China Generative AI in BFSI Market Overview

As per MRFR analysis, the China Generative AI in BFSI Market Size was estimated at 72.6 (USD Million) in 2023.The China Generative AI in BFSI Market Industry is expected to grow from 91.8(USD Million) in 2024 to 1,089.6 (USD Million) by 2035. The China Generative AI in BFSI Market CAGR (growth rate) is expected to be around 25.22% during the forecast period (2025 - 2035).

Key China Generative AI in BFSI Market Trends Highlighted

China’s Generative AI in the BFSI sector is experiencing notable trends driven by technological advancements and the growing need for efficiency. The rapid digital transformation of financial services in China is a significant market driver. Institutions are increasingly adopting AI solutions to enhance customer experience, risk management, and operational efficiency.

Government initiatives, like the “New Generation Artificial Intelligence Development Plan,” encourage AI integration in various industries, including banking, insurance, and financial services. As financial regulations evolve, there is a heightened focus on compliance driven by AI technologies that help institutions streamline reporting and enhance data analysis capabilities.

Opportunities for financial institutions in China lie in personalized customer service and fraud detection. Generative AI can create tailored financial products based on individual customer profiles, thereby improving engagement and retention.

Furthermore, AI-powered systems can analyze vast amounts of transaction data in real-time, improving fraud detection and prevention measures. This creates a proactive rather than reactive approach to security, a significant concern in China's rapidly digitizing economy. Recent trends also highlight the rising collaboration between tech startups and traditional financial institutions.

This synergy is fostering innovation, as startups provide cutting-edge AI solutions that can be quickly integrated into existing systems.As a result, there is a push toward enhancing product offerings and improving the overall customer experience. Overall, the integration of generative AI in the BFSI sector in China signifies a shift toward smarter, more personalized financial services, marking a transformative phase in its banking landscape.

Source: Primary Research, Secondary Research, MRFR Database and Analyst Review

China Generative AI in BFSI Market Drivers

Rapid Digital Transformation in Financial Services

China's financial services industry is rapidly embracing digital, thanks to rising internet connectivity and smartphone adoption. In 2022, there were over 1.05 billion internet users in China, or roughly 74% of the country's total population, according to the China Internet Network Information Center. As organizations want to improve customer experience and expedite processes, this broad access is encouraging the banking, financial services, and insurance (BFSI) sector to use generative artificial intelligence technology.

This change has been expedited by well-known companies like Ant Group and Tencent, who have made investments in cutting-edge AI capabilities that enable them to improve risk management techniques and offer individualized financial solutions. It is anticipated that these developments would greatly benefit the China Generative AI in BFSI Market Industry, fostering efficiency and innovation throughout the industry.

Government Initiatives and Regulatory Support

The Chinese government has been actively promoting the integration of Artificial Intelligence within various sectors, including Banking, Financial Services, and Insurance. Initiatives such as the 'New Generation Artificial Intelligence Development Plan' aim to position China as a global leader in AI technology by 2030. As a result, financial institutions are encouraged to adopt Generative AI solutions for compliance, risk assessment, and fraud detection.

This proactive regulatory environment is catalyzing investments in AI technologies across the BFSI sector. Notably, institutions like the Bank of China have started adopting AI-driven solutions to enhance their compliance processes, responding positively to government incentives and shaping the future of the China Generative AI in BFSI Market Industry.

Growing Demand for Enhanced Customer Experience

In the competitive landscape of the Chinese BFSI sector, there is a growing demand for enhanced customer experience, which is crucial for customer retention and acquisition. Reports indicate that financial institutions that leverage Generative AI technologies to personalize services can achieve a customer satisfaction rate as high as 85%.

Major players like China Construction Bank are implementing AI-driven chatbots and customer service platforms to meet these expectations.The emergence of such technologies is transforming how clients interact with their financial service providers, emphasizing the need for innovation in customer relationship management. This driver is accelerating growth in the China Generative AI in BFSI Market Industry as businesses strive to integrate advanced AI capabilities to enhance their service offerings.

China Generative AI in BFSI Market Segment Insights

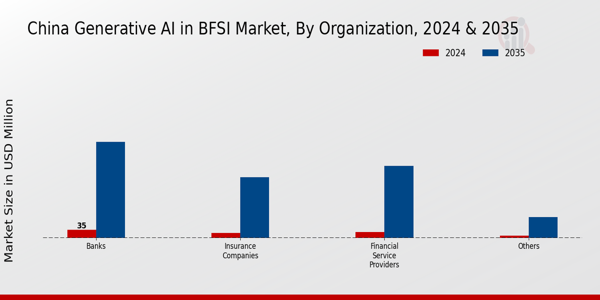

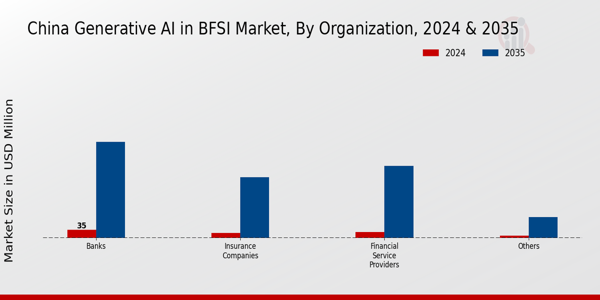

Generative AI in BFSI Market Organization Insights

The Organization segment within the China Generative AI in BFSI Market plays a vital role in shaping the financial services landscape. With a significant rise in the adoption of Generative AI technologies, organizations such as banks, insurance companies, and financial service providers are increasingly leveraging these tools to enhance operational efficiency, customer experience, and compliance processes. For banks, the implementation of artificial intelligence solutions has led to improved risk management and better fraud detection. Similarly, insurance companies utilize Generative AI to streamline claims processing and enhance underwriting accuracy, thereby reducing operational costs and improving customer satisfaction.

