Increased Foreign Direct Investment (FDI)

China's investment banking market is significantly influenced by the influx of foreign direct investment (FDI). In recent years, FDI has shown a steady increase, with inflows reaching approximately $150 billion in 2025. This trend indicates a growing confidence among international investors in China's economic prospects. Investment banks are essential in this context, providing advisory services to foreign firms looking to enter the Chinese market or expand their operations. The investment banking market is likely to see heightened activity as these banks facilitate cross-border transactions, helping to bridge the gap between foreign investors and local enterprises.

Regulatory Environment and Compliance Needs

The investment banking market in China is shaped by a complex regulatory environment that necessitates compliance and risk management. Recent regulatory reforms have introduced new requirements for transparency and accountability, compelling investment banks to enhance their compliance frameworks. This shift is likely to drive demand for specialized services within the investment banking market, as firms seek to ensure adherence to evolving regulations. The ability to navigate these regulatory challenges effectively can provide a competitive advantage, positioning investment banks as trusted advisors in an increasingly scrutinized financial landscape.

Economic Growth and Investment Opportunities

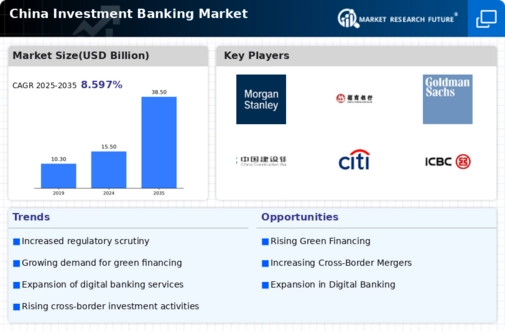

The investment banking market in China is currently experiencing a surge due to robust economic growth. With a projected GDP growth rate of approximately 5.5% in 2025, the demand for capital raising and advisory services is likely to increase. This growth is driven by a burgeoning middle class and increased consumer spending, which creates numerous investment opportunities. As companies seek to expand and innovate, investment banks play a crucial role in facilitating mergers and acquisitions, initial public offerings, and other financial transactions. The investment banking market is thus positioned to benefit from this economic dynamism, as firms look to leverage financial expertise to navigate the evolving landscape.

Rising Demand for Financial Advisory Services

The investment banking market in China is witnessing a rising demand for financial advisory services, particularly in the context of corporate restructuring and strategic planning. As companies face increasing competition and market volatility, the need for expert guidance has become paramount. In 2025, the market for financial advisory services is expected to grow by approximately 8%, reflecting the critical role that investment banks play in helping firms navigate complex financial landscapes. The investment banking market is thus adapting to these needs, offering tailored solutions that address the unique challenges faced by businesses in a rapidly changing environment.

Technological Advancements and Digital Transformation

The investment banking market in China is undergoing a transformation driven by technological advancements. The integration of artificial intelligence, big data analytics, and blockchain technology is reshaping how investment banks operate. In 2025, it is anticipated that investment banks will allocate over 20% of their budgets to technology initiatives aimed at enhancing operational efficiency and client service. This digital transformation is likely to create new opportunities within the investment banking market, as firms leverage technology to streamline processes, improve decision-making, and offer innovative financial products.