Growth of the Beverage Sector

The beverage sector in China is experiencing robust growth, significantly impacting the glass container market. With the rise in consumption of bottled beverages, including soft drinks, alcoholic drinks, and juices, the demand for glass containers is on the rise. In 2025, the beverage industry is expected to contribute over $100 billion to the economy, with glass containers accounting for a substantial share due to their ability to preserve product quality and enhance shelf appeal. This growth in the beverage sector is likely to bolster the glass container market, as manufacturers seek to meet the increasing demand for high-quality packaging solutions that align with consumer preferences.

Urbanization and Changing Lifestyles

Rapid urbanization in China is reshaping consumer lifestyles, which in turn influences the glass container market. As more individuals move to urban areas, there is a growing trend towards convenience and premium products, leading to an increased demand for glass containers. The urban population is projected to reach 1 billion by 2030, creating a larger consumer base for packaged goods. This demographic shift suggests that the glass container market will benefit from the rising demand for aesthetically pleasing and functional packaging solutions that cater to urban consumers' preferences. Additionally, the trend towards dining out and take-away services further propels the need for glass containers in food and beverage applications.

Rising Demand for Eco-Friendly Packaging

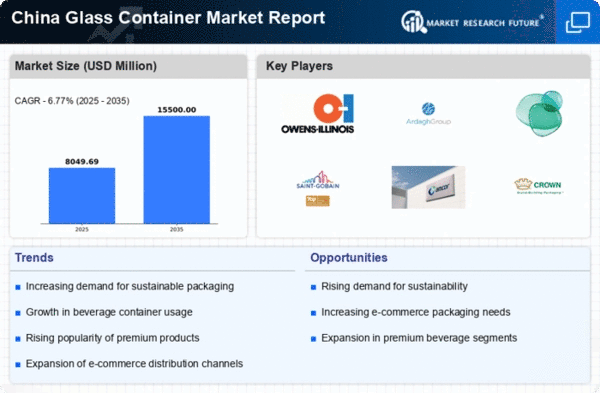

The increasing consumer awareness regarding environmental issues drives the demand for eco-friendly packaging solutions in the glass container market. In China, the shift towards sustainable practices has led to a notable rise in the use of glass containers, which are recyclable and reduce plastic waste. As of 2025, the market for glass containers is projected to grow at a CAGR of approximately 6.5%, reflecting a strong preference for sustainable materials. This trend is further supported by government initiatives promoting green packaging, which encourages manufacturers to adopt glass as a primary material. Consequently, the glass container market is witnessing a transformation as businesses align their strategies with consumer expectations for environmentally responsible products.

Regulatory Support for Packaging Standards

The Chinese government is implementing stricter regulations regarding packaging materials, which is likely to favor the glass container market. Policies aimed at reducing plastic usage and promoting recyclable materials are becoming more prevalent. As of 2025, regulations are expected to mandate a minimum percentage of recyclable content in packaging, which could lead to increased adoption of glass containers. This regulatory environment creates opportunities for the glass container market to expand, as manufacturers adapt to comply with new standards. The emphasis on sustainable packaging solutions aligns with global trends, positioning glass containers as a preferred choice for compliant businesses.

Innovation in Glass Manufacturing Techniques

Advancements in glass manufacturing techniques are enhancing the efficiency and sustainability of the glass container market. Innovations such as lightweight glass and improved production processes are reducing material usage and energy consumption. In 2025, the introduction of new technologies is anticipated to lower production costs by approximately 15%, making glass containers more competitive against alternative packaging materials. This technological evolution is likely to attract more manufacturers to the glass container market, as they seek to leverage these advancements to meet consumer demands for quality and sustainability. The potential for increased production efficiency may also lead to a broader range of glass container designs, appealing to diverse market segments.