.

In addition, the government's adoption of financial analytics enhances decision-making related to budget allocation and fiscal policies. Utilities and media, and entertainment industries also leverage analytics to forecast demand and streamline operations, driving innovation and strategic growth. Moreover, in the manufacturing and automotive sectors, financial analytics assists organizations in monitoring production costs and predicting market trends, facilitating informed business strategies. The collective adoption of financial analytics across these sectors reflects a concerted effort in China to harness data for improved financial performance and competitiveness in the global marketplace, aiding in the overall growth trajectory of the China Financial Analytics Market.

China Financial Analytics Market Key Players and Competitive Insights

The China Financial Analytics Market is a rapidly evolving sector that showcases a broad range of services, including risk assessment, data-driven insights, and performance metrics for financial institutions, investors, and businesses. The competitiveness within this market is characterized by a mix of established players and emerging start-ups leveraging advanced technologies like artificial intelligence, machine learning, and big data analytics to deliver innovative solutions. The market's dynamism is further fueled by the growing demand for real-time data analysis and predictive modeling capabilities, as businesses strive to optimize their operational efficiencies and enhance decision-making processes.

This competitive landscape necessitates continuous adaptation from its participants to maintain relevance and capitalize on the shifting consumer preferences and regulatory landscapes.JD.com significantly stands out within the China Financial Analytics Market due to its robust data infrastructure and advanced analytical capabilities. With a comprehensive ecosystem that encompasses e-commerce, logistics, and technology, JD.com utilizes its vast amounts of transactional data to derive financial analytics that drive informed decisions across various sectors. The company’s strengths lie in its integration of artificial intelligence with data analytics, enabling it to offer precise insights into market trends, consumer behavior, and financial performance.

Additionally, JD.com's commitment to innovation through technology enhances its competitive edge, allowing it to provide tailored financial solutions that cater specifically to the needs of businesses engaging in China's dynamic marketplace.Ant Group plays a pivotal role in the China Financial Analytics Market, known for its innovative financial services and digital infrastructure. The company offers a suite of products, including payment solutions, wealth management, and credit services, all underpinned by powerful analytics capabilities. Its robust data analysis and risk assessment tools enable financial institutions to make data-driven decisions efficiently. Ant Group's market presence is bolstered by its extensive user base in the digital payment segment and partnerships with various financial entities, which expand its reach and influence.

The company's strengths are further enhanced by its continuous focus on technology and innovation, particularly in the realms of blockchain and machine learning. Furthermore, Ant Group has engaged in strategic mergers and acquisitions to diversify its services and strengthen its position in the market, making it a formidable player in China's financial analytics landscape.

Key Companies in the China Financial Analytics Market Include

- JD.com

- Ant Group

- Tencent

- Alibaba Group

- China International Capital Corporation

- ZhongAn Technology

- Beijing Sankuai Online Technology

- Huawei

- Ping An Technology

- Baidu

- China Construction Bank

- China UnionPay

- Industrial and Commercial Bank of China

- China Merchants Bank

China Financial Analytics Industry Developments

In recent developments, the China Financial Analytics Market has been showing significant growth, driven by technological advancements and increased demand for data-driven insights. Notable companies like JD.com and Alibaba Group are enhancing their analytical capabilities to optimize operations and improve customer experiences. In October 2023, Ant Group announced a strategic partnership with Tencent, focusing on leveraging each other's strengths in data analytics to enhance service offerings. Additionally, in September 2023, China International Capital Corporation expanded its investment analytics platform, which reflects a growing trend in integrating artificial intelligence into financial services.

In terms of mergers and acquisitions, Beijing Sankuai Online Technology was reported to acquire a stake in a financial analytics startup to augment its service portfolio in July 2023. The market value of companies such as Industrial and Commercial Bank of China has also seen an upward trend, influenced by the financial technology boom. Over the past couple of years, the demand for financial analytics solutions in China has surged, emphasizing the importance of real-time data analysis and risk management in financial institutions. As more organizations turn to analytics for strategic decision-making, the competitive landscape continues to evolve rapidly.

China Financial Analytics Market Segmentation Insights

Financial Analytics Market Components Outlook

- Financial market analytics

- Financial function analytics

Financial Analytics Market Services Outlook

- Professional services

- Managed services

Financial Analytics Market Deployment Modes Outlook

- Cloud technology

- On-premise technology

Financial Analytics Market Applications Outlook

- Stock management

- Wealth management

- Fraud prevention and detection

- Risk, governance and compliance management

- Claim management

- Customer management

- Track management

Financial Analytics Market Organization Outlook

- Small and medium-sized enterprise

- Large-scale enterprise

Financial Analytics Market End-user Outlook

- Transportation and logistics

- Banking, insurance and financial services

- Retail and eCommerce

- Government

- Utilities

- Media and entertainment

- Manufacturing and automotive

FAQs

What is the expected market size of the China Financial Analytics Market in 2024?

In 2024, the China Financial Analytics Market is expected to be valued at 620.25 million USD.

What is the projected market size of the China Financial Analytics Market by 2035?

By 2035, the overall market is projected to reach a valuation of 2380.42 million USD.

What is the expected compound annual growth rate (CAGR) for the China Financial Analytics Market from 2025 to 2035?

The market is anticipated to grow at a CAGR of 13.005% during the period from 2025 to 2035.

Which segment of the China Financial Analytics Market is expected to be larger in 2024?

In 2024, Financial function analytics is anticipated to dominate with a value of 372.15 million USD.

What is the projected value of Financial market analytics in 2035?

By 2035, the Financial market analytics segment is expected to reach 910.52 million USD.

Who are the major players in the China Financial Analytics Market?

Key players include JD.com, Ant Group, Tencent, and Alibaba Group among others.

What challenges does the China Financial Analytics Market face?

Challenges include rising competition and the need for regulatory compliance.

What opportunities exist within the Financial function analytics segment?

There is significant opportunity for growth driven by the demand for advanced data-driven insights.

How does regionality affect the growth of the China Financial Analytics Market?

The market shows varying growth rates across different regions owing to local economic conditions.

What are the key applications of financial analytics in China?

Key applications include risk management, performance measurement, and regulatory compliance.

Kindly complete the form below to receive a free sample of this Report

Customer Stories

“This is really good guys. Excellent work on a tight deadline. I will continue to use you going forward and recommend you to others. Nice job”

“Thanks. It’s been a pleasure working with you, please use me as reference with any other Intel employees.”

“Thanks for sending the report it gives us a good global view of the Betaïne market.”

“Thank you, this will be very helpful for OQS.”

“We found the report very insightful! we found your research firm very helpful. I'm sending this email to secure our future business.”

“I am very pleased with how market segments have been defined in a relevant way for my purposes (such as "Portable Freezers & refrigerators" and "last-mile"). In general the report is well structured. Thanks very much for your efforts.”

“I have been reading the first document or the study, ,the Global HVAC and FP market report 2021 till 2026. Must say, good info! I have not gone in depth at all parts, but got a good indication of the data inside!”

“We got the report in time, we really thank you for your support in this process. I also thank to all of your team as they did a great job.”

Leave a Comment