Financial service providers are heavily investing in advanced analytics and machine learning to provide personalized services to their clients, leading to a more competitive marketplace. The segment also includes other various entities that facilitate financial transactions and services, which contribute to the overall growth of the market.

In China, government initiatives further encourage the financial sector to adopt AI solutions, aligning with the nation’s broader goals of digital transformation and technological advancement. The growing emphasis on data security and regulatory compliance has prompted organizations to adopt Generative AI not only to enhance their service offerings but also to ensure they meet the stringent regulatory requirements.

As the landscape evolves, the competition among these organizations will likely intensify, spurring innovations in Generative AI applications tailored for the BFSI market. Understanding the dynamics of the Organization segment in the China Generative AI in BFSI Market reveals how these various entities work towards creating more efficient and customer-centric financial services. The increasing penetration of internet connectivity and mobile banking in China presents opportunities for banks and financial service providers to reach broader audiences, while insurance companies are tapping into big data analytics to inform their strategies and product development.

This trend represents a shift towards more intelligent financial ecosystems capable of adapting rapidly to changing consumer needs and regulatory landscapes. As organizations embrace Generative AI, they will continue to play a pivotal role in the evolution of the BFSI sector in China.

Source: Primary Research, Secondary Research, MRFR Database and Analyst Review

Generative AI in BFSI Market Application Insights

The China Generative AI in BFSI Market focuses on several essential applications that drive its growth and efficacy. In the past, the increasing demand for Fraud Detection solutions has significantly impacted financial institutions, enhancing security and trust. Risk Assessment, another vital application, utilizes advanced algorithms to better evaluate potential threats and assist with informed decision-making processes.

Moreover, Customer Experience solutions leverage Generative AI to improve service interactions, driving customer engagement and satisfaction while creating personalized financial recommendations.Algorithmic Trading has emerged as a dominant area, harnessing real-time data analysis to optimize trading strategies and facilitate more efficient market movements. Other applications also contribute positively, integrating innovation in various financial service sectors.

The combination of these applications underscores the adaptability of Generative AI technologies in addressing complex challenges within the BFSI industry in China, reflecting a robust response to market demands and competitive pressures. Overall, these applications are crucial for modernizing the banking, financial services, and insurance landscape, ensuring that organizations remain resilient in a rapidly evolving technological environment.

Generative AI in BFSI Market Deployment Insights

The Deployment segment of the China Generative AI in BFSI Market plays a crucial role in shaping the operational efficiency and service delivery of financial institutions. With the increasing digitization in China, both On-Premise and Cloud-Based solutions are gaining traction, each catering to different organizational needs. On-Premise deployments offer enhanced security and control over sensitive financial data, which aligns with the regulatory requirements in China, thus appealing to institutions that prioritize data privacy.

On the other hand, Cloud-Based solutions provide flexibility, scalability, and lower upfront costs, making them attractive to startups and smaller financial entities looking to leverage cutting-edge technologies without heavy initial investments.The rise in demand for real-time analytics and personalized customer experiences is driving institutions towards deploying generative AI, facilitating improved decision-making and operational automation.

Furthermore, as banks and financial service providers in China aim to optimize their digital transformation strategies, the emphasis on integrating such AI technologies through these deployment methods is likely to continue to evolve, presenting numerous opportunities for growth in the market. The alignment of these deployment options with China's broader goals of technological advancement further underscores their significance in the overall landscape of the BFSI industry.

China Generative AI in BFSI Market Key Players and Competitive Insights

The competitive landscape of China Generative AI in the BFSI (Banking, Financial Services, and Insurance) market is characterized by rapid innovation and substantial investment from key players seeking to enhance customer experience and operational efficiency. As technology continues to advance, companies in the BFSI sector are increasingly adopting generative AI solutions to streamline processes, reduce costs, and improve decision-making.

This growing focus on data-driven insights and automation is fostering a dynamic environment where businesses are competing to offer the most sophisticated AI capabilities. This competitive setting is fueled by the need for enhanced risk management, personalized financial services, and fraud detection, positioning generative AI as a crucial enabler of transformation in the BFSI sector within China.Ant Group, a significant player within the China Generative AI in BFSI market, is recognized for its innovative financial technology solutions.

The company has leveraged its extensive ecosystem of digital payment and financial services to integrate AI capabilities effectively. Ant Group's strengths lie in its vast user base and the ability to harness large volumes of data to generate personalized offerings. This data-centric approach allows Ant Group to enhance credit risk assessments and improve customer engagement through tailored financial products. Moreover, the company has established partnerships with various banks and financial institutions, enhancing its presence in the market and enabling collaborative innovations that further enrich its AI-driven solutions.

Tencent is another formidable entity in the China Generative AI in BFSI sector, with a diverse range of products and services that cater to both consumers and businesses. The company has invested significantly in developing advanced AI technologies that support financial analysis, customer service automation, and fraud detection.

Tencent's strengths include its robust social media and messaging platforms, which serve as valuable channels for financial services delivery, fostering user engagement and accessibility. The company has also pursued strategic mergers and acquisitions to bolster its AI capabilities and expand its market reach. By continually innovating and adapting its offerings to meet the evolving needs of the BFSI landscape, Tencent has solidified its position as a key competitor in the generative AI space, specifically within China.

Key Companies in the China Generative AI in BFSI Market Include

- Ant Group

- Tencent

- Industrial and Commercial Bank of China

- QingCloud

- Ping An Technology

- JD Technology

- SenseTime

- Baidu

- ZhongAn Online

- Megvii

- China Construction Bank

- Huanghe Whirlwind

- Alibaba

- Huatai Securities

- China Merchants Bank

China Generative AI in BFSI Industry Developments

In recent months, significant developments have shaped the China Generative AI in Banking, Financial Services, and Insurance (BFSI) market. Notable companies such as Ant Group and Tencent are intensifying their focus on generative AI applications to enhance customer experience and streamline operations. The use of artificial intelligence in fraud detection and risk assessment is garnering attention, as institutions like the Industrial and Commercial Bank of China and China Construction Bank are integrating these technologies.

In April 2023, Baidu announced advancements in itsAI algorithms that support financial forecasting, gaining recognition from market analysts. Meanwhile, Ping An Technology has launched solutions that leverage generative AI for improved underwriting processes. Furthermore, the merger and acquisition landscape is witnessing active participation, exemplified by JD Technology's acquisition of a small tech firm in June 2023 to bolster its AI capabilities.

The market valuation for companies in the sector continues to rise, driven by increasing investments and adoption of generative AI technologies within the financial services framework. Over the past two years, collaborations among companies such as Alibaba and Megvii have gained momentum, enhancing their respective AI capabilities.

China Generative AI in BFSI Market Segmentation Insights

-

Generative AI in BFSI Market Organization Outlook

- Banks

- Insurance Companies

- Financial Service Providers

- Others

-

Generative AI in BFSI Market Application Outlook

- Fraud Detection

- Risk Assessment

- Customer Experience

- Algorithmic Trading

- Others

-

Generative AI in BFSI Market Deployment Outlook

| Report Attribute/Metric Source: |

Details |

| MARKET SIZE 2023 |

72.6(USD Million) |

| MARKET SIZE 2024 |

91.8(USD Million) |

| MARKET SIZE 2035 |

1089.6(USD Million) |

| COMPOUND ANNUAL GROWTH RATE (CAGR) |

25.22% (2025 - 2035) |

| REPORT COVERAGE |

Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| BASE YEAR |

2024 |

| MARKET FORECAST PERIOD |

2025 - 2035 |

| HISTORICAL DATA |

2019 - 2024 |

| MARKET FORECAST UNITS |

USD Million |

| KEY COMPANIES PROFILED |

Ant Group, Tencent, Industrial and Commercial Bank of China, QingCloud, Ping An Technology, JD Technology, SenseTime, Baidu, ZhongAn Online, Megvii, China Construction Bank, Huanghe Whirlwind, Alibaba, Huatai Securities, China Merchants Bank |

| SEGMENTS COVERED |

Organization, Application, Deployment |

| KEY MARKET OPPORTUNITIES |

Talent optimization through AI, Enhanced customer engagement solutions, Personalized risk assessment tools, Automated compliance management systems, Fraud detection and prevention innovations |

| KEY MARKET DYNAMICS |

Regulatory compliance and oversight, Increasing demand for personalized services, Cost reduction and operational efficiency, Enhanced fraud detection capabilities, Rapid technology adoption in finance |

| COUNTRIES COVERED |

China |

Frequently Asked Questions (FAQ) :

The market is expected to be valued at 91.8 USD Million in 2024.

The market is projected to reach a value of 1089.6 USD Million by 2035.

The expected CAGR for the market during this period is 25.22.

Banks are projected to take a leading position, valued at 35.0 USD Million in 2024 and reaching 420.0 USD Million by 2035.

Insurance Companies are expected to have a market value of 22.0 USD Million in 2024.

Financial Service Providers are anticipated to increase from 25.0 USD Million in 2024 to 315.0 USD Million by 2035.

'Others' are projected to account for a market value of 9.8 USD Million in 2024.

Major players include Ant Group, Tencent, and Ping An Technology, among others.

Key opportunities stem from increased automation and enhanced customer experience within the BFSI sector.

Global trends such as digital transformation are significantly enhancing the adoption of generative AI technologies in BFSI.